Institutional investors have been betting on Solana ($SOL) and Cardano ($ADA) investment products as the cryptocurrency market recovers and bitcoin moves back toward the $50,000 mark, data shows.

According to CoinShares’ latest “Digital Asset Fund Flows Weekly” report, institutional investors moved $7.1 million into Solana investment products over the last week, seemingly reacting to SOL’s recent price surge that saw it jump from little over $35 to a new all-time high above $75.

The price of Solana has surged partly thanks to a growing number of projects developing on top of its network receiving capital inflows. Decentralized exchange Mango markets, for example, raised $70 million in a token sale earlier this month.

Serum, a decentralized exchange founded by cryptocurrency billionaire Sam Bankman-Fried, who’s also the CEO of cryptocurrency exchange FTX, is also built on top of the Solana blockchain.

CoinShares’ report, first spotted by Cointelegraph, notes institutional cryptocurrency investment products bucked a six-week outflow trend with roughly $21 million flowing into cryptocurrency investment products this week.

Behind Solana investment products, the most popular ones were those tracking the price of Cardano’s ADA, with inflows of over $6.4 million. Behind these two were bets on ETH and LTC investment products.

As reported, institutional investors have been seemingly favoring Cardano over other major cryptocurrencies for some time, ahead of the cryptocurrency network’s launch of smart contracts through the Alonzo hard fork.

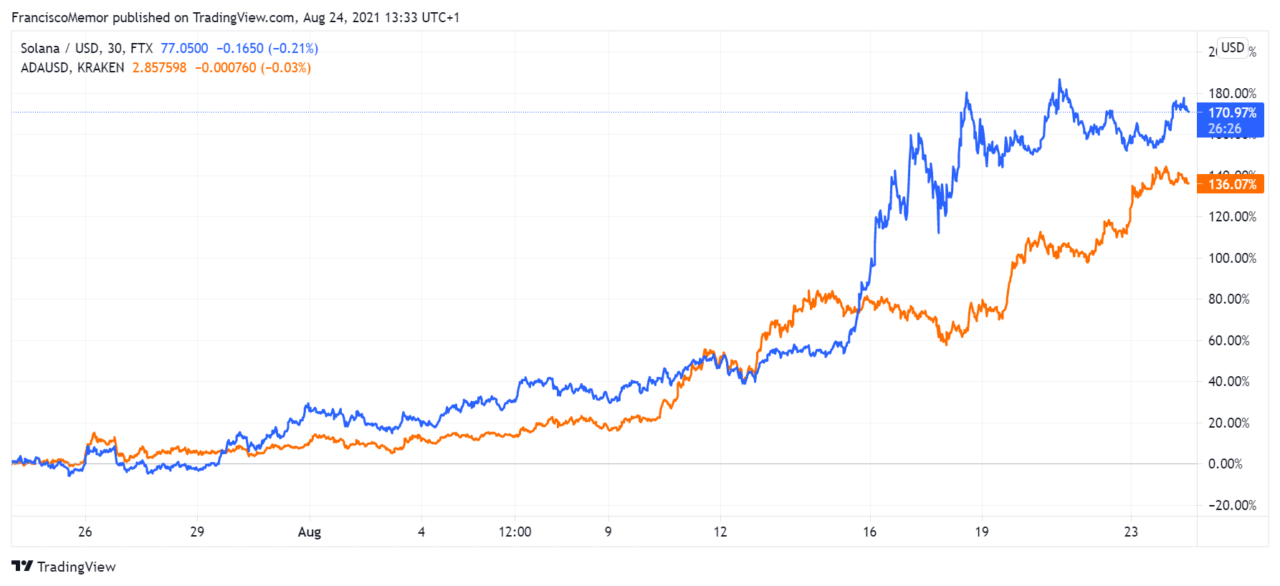

The Alonzo hard fork will bring smart contracts to the network. Smart contracts will allow Cardano to compete with Ethereum, the Binance Smart Chain, and others with its own decentralized finance (DeFi) applications. ADA’s price has surged over 135% over the last 30 days, while SOL is up over 175%.

Over the week, funds tracking the price of bitcoin saw $2.8 million in outflows, with month-to-date flows being down by $57.5 million. Despite the negative trend BTC products have been facing, year-to-date they’re leading the market with over $4 billion in inflows.

The total assets under management of cryptocurrency investment product issuers is now sitting above $57.3 billion.

DISCLAIMER

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.

IMAGE CREDIT

Featured image via Unsplash