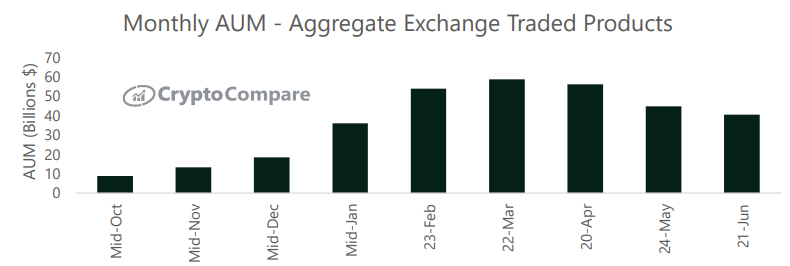

The total assets under management among cryptocurrency investment products dropped by 9.5% to $40.5 billion this month after the prices of leading cryptocurrencies plunged, with bitcoin falling 15.1% month-to-date and ethereum dropping 30.3% over the same period.

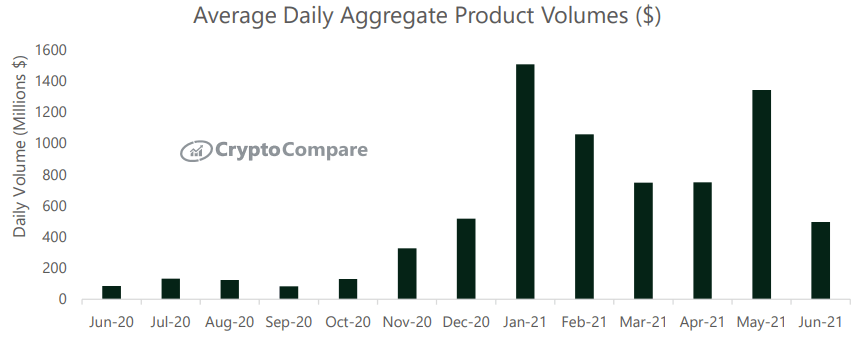

According to CryptoCompare’s Digital Asset Management Review, average weekly asset inflows across all major cryptocurrency investment products decreased by a whopping 215% since May, as $86 million of outflows were recorded.

Notably, cryptocurrency exchange-traded funds (ETFs) saw a net increase in assets under management of 8.5% to $1.8 billion. Crypto investment products with underlying BTC saw their assets under management drop 6.4% to $29.1 billion, which means they now represent 71.9% of total AUM, up from 69.5% last month.

Ethereum products’ assets under management fell by 15.2% to $9.5 billion, and now represent 23.4% of total assets under management. Among the ETFs, the 3iQ CoinShares Bitcoin ETF (BTCQ) had the highest AUM at $752 million, followed by Purpose’s Bitcoin ETF (BTC) with $715 million.

While assets under management dropped by less than 10%, the report details aggregate daily volumes across all cryptocurrency investment products decreased by “an average of 63.1% in June compared to May,” meaning average daily volumes for this month are now at $494.4 million.

Over the last 30 days, both bitcoin and ether-based products experienced heavy losses that got up to 22.8%. The MVDA Index, a “market cap-weighted index that tracks the performance of a basket of the 100 largest digital assets,” dropped by 15% over the same period.

Data from TradingView shows that the total crypto market capitalization has dropped by around $1 billion since it hit a $2.4 billion peak last month. It’s still far above the $1 trillion mark, which was for the first time surpassed earlier this year.

DISCLAIMER

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.

IMAGE CREDIT

Featured image via Pixabay