On Monday (August 2), three days after Ethereum’s sixth birthday and three days before the London hard fork is scheduled to go live on the mainnet, Ether’s price action is continuing to impress the crypto community.

Last Friday (July 30), Ethereum celebrated its sixth birthday (since the mainnet went live on 30 July 2015).

The original Ethereum white paper (titled: “Ethereum White Paper: A next-generation smart contract and decentralized application platform”) was written by Russian-Canadian programmer Vitaly Dmitriyevich Buterin (better known as “Vitalik Buterin”), and published on his blog in December 2013.

Here is how Vitalik described the main objective of Ethereum in the abstract of this paer:

“What Ethereum intends to provide is a blockchain with a built-in fully fledged Turing-complete programming language that can be used to create ‘contracts’ that can be used to encode arbitrary state transition functions, allowing users to create any of the systems described above, as well as many others that we have not yet imagined, simply by writing up the logic in a few lines of code.”

Ethereum got announced by Vitalik on 27 January 2014 on Day 2 of the North American Bitcoin Conference in Miami, Florida.

During his talk, Vitalik said that one of the uses for Ethereum was to create cryptoassets for specialized purposes:

“Let’s not have one currency. Let’s have 1,000s of currencies.”

Around six months later (on 7 June 2014), Ethereum’s eight co-founders―Vitalik Buterin, Anthony Di Iorio, Charles Hoskinson, Mihai Alisie, Amir Chetrit, Joseph Lubin, Gavin Wood, and Jeffrey Wilke―met in a rented house in Zug, Switzerland (a town that has been given the nickname “Crypto Valley”). At this meeting, Vitalik proposed that the Ethereum project should proceed as a non-profit.

Ethereum’s Development was funded via an initial coin offering (ICO) during July–August 2014, with the participants paying for the Ether (ETH) token with Bitcoin (BTC). This ICO raised 3,700 BTC in its first 12 hours, and in total, $18 million was raised.

Ethereum Foundation’s last proof-of-concept prototype, which was codenamed “Frontier”, went live on 30 July 2015.

The upcoming London hard fork, the most important component of which is EIP-1559, was originally expected to go live on the ETH 1.0 mainnet in July, as you can see from the two Twitter posts below (from February ) by Ethereum consultant Ryan Berckmans.

Here is a description of how Ethereum’s transaction pricing mechanism will work after EIP-1559 goes live:

“The proposal in this EIP is to start with a base fee amount which is adjusted up and down by the protocol based on how congested the network is. When the network exceeds the target per-block gas usage, the base fee increases slightly and when capacity is below the target, it decreases slightly.

“Because these base fee changes are constrained, the maximum difference in base fee from block to block is predictable. This then allows wallets to auto-set the gas fees for users in a highly reliable fashion.

“It is expected that most users will not have to manually adjust gas fees, even in periods of high network activity. For most users the base fee will be estimated by their wallet and a small priority fee, which compensates miners taking on orphan risk (e.g. 1 nanoeth), will be automatically set. Users can also manually set the transaction max fee to bound their total costs.

“An important aspect of this fee system is that miners only get to keep the priority fee. The base fee is always burned (i.e. it is destroyed by the protocol). This ensures that only ETH can ever be used to pay for transactions on Ethereum, cementing the economic value of ETH within the Ethereum platform and reducing risks associated with miner extractable value (MEV).

“Additionally, this burn counterbalances Ethereum inflation while still giving the block reward and priority fee to miners. Finally, ensuring the miner of a block does not receive the base fee is important because it removes miner incentive to manipulate the fee in order to extract more fees from users.”

The London hard fork is expected to go live on the Ethereum mainnnet at block height 12965000 at 12:00 UTC on August 5.

Earlier today, one Ethereum fan explained on Twitter that although EIP-1559 “doesn’t make $ETH deflationary by default”, it is still “very bullish for $ETH” and proceeded to explain why:

He/she then went on to say that once Ethereum has fully completed its transition to a Proof-of-Stake (PoS) consensus mechanism (i.e. once “The Merge” has taken place, which is expected to occur sometime in the first half of 2022), then EIP-1559 should help ETH to become a deflationary asset:

Yesterday (August 1), Simon Dedic, who is Co-Founder and Managing Partner at Moonrock Capital, a blockchain advisory and investment partnership based in London and Hamburg”, had this to say about Ethereum’s recent price action:

A few hours later, Chris Burniske, a partner at crypto-focused venture capital firm Placeholder, said that ETH seems to be much more in demand than BTC:

Then, earlier today, Popular cryptocurrency analyst Michaël van de Poppe expressed his bullishness in ETH by saying that he believe that ETH will eventually flip BTC (i.e. its market cap will eventually exceed that of BTC).

