Important information: This is a sponsored story. Please remember that the value of investments, and any income from them, can fall as well as rise so you could get back less than you invest. If you are unsure of the suitability of your investment please seek advice. Tax rules can change and the value of any benefits depends on individual circumstances.

Global markets have been trending downward over the last few weeks and bitcoin is one of the assets that took a large hit. The price of the cryptocurrency dropped by 15% in September and is showing no strong signs of recovering to $45,000, a key resistance level.

Bitcoin is now trading below its 21-week moving average, which could be interpreted as a sign the cryptocurrency is entering a bear market territory. For now, investors may have more things to worry about.

Cryptocurrency exchanges forced to stop serving some users

Last Friday, China reiterated that all cryptocurrency transactions are illegal in the country and that they “seriously endanger the safety of people’s assets”, according to the People’s Bank of China. China is one of the world’s largest cryptocurrency markets and any bad news from China could cause an earthquake in the bitcoin market.

Under pressure from the government, the China-based crypto exchange Huobi announced its decision to expel Chinese users by the end of December 31, 2021. The Huobi token saw a 38% plunge after the announcement as chances are some of its users are being forced to leave the platform.

Binance, one of the world’s largest cryptocurrency exchanges, announced on Monday that it will block Singapore users from buying and trading cryptocurrency to comply with local regulations.

Binance is facing resistance from more and more countries, first Germany, then the United Kingdom, and now Singapore. Hong Kong, Italy and Japan also joined in and scrutinized the exchange. Banks including Barclays, Nationwide, HSBC, and Santander have blocked transactions to Binance.

As regulators pay increased attention to the market, what happened with Binance may happen to other platforms and companies. Investors shouldn’t necessarily flee, but the scenario is a strong reminder BTC is a highly volatile asset and investors should be wary a pullback is possible.

Bitcoin to hit $30,000?

