Cryptocurrency prices started picking up in late July, with Bitcoin and Ethereum rising 18.3% and 11.2% respectively month on month. While the rise helped open interest surge for the first time in three months, spot volumes fell to a yearly low.

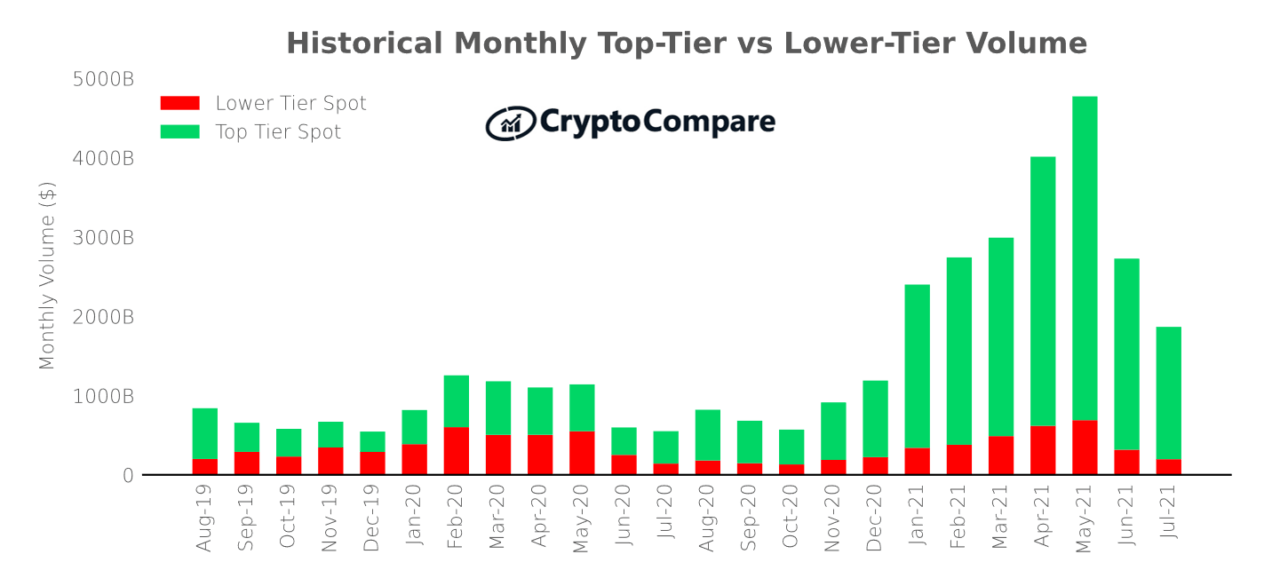

That’s according to CryptoCompare’s Exchange Review report, which details that spot volumes fell 31.5% from June to July, even though rising prices helped volumes surge late in the latter month, with a maximum of $98 billion being traded on July 26.

Top-Tier cryptocurrency exchanges saw their volumes drop 30.7% to $1.7 trillion, while Lower-Tier exchanges saw their spot volumes decreased to $197 billion. Top-Tier trading platforms, it details, now represent 89.3% of the total spot volume.

It’s worth noting Top-Tier exchanges are those rated AA-BB according to the CryptoCompare’s Exchange Benchmark, while Lower-Tier trading platforms are those rated C-F according to the same benchmark. Binance, graded A, was the largest Top-Tier spot exchange, trading $455 billion.

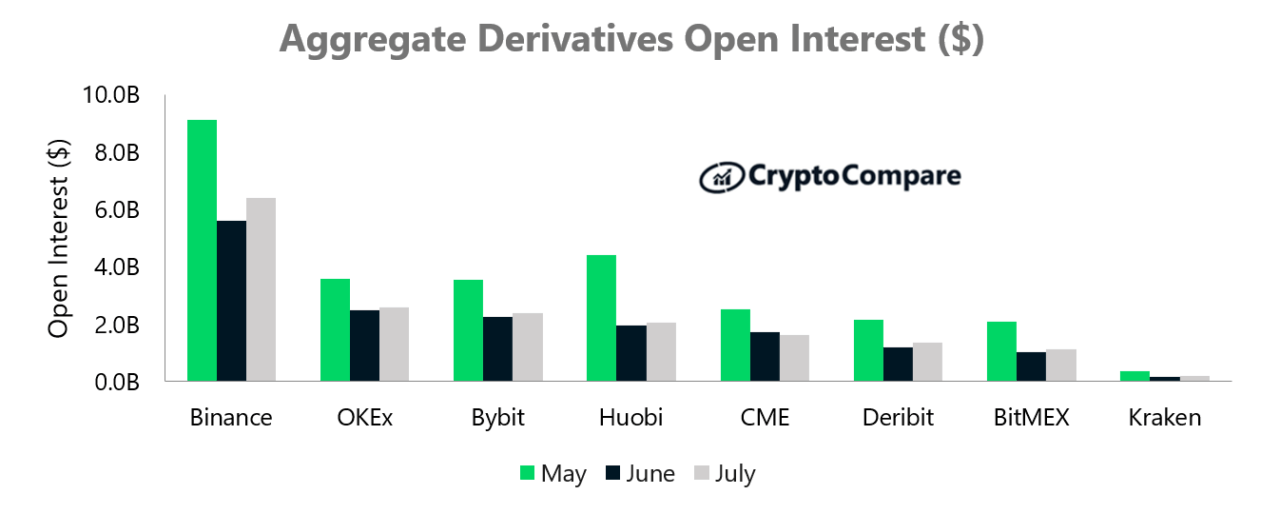

Derivatives trading volumes gained market share over spot volumes last month, decreasing only 22.6% to $2.5 trillion. The derivatives market now represents 56.9% of the total cryptocurrency market, up from 52.9% in June.

Binance was the largest derivatives trading platform, with a trading volume of $1.4 trillion. Behind it was OKEx, which traded $368 billion.

CryptoCompare’s report further details that aggregate open interest has risen in July for the first time in three months, from a weekly average of $16.4 billion in June to $17.7 billion in July. Open interest across BTC futures rose 4.5% to $10.1 billion, while open interest for ETH products rose 2.4% to $4.3 billion.

DISCLAIMER

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.

IMAGE CREDIT

Featured image via Pixabay