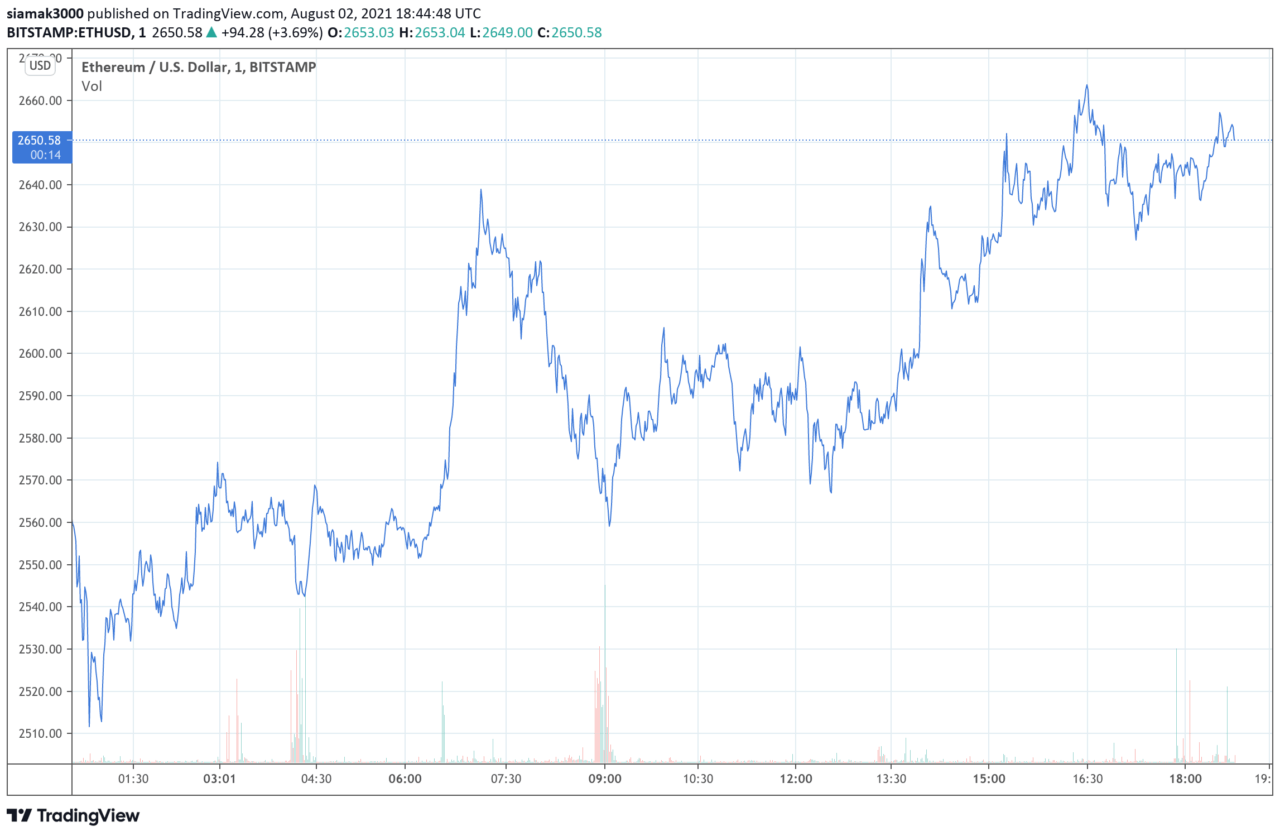

According to data by TradingView, on crypto exchange Bitstamp, ETH-USD is currently (as of 16:27 UTC on August 2) trading around $2,660, up 4.5% in the past 24-hour period and up 264% Ince the start of 2021.

DISCLAIMER

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.