Solana has been the hottest L1 blockchain this summer, with $SOL up almost 7800% so far in 2021. As the result of the interest Solana has generated, projects in the Solana ecosystem have benefited greatly and their tokens have enjoyed huge gains.

On June 1, a startup named Saber Labs announced the launch of StableSwap, which it introduced as “the first automated market maker optimized for trading pegged assets on Solana.” This was the date that StableSwap was launched on Solana’s Mainnet Beta network.

In its first blog post, which was published on June 1, the Saber team mentioned that StableSwap had “designed its AMM from the ground up based on the proven Curve Finance model of efficiently swapping between stable pairs of assets.”

They went on to mention what role they expected this product to play in the future once cross-chain bridges such as Wormhole became available:

“When a user sends USDC from Ethereum through Wormhole, they receive a wrapped version of USDC (Wormhole USDC) on Solana. However, in order to interact with Solana applications, they’ll likely need to swap to the native Solana version of USDC.

“There is currently very little liquidity to switch between Wormhole and native versions of tokens on Solana. StableSwap will be the first touchpoint of liquidity for cross-chain bridges, enabling more activity within the Solana ecosystem.“

One week later (on June 8), Saber Labs published another blog post to announce that SaberSwap had been rebranded to Saber:

“While our primary focus on stable asset pair trading remains the same, switching to the name Saber is a recognition that we don’t want to be limited to just StableSwaps— we want to tackle the most in-need areas within the crypto ecosystem.“

On July 13, the Saber team introduced the Saber Protocol Token ($SBR), which it said was a governance token with two main use cases:

- directing the development of the Saber Protocol

- “aligning incentives between Saber stakeholders”

$SBR’s maximum supply (or hard cap) is 10 billion tokens, and the token distribution was as follows:

- Mining Reserves: 31.42%

- Partnerships and Ecosystem: 25.10%

- Team and Advisors: 19.58%

- Strategic Fundraise: 15.48%

- Liquidity Reserve: 8.42%

Since its launch slightly over three months ago, Saber has become “the leading cross-chain stablecoin and wrapped assets exchange on Solana.”

Its backers include Race Capital, Multicoin Capital, Jump Capital, Social Capital (founded by billionaire Chamath Palihapitiya), Solana Foundation, CMS, Divergence Ventures, Reciprocal Ventures, Republic Labs, and Coin98 Ventures.

For traders, Saber offers the ability to “trade stable pairs instantly with low slippage and minimal fees”; for liquidity providers, its automated market maker, which has been “algorithmically designed to eliminate impermanent loss”, provides the opportunity to “earn yield from transaction fees, liquidity incentives”; and for developers, it acts core as a DeFi building block that “can easily be integrated into any Solana-based protocol or app”.

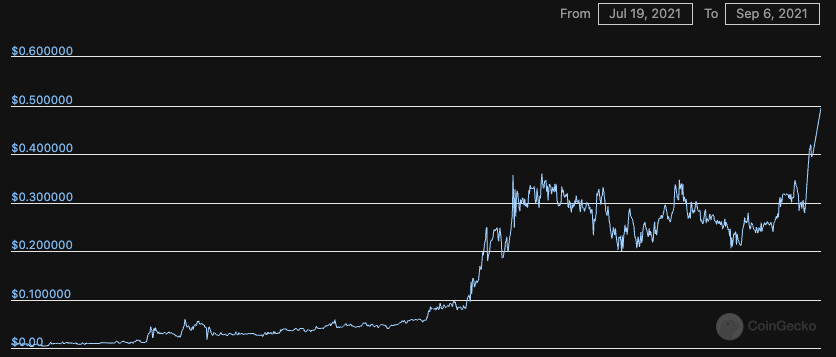

According to data by CoinGecko, the price of the $SBR token, which is currently only available for trading on decentralized exchanges Serum and Raydium, has gone in the past seven weeks from $0.00225782 (the all-time low on July 19) to $0.500170 (as of 10:10 UTC on September 6), which represents a gain of over 22,052%. In the past 24-hour period, $SBR is up 69.9%.

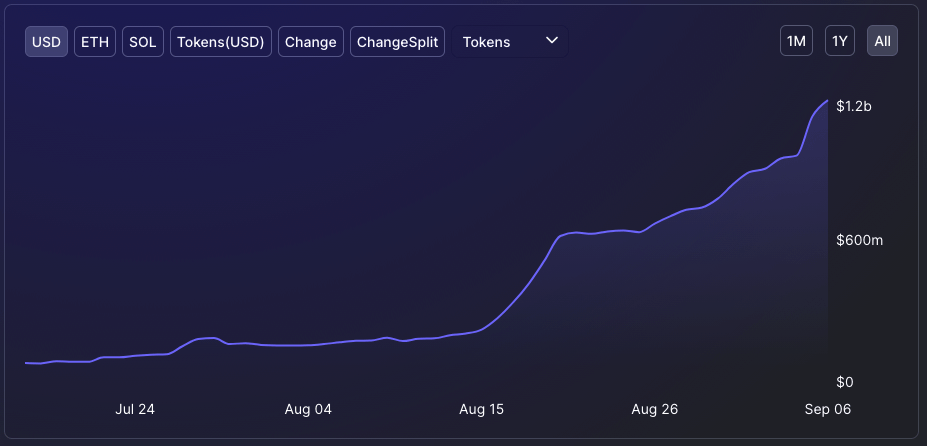

According to Defi Llama, Saber’s total value locked (in USD) currently stands at $1.19 billion.

DISCLAIMER

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.

IMAGE CREDIT

Image by “Skitterphoto” via Pixabay