Data from the bitcoin blockchain shows that even as the price of the flagship cryptocurrency plunged from around $57,000 to a $30,000 low before recovering, long-term BTC holders kept buying the dip, while new investors sold at a loss.

Cryptocurrency prices crashed earlier this week over a series of factors. Tesla CEO Elon Musk tweeted out the electric car market would no longer accept bitcoin payments over environmental concerns and then implied it could sell the BTC it holds in its treasury, before clarifying it hasn’t done so.

On top of that, China has reportedly banned financial institutions from dealing with cryptocurrencies and warned investors against speculative cryptocurrency trading. Quantitative crypto researcher Sam Trabucco also pointed out that leverage played a big role in the market, and that as forced liquidations occurred the price kept dropping.

The crash saw the price of bitcoin plunged to a $32,000 low before recovering to $39,800 at press time according to CryptoCompare. Blockchain analytics firm Glassnode pointed out its latest weekly newsletter that data shows a “notable bifurcation of reactions.”

Per the firm, newer market entrants started “panic selling and realizing losses, whilst long-term hodlers appear relatively unphased by the news.” It added there are “many supply and demand dynamics that resemble the 2017 macro top,” with unique differences.

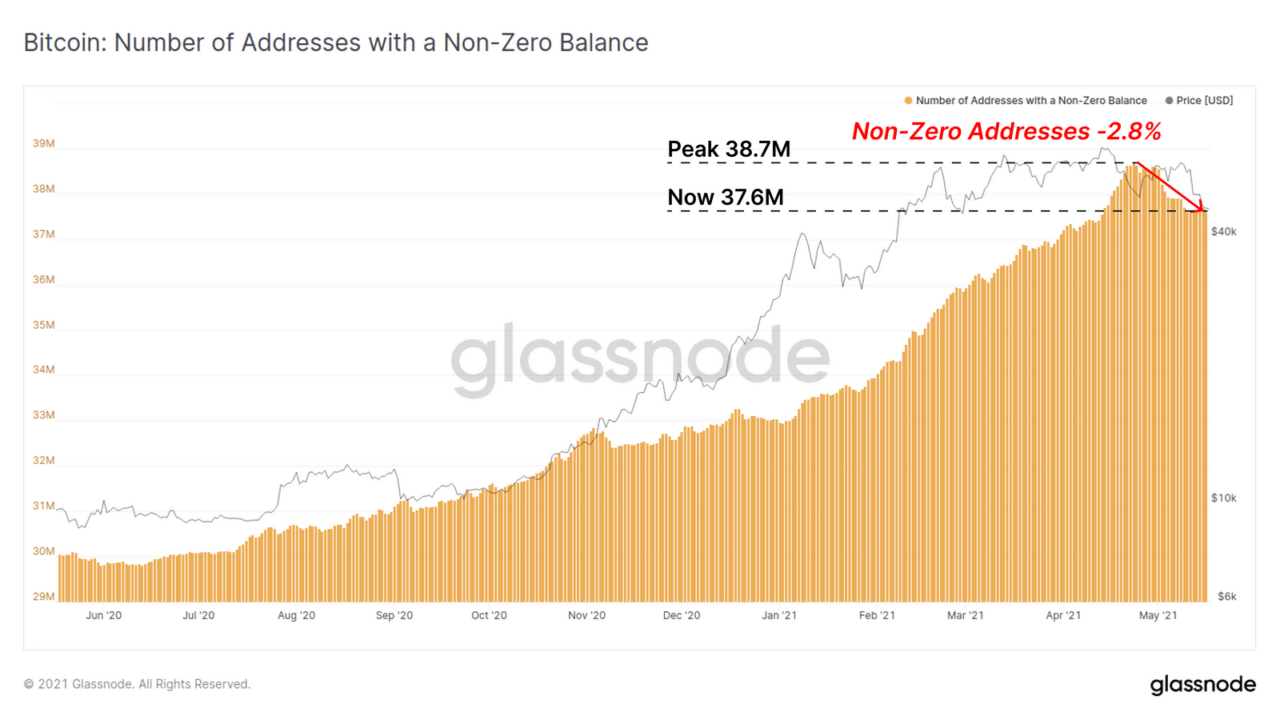

According to Glassnode the amount of coins being sold at a loss hit levels that usually mark the bottom of a dip. Newer investors were panic selling as there was a clear downtrend in the number of addresses with a BTC balance above zero after these hit a new all-time high of 38.7 million. A total of 1.1 million addresses, the firm wrote, spent all of their coins.

While new market participants panic-sold their holdings, strong hands bought the dip. The firm wrote:

However, long-term holders are stepping in to buy the dip and their confidence is largely unshaken. The PoW (proof of work) energy consumption narrative is nuanced to say the least, and what follows will be a test for the whole Bitcoin market’s conviction.

Similarly, cryptocurrency analytics firm Chainalysis pointed out that it does not appear “that t institutions are significant sellers, although they may be more cautious as buyers right now.

As reported, Nasdaq-listed business intelligence firm MicroStrategy has taken advantage of the recent sell-off in cryptocurrency markets to add more bitcoin to its treasury, investing $10 million in the flagship cryptocurrency when it was trading at $43,600.

DISCLAIMER

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.

IMAGE CREDIT

Featured image by Karolina Grabowska on Pexels