On Wednesday (August 25), the teams behind two of the most crypto projects announced the results of an integration that is “the result of many months of close collaboration.” And on Tuesday (August 24), Osprey Funds signalled its intention to launch a private Solana fund.

In a press release issued yesterday, the Chainlink and the Solana teams jointly announced that Chainlink’s Cryptocurrency Data Feeds, which are widely used in decentralized finance (DeFi), are currently “running live on the Solana Devnet at sub-second updates.” The Chainlink team aims to deploy the mainnet integration before the end of this year.

Solana’s high performance means that Chainlink’s price feeds, which have been powered by sub-second data providers such as CryptoCompare, are now able to “realize those speeds on-chain without compromising on quality or security,” which will allow “DeFi app development that competes with CeFi trade execution and risk management quality.”

Anatoly Yakovenko, Founder and CEO of Solana Labs, stated:

“Integrating Chainlink natively into the Solana blockchain can significantly increase the rate at which Solana developers can build secure, high-throughput DeFi applications by providing them with direct access to reliable off-chain data and computation… The combination of high-quality oracle infrastructure and Solana’s high-speed blockchain network can enable DeFi applications to scale to a global level.“

And Sergey Nazarov, Co-founder of Chainlink, had this to say:

“With Chainlink Price Feeds providing sub-second updates on the Solana blockchain, smart contract developers will have the proven oracle infrastructure they need to build high-speed and tamper-proof DeFi applications… We are excited to be supporting the growth of the Solana ecosystem through oracle networks that provide end-to-end decentralization, data accuracy, and a wide range of secure off-chain services.”

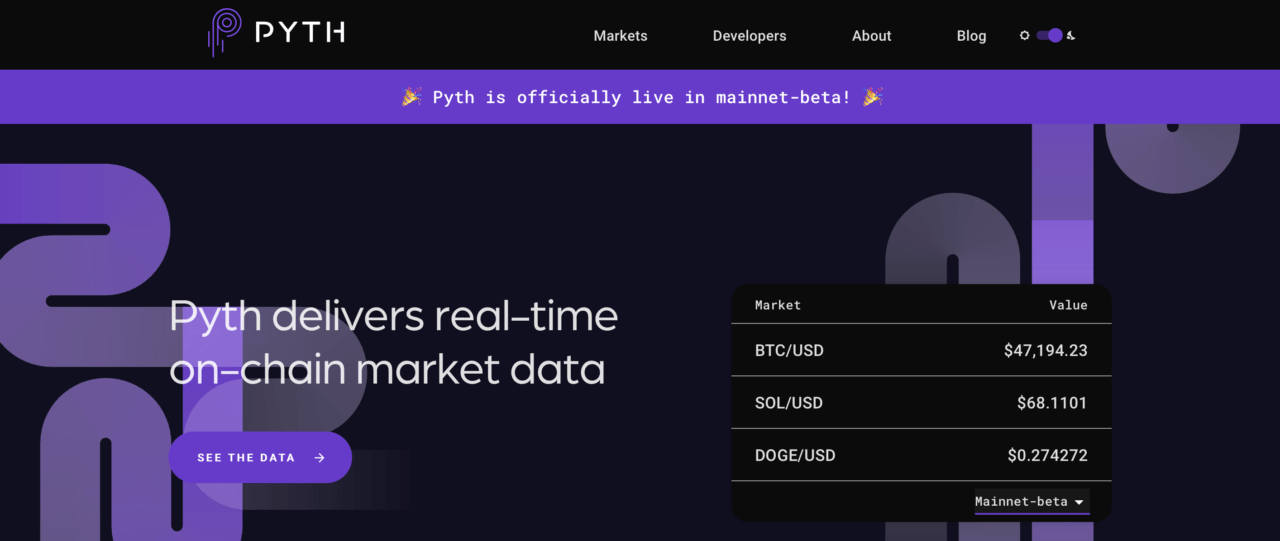

Also, yesterday (August 25), Bloomberg reported that real-time on-chain market data provider Pyth Network intends to launch on the Solana mainnet in the very near future.

And it seems that Pyth has launched on mainnet-beta:

The Bloomberg report went on to say:

“Pyth publishes at sub-second intervals and provides coverage of high-fidelity streaming data from cryptocurrency, U.S. equities, foreign exchange and commodities markets. It’s composed of both primary and derived data from trading firms and exchanges, which allows it to cover a large share of global market activity with minimal dependency on any single data source — cutting the likelihood of one or more data providers attacking or manipulating the aggregate price.“

It also mentioned that “in coming weeks, Pyth will be able to broadcast market data through the so-called Wormhole Network, which will allow it to communicate with decentralized applications, or dapps, across the Ethereum, Binance Smart Chain and Terra ecosystems, further expanding its capabilities.”

And finally, according to a report published by CoinDesk on Tuesday (August 24), boutique digital asset investment firm Osprey Funds, which has so far launched three crypto funds — the Osprey Bitcoin Trust (OBTC), the Osprey Polkadot Trust, and the Osprey Algorand Trust — is working on a private Solana fund for accredited (i.e. “wealthy”) investors.

The Form D notice (“Notice of Exempt Offering of Securities”) filed with the U.S. Securties and Exchange Commission (SEC) on August 24 states that the issuer will be Delaware-incorporated Osprey Solana Trust and that the first sale of this new security is yet to occur.

The U.S. SEC points out that “the federal securities laws require the notice to be filed by companies” that wish to sell “securities without registration under the Securities Act of 1933 in an offering made under Rule 504 or 506 of Regulation D or Section 4(a)(5) of the Securities Act.”

The CoinDesk report went on to say that — according to documents reviewed by the CoinDesk Show — Osprey is hoping to get approval for the shares of the Osprey Solana Trust to trade on the same OTC marketplace as the Osprey Bitcoin Trust, which would be great for U.S. residents because it would allow the shares in the trust to be be held in an IRA or other tax advantaged account.

DISCLAIMER

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.