On Tuesday (August 10), Coinbase Global Inc. (NASDAQ: COIN) announced its impressive financial results for the second quarter of 2021.

According to the company’s Shareholder Letter, in Q2 2021, it managed to generate $2.0 billion in net revenue ($1.9 billion of this amount is transaction revenue and the other $0.1 billion is revenues from subscription and services). The net income for the quarter was $1.6 billion (adjusted EBITDA was $1.1 billion).

Coinbase says that it had 68 million verified users and that the number of retail monthly transacting users (MTUs) increased 44% from Q1 2021 to 8.8 million.

It is worth keeping in mind that in April the price of Bitcoin went over $64,000, setting a new all-time high and that the highly bullish investor sentiment in the first half of the quarter and the 50% market crash that followed in the second half is probably what helped Coinbase to deliver such strong results.

Here is Coinbase acknowledging the part that volatility played in helping it do so well in Q2 2021:

“As volatility and crypto asset prices are highly correlated with trading revenue, the crypto market environment heavily influenced our Q2 financial results.”

Coinbase’s financial results were much better than the analysts were expecting. According to a report by CNBC, based on data by Refinitiv, Coinbase reported $3.45 earnings per share while analysts were on average expecting $2.33.

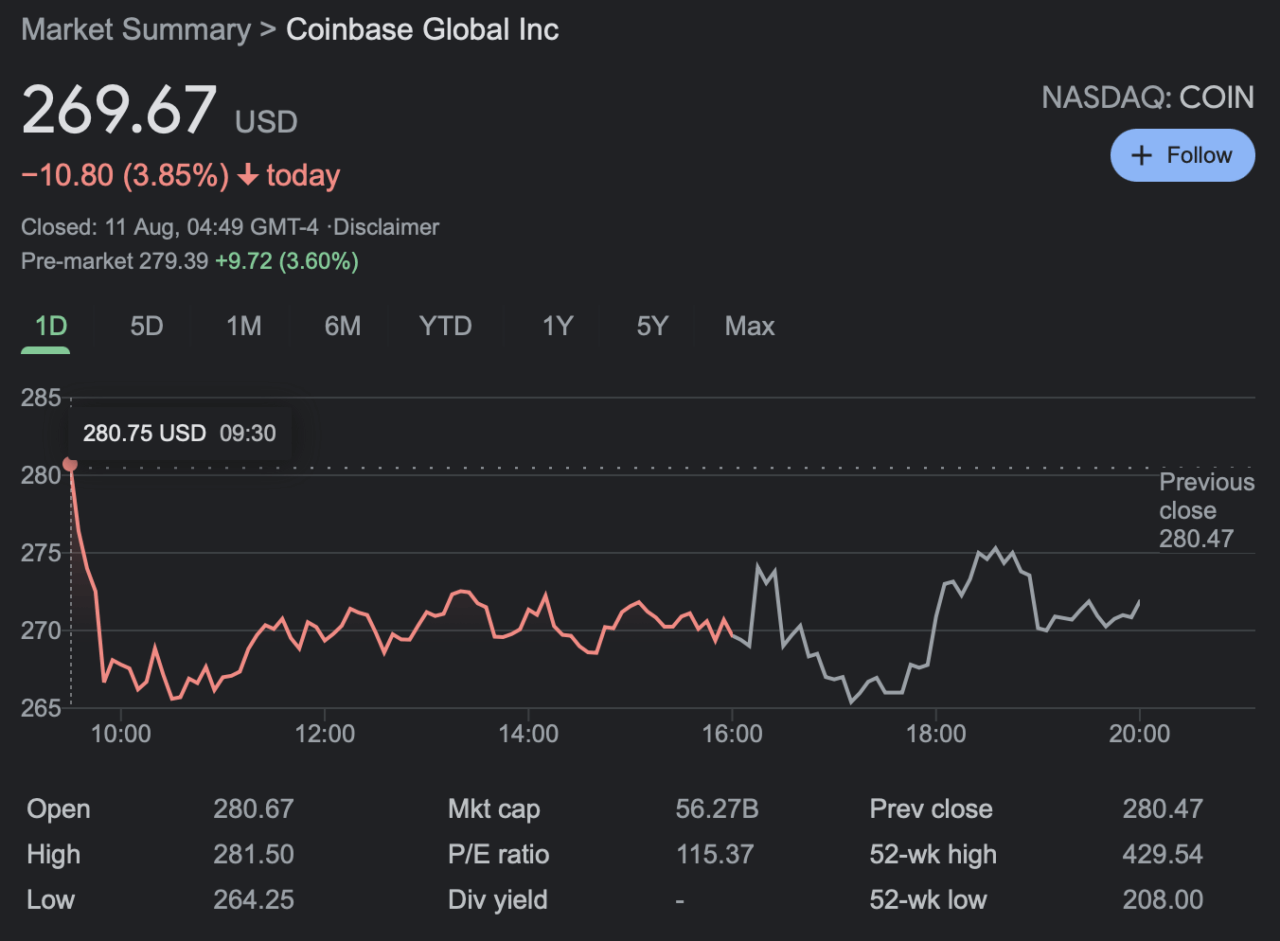

Although the Coinbase share price ended the regular trading session yesterday at $269.67, in after-hours trading, the share price rose to as high as $275.30 (at 18:35 ET).

During Coinbase’s Q2 2021 Earnings Call, this is what Co-Founder and CEO Brian Armstrong had to say about his company’s latest quarterly results, the trends they are seeing in user behaviour, and their plans for the future:

“So Q2 was a really a strong quarter for us. We had amazing growth in terms of users added to the platform, assets on the platform, revenue, just about everything.

“And also great diversification across our revenue lines and users. So this is really good to see more and more people are using crypto and using the cryptoeconomy, individuals, businesses, developers, all over of the world...

“… we’re continuing to see this trend of people using crypto for more and more things beyond trading. So for example, we shared in the letter that we now have 1.7 million users doing staking in crypto, which is a way to earn yield on your assets. And this is up from — basically, that number was probably zero a year ago…

“We’re also focusing on international expansion – another form of decentralization – and just listing more and more assets. We want to be the Amazon of assets, list every asset out there in crypto that’s legal. And there’s thousands of them today, there’s eventually going to be millions of them. These are — this is the all into the theme of embracing decentralization.“

And Coinbase CFO Alesia Haas talked about user growth:

“… we saw user growth across the board with our retail MTUs, institutions and our ecosystem partners. The metric that we really focus on is what percent of our retail MTUs are now using multiple products on Coinbase. And in Q2, this grew to 27%, up from 25% in the first quarter.

“What’s really notable to me though, when I look at this number is the growth in the underlying MTUs and how many users we now have using multiple products on our platform. Brian shared we have 1.7 million users staking, but we also saw 2.3 million users engaging in an earn campaign during the quarter.

“Separately, on our institutional side, we’re seeing broad adoption. One of the things that we highlighted for you all is that we now have 10% of the top 100 hedge funds measured by AUM, now clients of Coinbase and engaging with the crypto economy…

“About a year ago, hedge funds weren’t participating in crypto. This is really a new theme that we see where more and more hedge funds are making allocation to the crypto economy and engaging in multiple assets on our platform.“

DISCLAIMER

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.