Important information: This is a sponsored story. Please remember that the value of investments, and any income from them, can fall as well as rise so you could get back less than you invest. If you are unsure of the suitability of your investment please seek advice. Tax rules can change and the value of any benefits depends on individual circumstances.

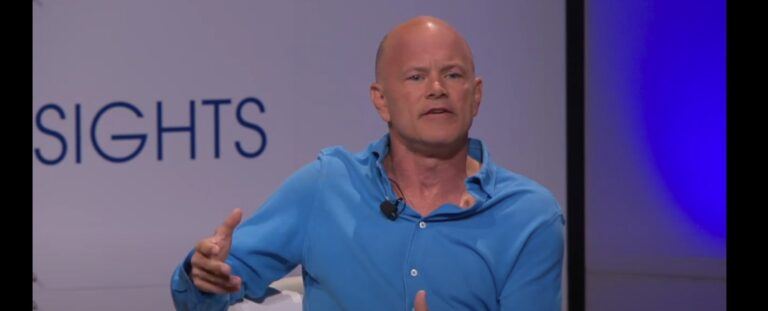

Within crypto and Bitcoin there are a few names that stand out. One of them is Michael Novogratz. But who is he? And why is he a big deal?

Michael grew up in a family of seven siblings in Virginia. From an early age, he was a successful wrestler, and would during his time at Princeton University be named All-Ivy League twice. A few of his other siblings have also risen to fame, such as his sister Jacqueline who founded the Acumen Fund.

Beginnings of his crypto career

Today, Novogratz is the CEO of Galaxy Investment Partners – a crypto investment firm that he joined in 2017. But he actually entered the crypto market way before that. He started his first crypto investments as early as 2015 after visiting a business friend.

He then started investing in ether, a token of the Ethereum network, and within just a couple of years had gained $250 million – the largest haul of his career yet. Those who want to follow in his footsteps can begin to compare crypto brokers to receive the best chances of success.

What’s impressive about Novogratz’s switch to cryptocurrency investment is how little support there was in the early days of his crypto career. His previous company, Fortress Investment where he worked mainly with hedge funds, was doing so poorly that Novogratz basically lived in Wall Street exile for two years before leaving in 2017. Simultaneously, many were skeptical of the crypto market due to its volatility, liability, and lack of liquidity.

A fifth of his net worth in digital currency

In an interview with Bloomberg News in the fall of 2017, Novogratz estimated that as much as 20% of his net worth lies in digital assets. These stem not only from his work with Galaxy Investment Partners, but also through his personal investments in crypto.

Among others, his family office has investments in trading platforms, bitcoin technology, and bitcoin mining. Novogratz himself has been quoted to describe cryptocurrency as a viable and “excellent alternative” to inefficient monetary policy.

His work at Galaxy Investment is also going incredibly well. According to the company’s own financial statements, the third quarter of 2021 saw the purchase of $62 million worth of non-fungible token (NFT) related companies.

Furthermore, the third- statement shows that the company owns $1.9 billion in “unrestricted” cryptocurrency. Of these, over $600 million are held in managed funds and almost $160 million in General Partner interest. Their Bitcoin figure is likely to amount to $768 million.

Hopes for the future

A signifying trait for Novogratz is his endless optimism. Recently, he’s stated that the Bitcoin currency will reach $500,000 price within the next five years, and that he will have been wrong about the entire adoption cycle if it doesn’t. The currency reached an all-time high in late 2021 when it surged to nearly $69,000, so there is still some way to go. Novogratz bases his argument on comparing the growth of crypto to the growth and development of computers in the 1990s and says that the speed today is unlike any other.