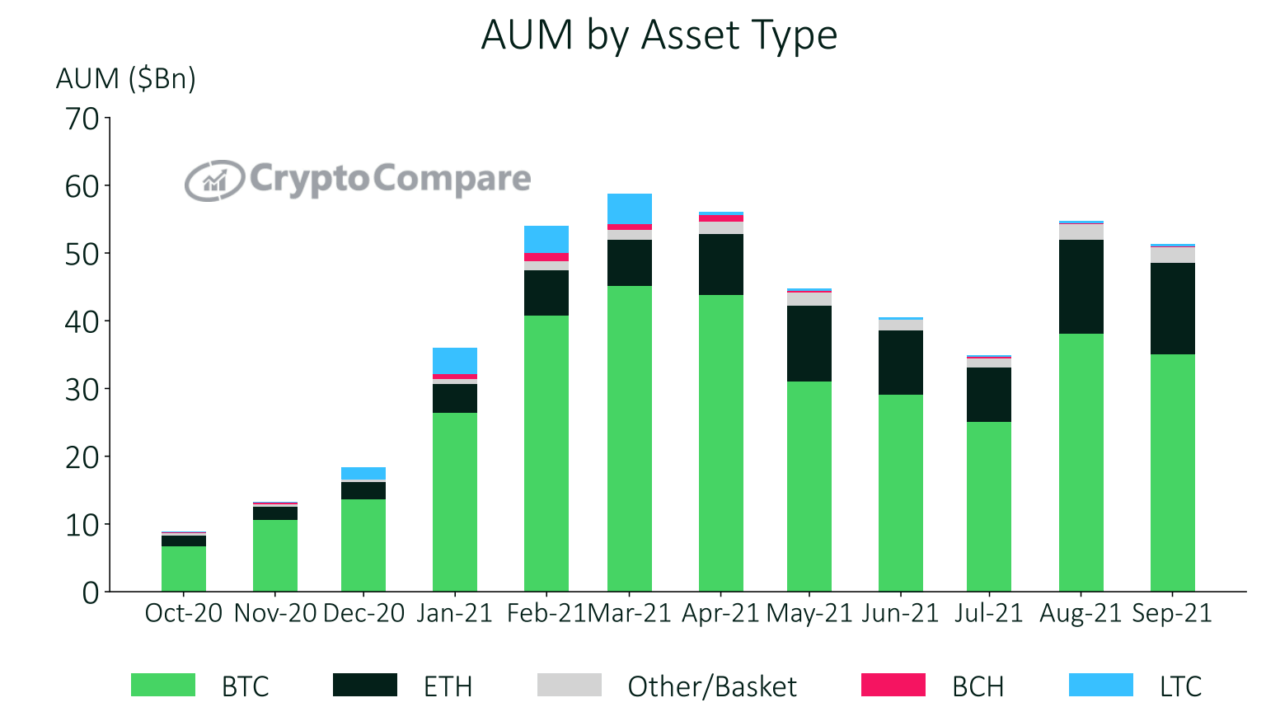

Institutional investors’ interest in Ethereum (ETH) and other bitcoin alternatives appears to be increasing, with bitcoin investment products seeing their total assets under management falling 7.8% in September to $35.1 billion, their lowest share this year.

According to the September edition of CryptoCompare’s Digital Asset Management Review, Ethereum-based products reached their highest market share of assets under management last month. The movements appear to suggest investors are looking to diversify their exposure in the cryptocurrency space.

It adds that Grayscale’s Ethereum Trust (ETHE) was the most traded digital asset product last month with an average daily trading volume of $250 million, up 29% over August. For the first time ever, it dethroned the Grayscale Bitcoin Trust (GBTC).

Ethereum-related products’ rise came even as their assets under management fell marginally to $13.4 billion. Products offering exposure to cryptocurrency baskets saw their AUM drop 1.3% to $2.8 billion.,

In total, the AUM across all digital asset investment products decreased 6.3% since August to $51.3 billion as of September 24. Aggregate daily volume across all crypto investment product types notably rose by an average of 4.1%, with daily volumes now averaging $566 million.

The report details that after three months of net outflows, crypto investment products saw net flows turn positive in September. Exchange-traded notes (ETNs) were the only product type to see a rise in assets under management last month, as it grew by 7.2% to $3.7 billion.

DISCLAIMER

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.

IMAGE CREDIT

Featured image via Pixabay