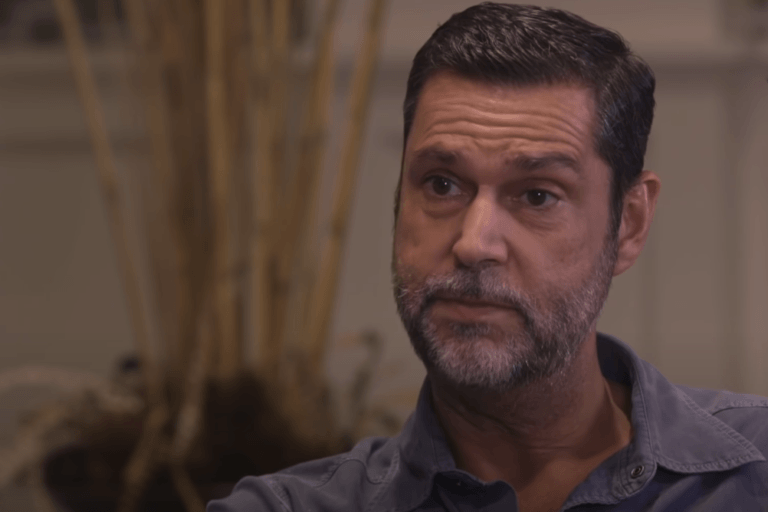

Recently, former Goldman Sachs executive Raoul Pal, who is seen as an important influencer in the crypto community, explained how he has been trying to optimise his crypto portfolio’s asset allocation strategy.

Prior to founding macro economic and investment strategy research service Global Macro Investor (GMI) in 2005, Pal co-managed the GLG Global Macro Fund in London for global asset management firm GLG Partners (which is now called “Man GLG”). Before that, Pal worked at Goldman Sachs, where he co-managed the European hedge fund sales business in Equities and Equity Derivatives. Currently, he is the CEO of finance and business video channel Real Vision, which he co-founded in 2014.

His comments came during an interview with the host of the “Cryptoinsightuk” YouTube channel.

According to a report by The Daily Hodl, Pal said:

“I started layering into more macro bets on where I thought the space was going. So trying to be more intelligent than just a basket, I’ve still kept the basket, but my bets are moving towards the metaverse and social tokens, and community tokens, which I think are going to be a huge, huge disruptive business model, and I think the metaverse is where everything going. So that’s kind of how I’ve played it. Now, I’m roughly 25% Bitcoin, 55% Ethereum, and 20% in all the other stuff.“

DISCLAIMER

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.