Higher quality cryptocurrency trading platforms have been steadily gaining market share over the last few quarters, to the point they now command over 90% of the cryptocurrency space’s trading volumes.

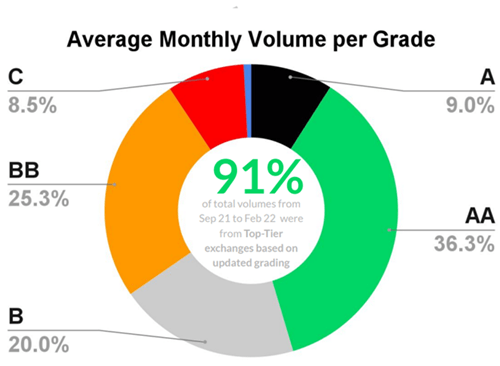

According to CryptoCompare’s latest Exchange Benchmark report, Top-Tier crypto trading platforms have been seeing their market share of total exchange volumes grow since August 2021. The report details that in July 2021 they stood at 89% and are now at an average of 91%.

To put the figures into context, Top-Tier exchanges traded a total of $1.5 billion in February, compared to $62 billion for Lower-Tier exchanges.

CryptoCompare finds Top-Tier exchanges after ranking more than 150 global spot exchanges based on a comprehensive methodology that assesses counterparty, operational, trading, and security risks. Top-Tier exchanges, it’s worth noting, are those ranked AA-B.

Only four cryptocurrency exchanges – Coinbase, Gemini, Bitstamp, and Binance – have received an AA rating from the cryptoasset data provider, while 11 exchanges received an A rating, 27 received a BB rating, and 37 received a B rating. 80 crypto exchanges were ranked as Lowe-Tier.

CryptoCompare’s report details that know-your-customer (KYC) stringency “still requires improvement on many exchanges, with 35% rated as having poor or inadequate KYC programs (vs 34% in Aug 2021).” The report also found that 27% of exchanges sent funds to “higher risk entities for more than 4% of transactions.”

The firm’s co-founder and CEO Charles Hayter was quoted saying:

As the digital asset ecosystem continues to mature, it is important that market participants can reliably identify the lowest risk trading venues. Our Exchange Benchmark is an invaluable tool for funds, service providers, regulators, and investors who are looking to gain a better understanding of the global digital asset exchange landscape.

In a press release, the firm pointed out that since its Exchange Benchmark was introduced in 2019, its methodology has expanded and “is now approached in several dimensions using a comprehensive data set, covering more than 150 exchanges across 8 categories of evaluation, utilizing over 60 qualitative and quantitative metrics.”

DISCLAIMER

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.

IMAGE CREDIT

Featured image via Pixabay