Coinbase Ventures, which is the venture capital arm of Coinbase (NASDAQ: COIN), recently reviewed its activities in 2021, which was a record year with nearly 150 deals, and explained why how and why it invested in various sectors of the crypto space.

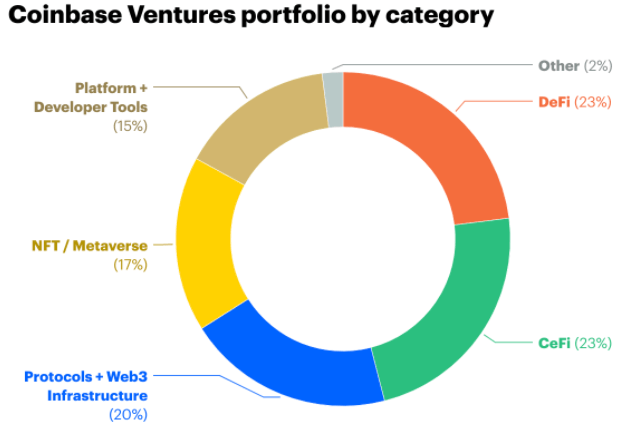

In a blog post published last Thursday (January 27), Coinbase Ventures said that “its portfolio now consists of over 250 companies” and breaks down across the following verticals:

Below are some highlights from Coinbase Ventures’ report.

Protocols & Web3 infrastructure

“To help scale existing Layer 1s and enable higher throughput, we supported Layer 2 solutions including Matter Labs, Optimism, and Arbitrum. As multiple Layer 1s have proliferated, so has the demand to safely and easily move funds across blockchains. As such, Ventures’ was active in investing in projects working to facilitate this cross-chain movement, including Biconomy, Movr, LayerZero, Chainflip, and more. We also observed and funded new protocols working to bring better privacy to Web3 through various zero-knowledge solutions (Aleo, MobileCoin, and a third TBA).“

“We were also active across the infrastructure layer of the Web3 stack: primitives that form the backbone of user applications. Specifically, technologies that introduce standards to Web3 for data storage (Arweave), messaging (XMTP), and identity (Spruce). Given that 2021 was a great year for DAOs, we were active across infrastructure projects focused on enabling DAO creation/incorporation (Syndicate, Utopia), discovery/participation (Snapshot/Consensys’ Metamask), payroll/operations (Diagonal), and coordination (Orca).“

DeFi

“We’re believers in the multichain future, and although we remained most active within Ethereum’s DeFi ecosystem, we also invested across Solana (Orca, Solend), Cosmos (Umee), Algorand (Folks), Polkadot (Acala, Moonbeam), NEAR, Polygon and Bitcoin.“

NFT / Metaverse

“Ventures has now invested heavily in the NFT ‘utility’ phase — one in which NFT assets expand to new types of mediums such as audio (Royal, Mint Songs, Sturdy), avatars (Genies, OFF), AR (Anima, Jambo), and gaming/GameFi (Ancient8, GuildFi). This will allow interesting social features to be layered on top of the programmatic recognition of NFTs (Gallery).“

Platform & Developer Tools

“Over the year, we followed the ‘developer journey’ from staging (Tenderly), collaboration (Radicle), query (Covalent), audit (Certik, OpenZeppelin, Certora) and real-time simulation/monitoring (Chaos Labs, Gauntlet). We also invested in developer toolkits like API providers (Alchemy, Consensys’ Infura).“

CeFi

“Coinbase Ventures actively invested in asset managers and brokers including AltoIRA, Onramp, Valkyrie, ForUsAll, Ledn, and One River Digital. We were also investors in various CeFi ‘picks and shovels’, with follow-on investments in TaxBit and CoinTracker, which automate crypto tax reporting across platforms. In addition, we supported projects helping startups integrate crypto with traditional fintech offerings, including Paxos, Tribal Credit, and Meow.“

Disclaimer

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.