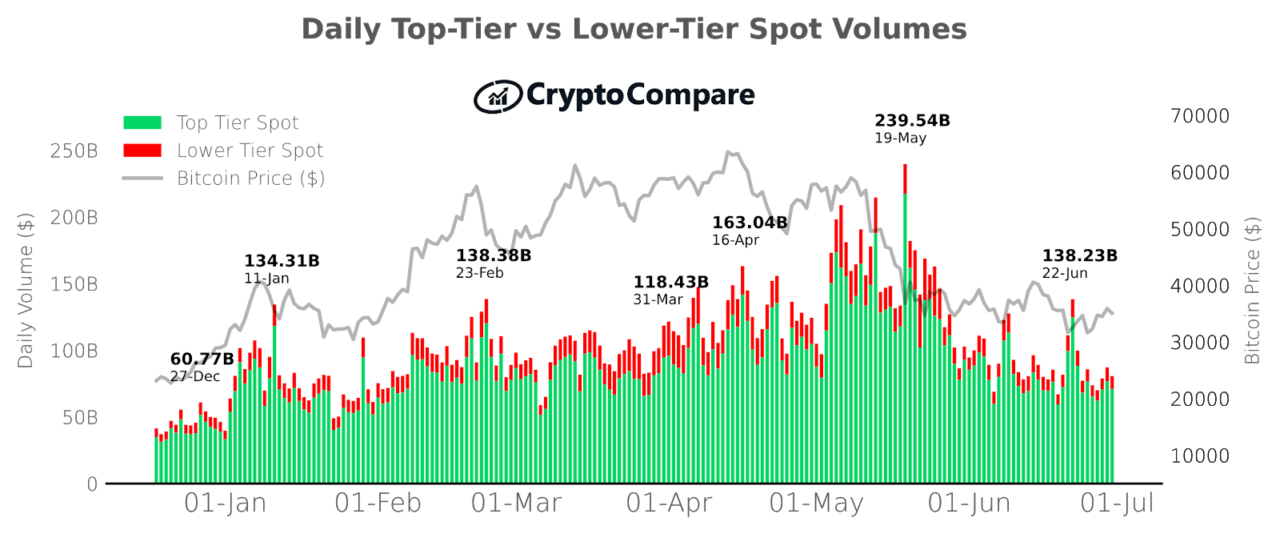

The price of bitcoin has dropped from a $64,000 all-time high in mid-May to a $30,000 low and recovered shortly after. The cryptocurrency has since been trading between $30,000 and $40,000 since and its reduced price and volatility have taken a toll on trading volumes.

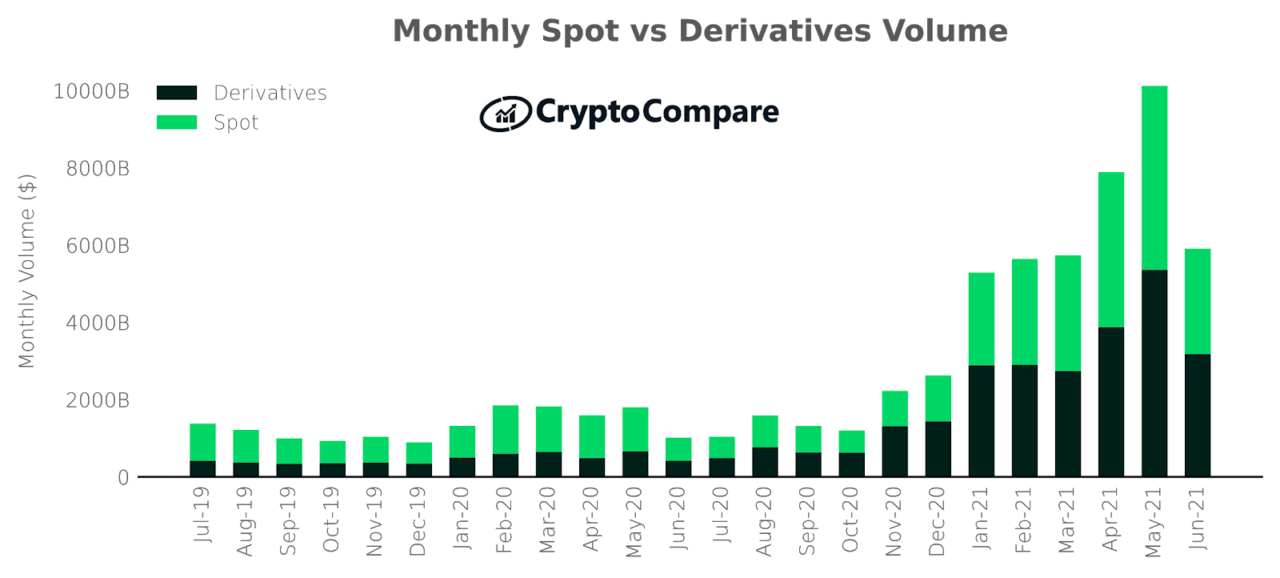

According to CryptoCompare’s June 2021 Exchange Review report, spot trading volumes have decreased by 42.7% compared to May, while derivatives trading volumes dropped by 40.7%. Bitcoin and Ethereum futures’ open interest also plunged by 31.8% and 29.3% respectively.

CryptoCompare details that for the first time this year, derivatives volumes surpassed spot volumes over the plunge, and now have 53.8% of the market share compared to 49.4% in May. Derivatives volumes in June were $3.2 trillion, while spot volumes were $2.7 trillion.

The report details Binance was the largest Top-Tier exchange by spot volume in June after trading $668 billion that month, down over 56%. It was followed by Huobi Global, which traded $162 billion, and by OKEx, which traded $141 billion. Binance also led derivatives trading volumes, followed by OKEx on this measure.

It’s worth noting Top-Tier exchanges are those graded AA-BB on CryptoCompare’s Exchange Benchmark, while Lower-Tier exchanges are those graded C-E. These top exchanges saw their market share rise in the continuation of a trend that has been ongoing since December 2019 as the market keeps attracting “further high-grade investment.” While in December 2019 Top-Tier exchanges had 47% of the market, they now handle 88% of the trading volume.

Open interest on cryptocurrency products also dropped 40.9% to $16.4 billion and is now at its lowest level since January 2021.

DISCLAIMER

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.

IMAGE CREDIT

Featured image via Pixabay