On Wednesday (February 9), prominent crypto analyst Ali Martinez used on-chain data from Santiment to examine the price of action of $ADA during the past one-year-period.

Here is how Binance Academy describes Cardano ($ADA):

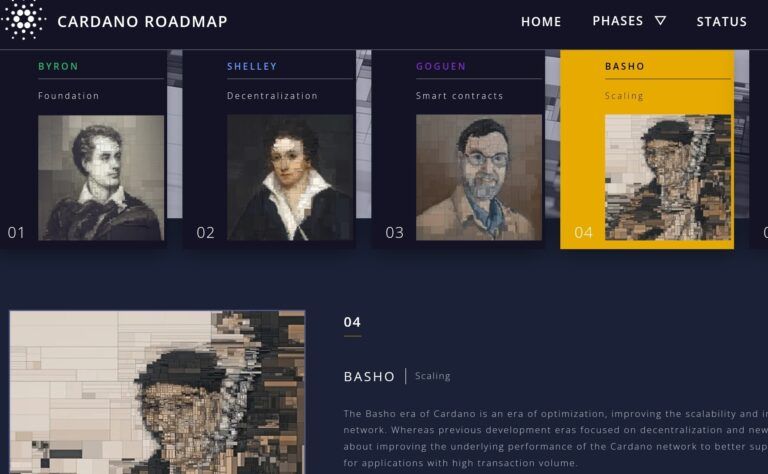

“Cardano is a general-purpose blockchain designed based on peer-reviewed academic research. It’s being developed by a multidisciplinary team of engineers, mathematicians, scientists, and business professionals.

“Ongoing platform development is always accomplished using a scientific approach. According to its creators, the key design principles behind Cardano are security, scalability, and interoperability.

“Ada, the native currency of Cardano, is used to perform operations on the Cardano blockchain, much like the relationship between ether (ETH) and Ethereum.

“Cardano’s development is separated into multiple business units. IOHK handles the development of the Cardano protocol, while the Cardano Foundation supervises the project, and EMURGO is responsible for business development and driving adoption.“

Santiment provides 11 on-chain metrics for looking at network value. The metric Martinez used for $ADA is MVRV Ratio, which “shows the average profit or loss of all ADA holders based on the price when each token last moved.” He used a particular variant of this metric — called MVRV Ratio (365d) — that measures the P/L of all $ADA holders that acquired $ADA in the past 365 days.

Martinez tweeted on Wednesday that based on this metric, it looks like $ADA has not been this undervalued since the crypto market crash of March 2020:

According to data by TradingView, currently (as of 12:05 p.m. UTC on February 11) on crypto exchange Coinbase $ADA is trading around $1.1539, up 0.21% in the past 24-hour period.

Disclaimer

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.