Recently, popular New Zealand-based crypto analyst Lark Davis (@TheCryptoLark on Twitter), gave some of the main reasons for his belief that the $ETH price will go over $10,000 in the long term.

Davis, who has long been bullish on Ethereum, believes that three main drivers could help push the price of $ETH over $10: rising demand for $ETH due to the increasing popularity of decentralized finance (DeFi) and non-fungible tokens (NFTs); decreasing market supply due to continued accumulation by investors; and the transaction fee burning mechanism that was activated on August 5 as part of the London network upgrade.

Another crypto analyst who is also highly bullish on Ethereum is the host of the YouTube channel “Coin Bureau”, who — according to a report by The Daily Hodl — said in a video he released on August 15 that the “ETH bull is not running out of steam” any time soon:

“It’s hard to take [a] look at all these fundamental factors and not be incredibly optimistic about [Ethereum’s] future. The London hard fork has shown just how smoothly the Ethereum community can execute fundamental protocol upgrades. It was a great demonstration of what we could expect to see when the 2.0 upgrades start being rolled out. With that proof-of-stake merge, we’re going to see ETH become ultra sound money, money that will have a deflating supply year on year, day by day, block by block.

“And it seems as if most of the crypto community agrees. ETH is being stacked, staked, and otherwise removed from the open market. It’s being held as a rare store of value that will be in much shorter supply one year from now… Institutions are chomping at the bit, or should I say ETH, as they continue to accumulate more of it. This is a theme that I don’t see slowing down anytime soon.

“Taking all of these factors into account, I can see why options expiring next year have such high strike prices. Market momentum is on our side, and the ETH bull is not running out of steam.“

Furthermore, he believes that it is not crazy to think that the $ETH price could even get as high as $17,000 in the long term:

“If ETH was at $17,000, that would give it a market cap equivalent to that of Microsoft. Is that inconceivable knowing exactly what Ethereum will one day be powering?“

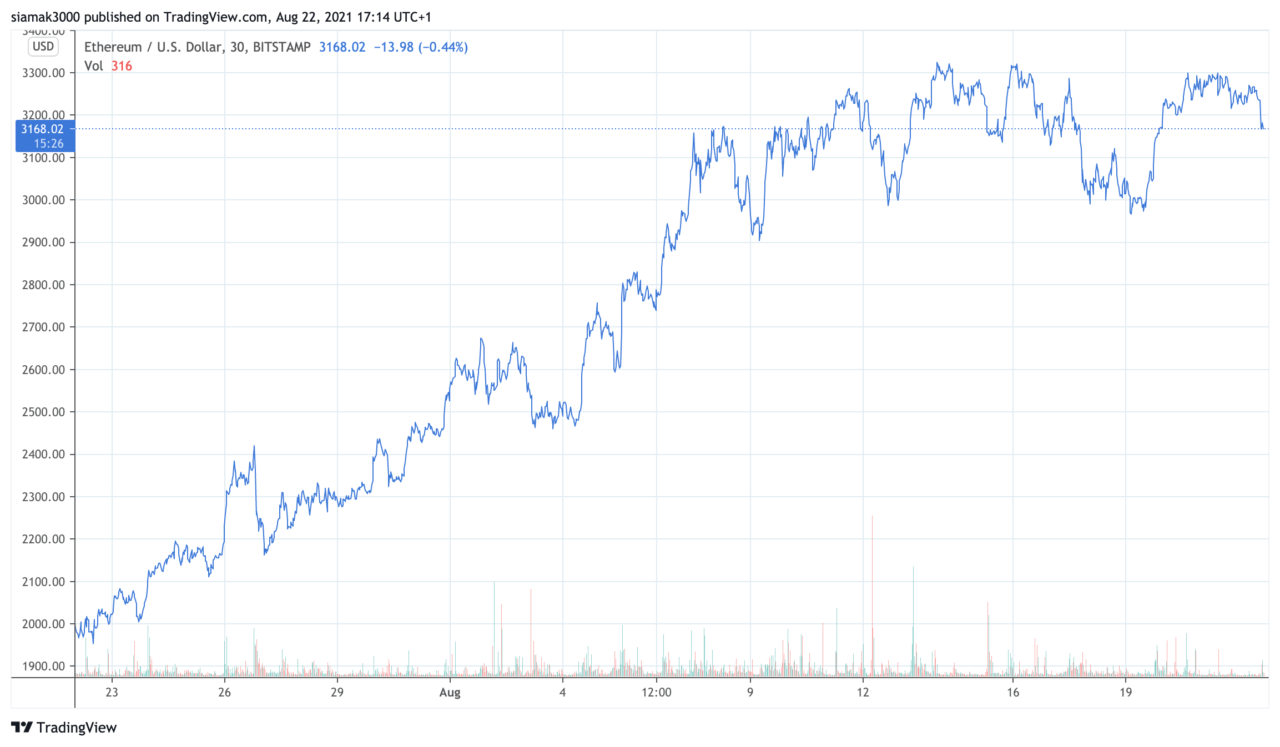

According to data by TradingView, on crypto Bitstamp, in the past one-month period the $ETH price has increased 56.72% vs USD. Currently (as of 16:15 UTC on August 22), ETH-USD is trading around $3,168.

DISCLAIMER

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.