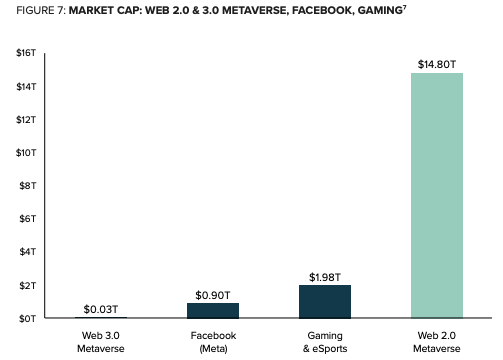

In a recently-released research report, Grayscale Investments (“Grayscale”), a subsidiary of Digital Currency Group, said that “the market opportunity for bringing the Metaverse to life may be worth over $1 trillion in annual revenue and may compete with Web 2.0 companies worth ~$15 trillion in market value today.”

Earlier this month, Grayscale released a 19-page research report (titled “The Metaverse: Web 3.0 Virtual Cloud Economies”) written by Head of Research David Grider, Head of Research and Research Analyst Matt Maximo.

Grider and Maximo started by explaining what they mean by the term metaverse:

“Crypto cloud economies are the next emerging market investment frontier and the Metaverse is at the forefront of this Web 3.0 internet evolution. The Metaverse is a set of interconnected, experiential, 3D virtual worlds where people located anywhere can socialize in real-time to form a persistent, user-owned, internet economy spanning the digital and physical worlds…

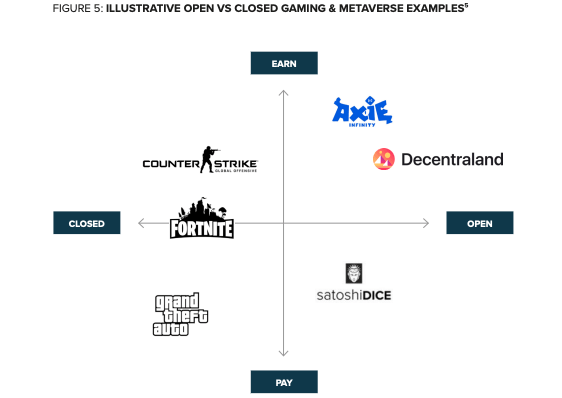

“Projects like Decentraland are creating an open-world metaverse where users can log in to play games, earn MANA (the native token of Decentraland, with which users can purchase NFTs, including LAND or collectibles, and vote on economy governance), or create NFTs, giving them real world interoperability for the value of their time spent in-game.“

They then explained the difference between a “Web 2.0 Closed Corporate Metaverse” and a “Web 3.0 Open Crypto Metaverse”:

“Many gamers today spend their money and hours of their time building digital wealth within Web 2.0 closed corporate metaverse worlds. The problem is, most game developers don’t let players monetize their investment and efforts. Developers prohibit players from trading items with other players and keep these worlds closed so players cannot transfer their in-game wealth to the real economy.

“Web 3.0 open crypto metaverse networks solve this problem by eliminating the capital controls imposed on these virtual worlds by Web 2.0 platforms. This new paradigm allows users to own their digital assets as Non-Fungible Tokens (NFTs), trade them with others in the game, and carry them to other digital experiences, creating an entirely new free-market internet-native economy that can be monetized in the physical world. This evolution of the ‘creator economy’ is known as ‘Play to Earn’.“

Next, they pointed out that “gaming is just one of the most immediately addressable segments where value is already starting to naturally shift to Web 3.0”, and that in fact “the Metaverse opportunity extends far beyond gaming”. Grayscale estimates the metaverse to be “a trillion-dollar revenue opportunity across advertising, social commerce, digital events, hardware, and developer/creator monetization”.

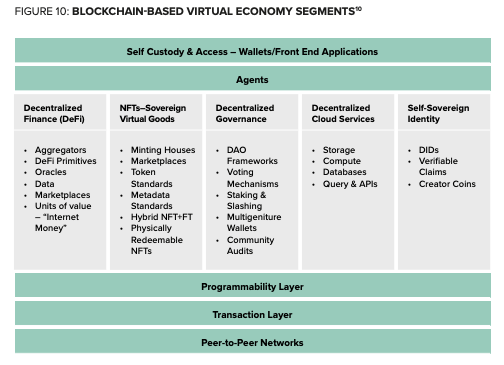

They then looked at the various segments of the blockchain-based virtual economy.

The authors concluded by saying that the immense potential of the metaverse, which has made Facebook “pivot towards the Metaverse” and change its name to Meta, could “serve as a catalyst for other Web 2.0 tech giants and investors to follow.”

Disclaimer

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.

Image Credit

Featured Image by “11333328” via Pixabay