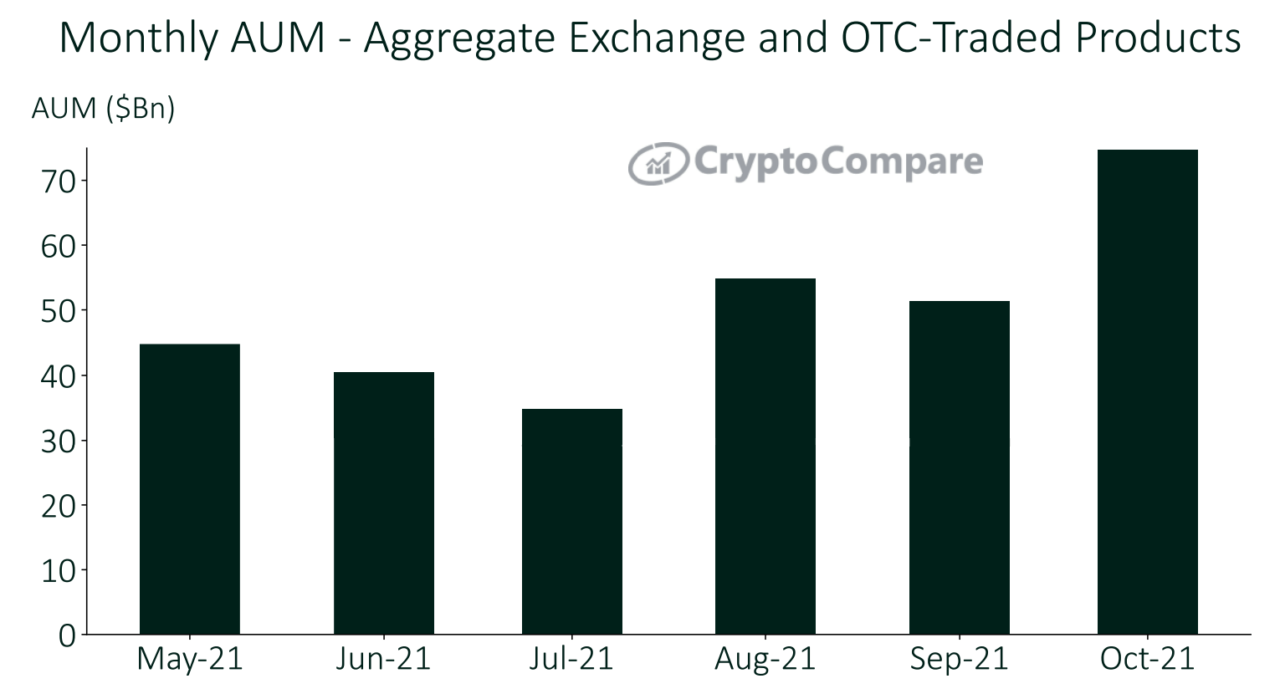

Cryptocurrency investment products have seen their total assets under management (AUM) increase b 45.5% to get near the $75 billion mark in October, surpassing the previous all-time high of $58.7 billion in March of this year.

According to CryptoCompare’s latest Digital Asset Management Review, rising cryptocurrency prices and weekly inflows led to the surge in assets under management, with the assets on bitcoin-based investment products growing 52.2% to $55.2 billion, another all-time high.

Similarly, Ethereum-based products saw their assets under management reach an all-time high of $15.9 billion in October after rising 30%.

Investment products focusing on other cryptoassets and baskets saw their assets under management rise by 26.5% to $3.6 billion, the report adds. Aggregate daily trading volumes for these assets increased by an average of 43.4% from September to October to now stand at $826 million.

CryptoCompare adds that Grayscale’s Bitcoin Trust (GBTC) “regained its majority market share of trust product volume in October at 63.1%,” with its trading volume rising 112% to $388 million. In October, on average, weekly inflows were $132 million.

As CryptoGlobe reported, the Korea Teacher’s Credit Union, a fund that managed over $40 billion in assets, is mulling investing in bitcoin next year and is planning to do so through cryptocurrency investment products.

Other large funds are eyeing crypto. The Houston Firefighters’ Relief and Retirement Fund, which has around $5.5 billion of assets under management, has invested $25 million into both bitcoin (BTC) and Ethereum’s ether (ETH).

DISCLAIMER

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.

IMAGE CREDIT

Featured image via Pixabay