It is fitting that a crypto exchange with the most coveted domain name in existence — Crypto.com — achieves yet another milestone in crypto adoption. As of November 22, 2021, Crypto.com completed the Service Organization Control (SOC) 2 audit. As the first cryptocurrency exchange to do so, it makes Crypto.com the officially most secure exchange.

Unlike the SOC 2 Type I audit, which occurs on a specific date, the Type II audit is an extensive process that commonly lasts for at least six months. During that time, an independent auditor lifts every security rock worth of note:

- Privacy — Whether the organization collects and safeguards private data according to the American Institute of Certified Public Accountants (AICPA) guidelines.

- Availability — Whether the system is accessible at peak-traffic times when people need it the most. One only has to mention Coinbase and Robinhood outages to understand its importance.

- Security — Whether the system is resistant to either logical or physical unauthorized access.

- Processing — Whether the organization processes trades accurately, timely, and complete.

Many crypto investors are reluctant to leave their funds with crypto exchanges because they hold users’ private keys, so passing this comprehensive test makes Crypto.com a step above the rest.

One of Crypto.com’s founders duly noted this achievement:

“I am extremely proud of our SOC 2 compliance and shows our commitment to security, privacy, and regulatory compliance which have been cornerstones of our business since day one,”

Kris Marszalek, Co-Founder and CEO of Crypto.com.

What Else Makes Crypto.com Special?

For the first decade of crypto growth, it was rare for cryptocurrencies to be used as…currencies for daily payments. This all changed in 2018 when Crypto.com spearheaded Visa prepaid cards. A year later, the exchange expanded the availability of those cards from Singapore to also cover the U.S., soon to be followed in 2020 by the U.K., Canada, and EU.

Boasting no annual and ATM fees, alongside generous up to 8% cashback rewards, the formerly known MCO Rewards Visa successfully bridged crypto with traditional finance. Such moves are critical for mass adoption of cryptocurrencies, as they attach to people’s existing habits.

One Crypto.com distinctive feature is that to obtain the Visa card the user needs to stake their crypto funds. This locks them up for a specified period, making the price of the card locking up the tokens — which also entails earning interest on them.

On the cultural front, Crypto.com has been on a sports sponsorship spree. If you have a passing interest in hockey or basketball, you may have already seen Crypto.com’s logo penetrate the public consciousness. One of the first big deals was NHL’s Montreal Canadiens in March, soon followed by a partnership with Formula 1, Ultimate Fighting Championship (UFC), Italian soccer competition Lega Serie A, and the recent deal with the French Paris Saint-Germain Football Club (PSG).

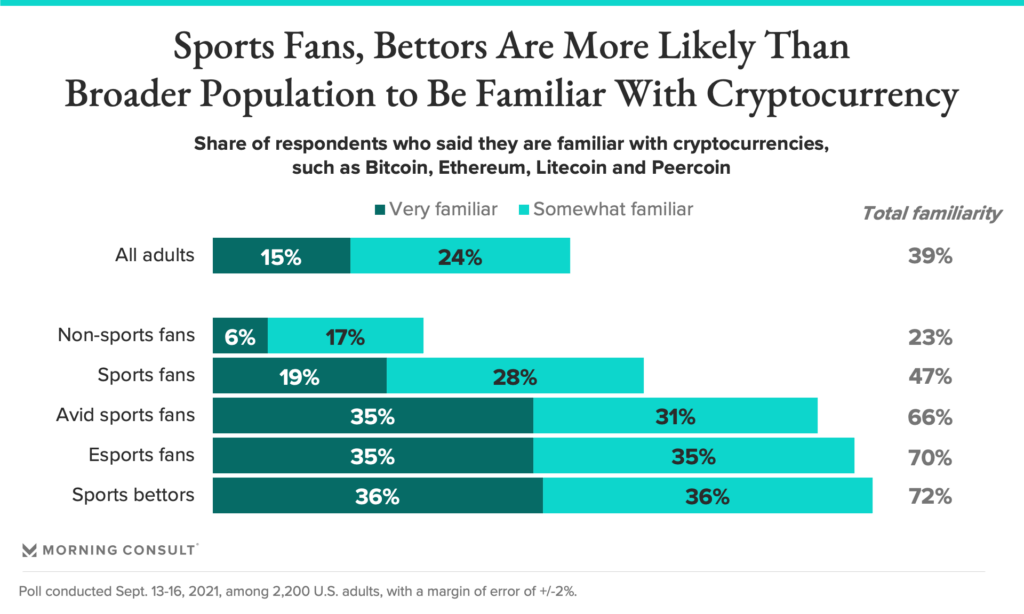

Altogether, Crypto.com invested over $400 million in these sponsorship deals. If you are wondering why, the reason is quite simple. Sports fans are the most likely audience to tap into the crypto world, according to a Morning Consult survey.

Lastly, for those wondering if Crypto.com’s base of operations in Hong Kong is safe from China’s banning reach, there is some reassuring news. The exchange expanded to Malta after obtaining an Electronic Money Institution (EMI) license from the Malta Financial Services Authority (MFSA) in July 2021.

Furthermore, Crypto.com also secured an Australian Financial Service License (AFSL) in December 2020. This is why Visa, as the world’s largest payment processor, feels safe protracting its partnership with Crypto.com.

Featured image via Unsplash.