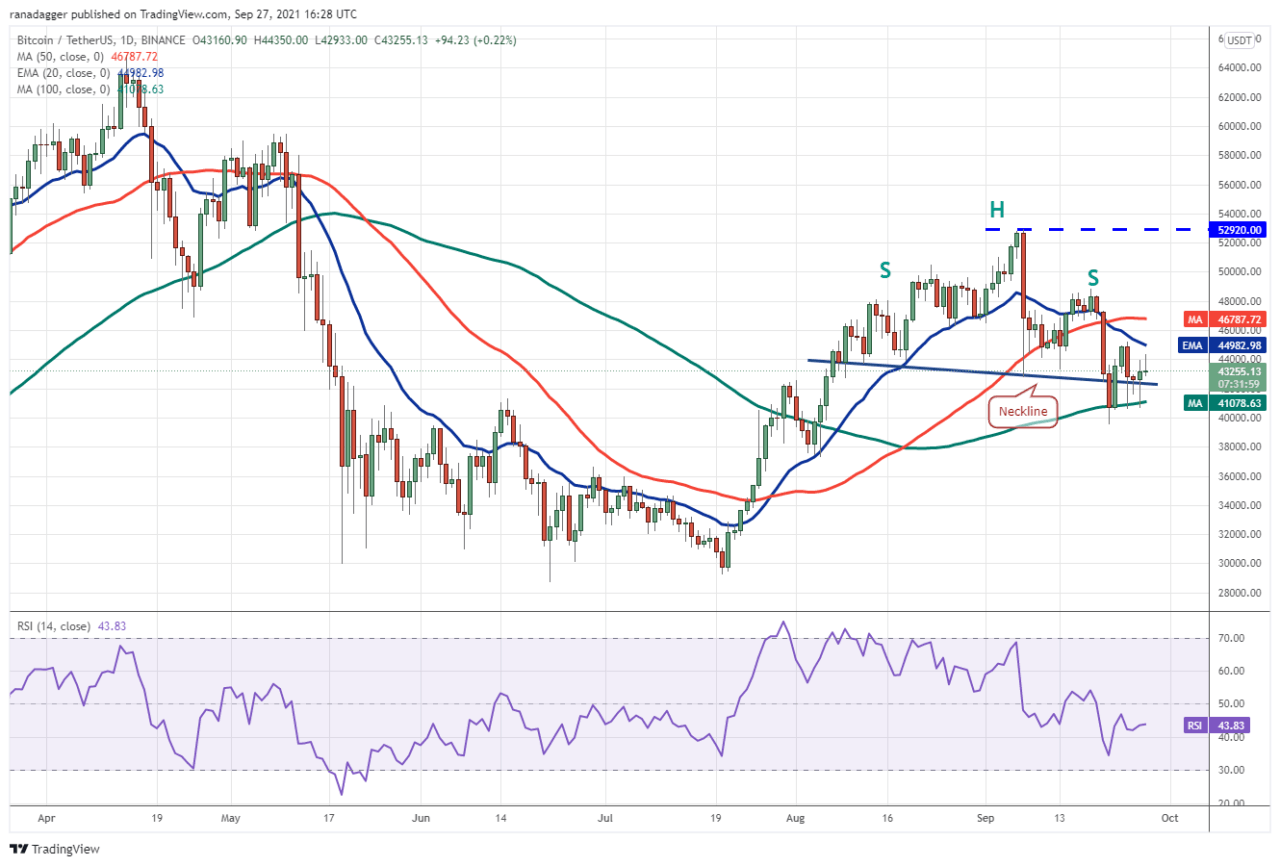

Buyers have been trying to flip $45,000 back to a support zone and failed. Bitcoin has dropped below $40,000 several times and is now trading in a narrow range of $42,000-$44,000. The longer it stays below $45,000, the more likely its strength is to be exhausted.

Market analyst Nunya Bizniz pointed out that BTC is now at a critical level. It is trading below its 21-week exponential moving average for the 19th time in history. If we look back, it only managed to resume its bullish momentum out this situation four times. The last time this indicator flashed, on May 2021, bitcoin price crashed below $30,000.

The 20-day EMA is sliding lower and the relative strength index is well below the midpoint. Now the 100-day simple moving average (at $41,078) is a critical level to watch: if bears manage to push bitcoin below it, a big sell-off could be on the way and push the price of bitcoin to $37,332, then to $30,000.

How can users avoid losses?

Bitcoin going down is scary but that’s the price we pay when dealing with such a volatile asset. With futures trading, some experienced traders can actually make a profitwhen the price of bitcoin goes down.

Let’s see how traders can take advantage of such a price drop.

Assume they used 0.1 BTC to open a short contract when bitcoin was trading at $40,000. Please note that up to 100x leverage is available on the market, so 0.1 BTC can be used to open a contract worth 10 BTC.

In such a scenario, if the price of bitcoin dropped to $35,000 there would be a profit: ($40,000 – $35,000) * 10 BTC/$35,000 *100% = 1.43 BTC.

Importantly, slight movements in the other direction could quickly lead to the loss of the 0.1 BTC. Using leverage essentially means traders are using borrowed funds from the exchange. The exchange avoids losing money by liquidating the traders’ position when their collateral is no longer enough to cover losses.

With 100x leverage applied, a single-digit percent movement in the wrong direction would quickly lead to the full losses of funds, even if in the long run the traders’ prediction was accurate and the price of BTC dropped to $30,000.

If you are interested in trading, Bexplus could be the right place. Bexplus offers products in BTC, ETH, ADA, DOGE, and XRP.

Headquartered in Hong Kong, Bexplus is trusted by over 800K traders from over 200 countries/regions, including the USA, Japan, Korea, and Iran. It charges no deposit fee, traders can receive the most attentive services, including 24/7 customer support.

Why Trade on Bexplus?

No Deposit Fees and Fast Withdrawals

No deposit fees are charged, you can start with just 0.001 BTC. To withdraw your deposit, you only need to file a request and confirm it via email. Withdrawals are available 24/7 and take less than an 1 hour during work hours.

Mobile App

The top-ranking Bexplus app helps you better manage your account. With the 24/7 notification, you can stay updated with the market. All data and assets can be accessed through all kinds of devices including desktops, mobile phones, and tablets. You can download the Bexplus APP on Google Play or Apple Store.

Wallet with annual interest

Prices go up, prices go down, but the Bexplus BTC wallet stays. If you would like to take a rest from the ever-changing crypto market, you can turn to the Bexplus interest wallet. It provides up to 21% annualized interest

100% Deposit Bonus to Help You

Users can get a 100% deposit bonus for every deposit on Bexplus.

Click here to register and start trying out Bexplus.