The Cardano (ADA) network may be undervalued when compared to its competitors, according to a new report published by leading digital asset manager Grayscale Investments. The report found the market did not keep up with Cardano’s significant growth over the last 12 months.

Cardano launched smart contracts after successfully deploying the Alonzo hard fork on its network in early September. The rollout allowed the network to host decentralized applications that can offer decentralized financial services, games, and more. Smart contracts help Cardano compete with Ethereum and the Binance Smart Chain, among others.

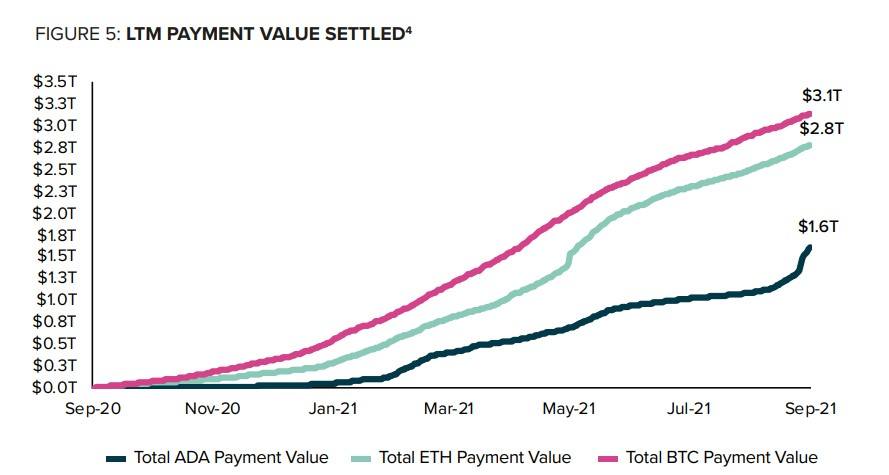

Grayscale’s report notes that the Cardano network has settled more payment value per unit of market capitalization than its direct competitors, noting it settled over $1.6 trillion in total on-chain transactions over the last twelve months.

In comparison, the Bitcoin network settled a total of $3.1 trillion in on-chain transaction value, while Ethereum settles $2.8 trillion. In Grayscale’s chart, Cardano’s recent acceleration is clear and may be related to the Alonzo hard fork.

The report adds Cardano may be undervalued relative to Ethereum on a market value per active monthly users basis, as reported by Cryptobriefing.

The native blockchain of ADA has 2.8 million active users per month, while Ethereum is estimated to have close to 7 million active users per month. Cardano, however, has a lower market value per user of $30,000, compared to Ethereum’s $55,000. Cardano’s market capitalization is now of $70 billion, compared to Ethereum’s $400 billion.

The Cardano network is currently processing around 115,000 transactions per day while rewarding ADA stakers for securing the network. Since July, over 70% of all ADA in circulation is staked by users and there are currently 2,919 active staking pools. The total number of addresses staking funds is 882,800.

Grayscale noted that despite the increased activity, Cardano still has a long way to go to build out a decentralized finance ecosystem that will rival those of its competitors.

DISCLAIMER

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.

IMAGE CREDIT

Featured image via Unsplash