The total value locked (TVL) on the decentralized finance ecosystem built on top of the Solana ($SOL) blockchain grew in ^November while Ethereum transaction fees hit a new all-time high that month, suggesting investors rotated to Solana over its cheaper transaction fees.

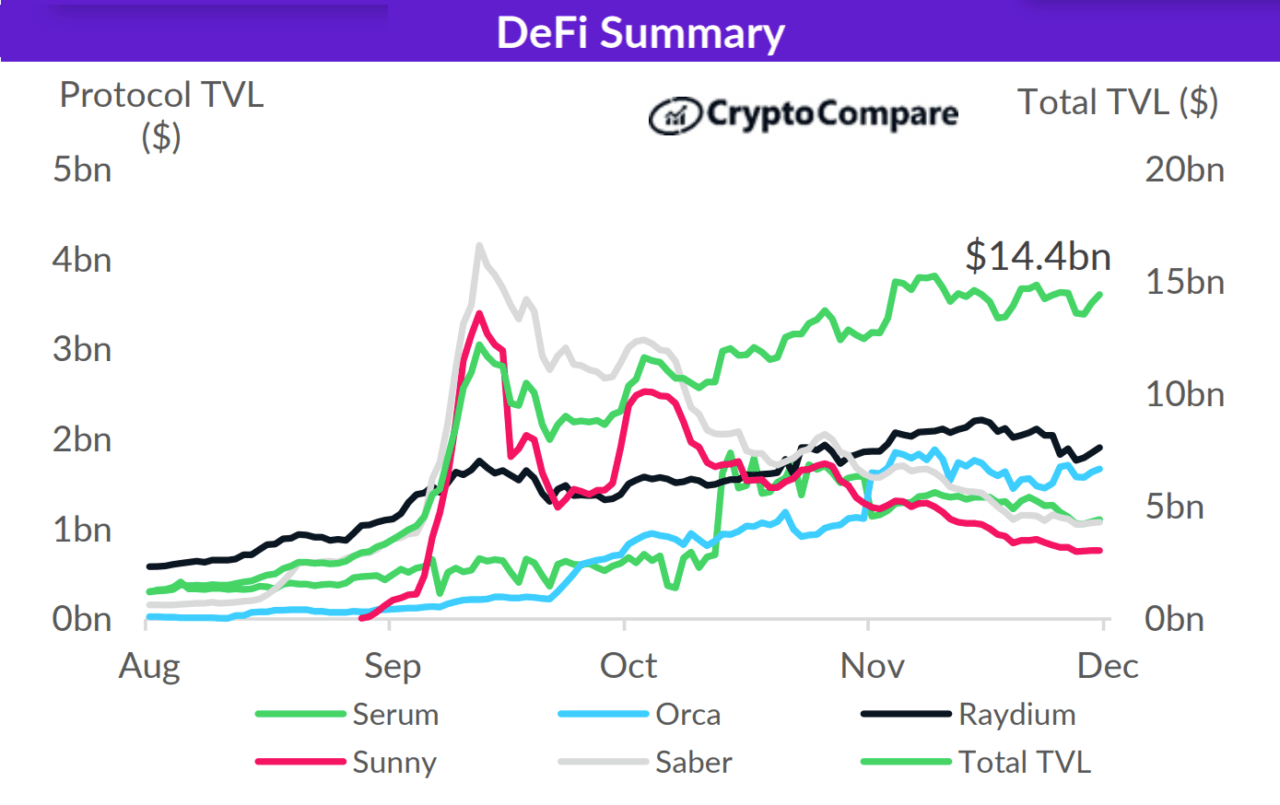

According to CryptoCompare’s latest Asset Report, decentralized finance activity on the Solana blockchain continued to grow last month, but at a slower pace when compared to October. IT grew 15.8% from October to $14.4 billion, compared to its 35% growth in October and 177% in September.

The report details that during November fees spent on the Ethereum network kept on rising and reached another monthly all-time high of $1.82 billion, a figure that represents a 34.6% growth from October.

CryptoCompare’s report details that the average fee per transaction rose to an all-time high of $48.33, far above Solana’s transaction fees which are, on average, well below one cent. s CryptoGlobe reported, over 77% of Solana’s $SOL tokens are being staked on the cryptocurrency’s network and earning their holders yield, so much so that staked value on the network surpassed $84 billion, according to data from Staking Rewards.

The network’s staking rewards have as such been making Solana a top choice for investors looking to earn interest in their cryptocurrency holdings. Staking allows users to earn interest in their crypto by helping secure the underlying network.

According to CryptoCompare, staking on-chain is possible with cryptocurrencies using a Proof-of-Stake (PoS) consensus mechanism. PoS networks are often more energy-efficient than PoW networks and maintain a certain degree of decentralization.

Solana itself is a high-performance blockchain founded by former Qualcomm, Intel, and Dropbox engineers that uses a delegated Proof-of-Stake (dPoS) consensus algorithm. The network uses a unique method of ordering transactions to significantly improve its speed and throughput.

CryptoCompare’s previous Digital Asset Management report had revealed solana-based investment products were, along with Litecoin-based products, outperforming Bitcoin-based alternatives.

DISCLAIMER

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.

IMAGE CREDIT

Featured image via Pixabay