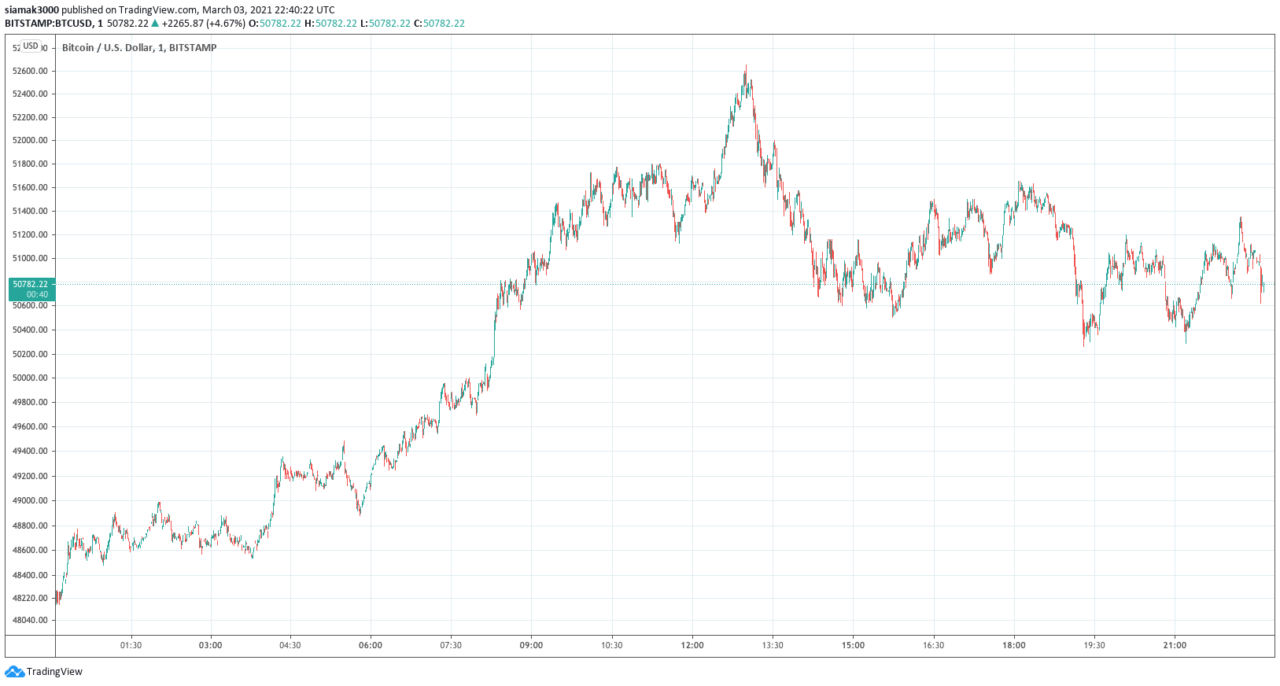

As the Bitcoin price went above $51,000 on Wednesday (March 3) for the first time since February 25, popular macroeconomist and crypto analyst Alex Krüger explained why Bitcoin is not getting too punished by rising real interest rates.

So, what are real interest rates?

Investopedia defines a “real interest rate” as follows:

“A real interest rate is an interest rate that has been adjusted to remove the effects of inflation to reflect the real cost of funds to the borrower and the real yield to the lender or to an investor. The real interest rate reflects the rate of time-preference for current goods over future goods. The real interest rate of an investment is calculated as the difference between the nominal interest rate and the inflation rate:

Real Interest Rate = Nominal Interest Rate – Inflation (Expected or Actual)“

Back in May 2020, Krüger listed the four macro drivers for Bitcoin:

He then went on to explain why real rates/yields had an impact on the price of Bitcoin:

“The economic crisis and central banks actions pushed real yields into negative territory. This makes it costly to hold interest bearing assets and makes assets such as gold more attractive, and likely bitcoin as well, at least for those who see it as digital gold.“

Well, earlier today, shortly after the Bitcoin price went above the $51,000 level (which happened at 16:01 UTC on March 3 on crypto exchange Bitstamp), Krüger once again took to Twitter to talk about the relationship between real rates and the price of Bitcoin.

He started by talking about why real rates are important:

“Why real rates matter Rising inflation + nominal interest rates capped at low levels = negative real interest rates. If real rates are positive one can hedge agaisnt inflation via rates instruments => don’t need gold or bitcoin to hedge.“

He then pointed out that — fortunately for Bitcoin HODLers — although rising real rates negatively impact the Bitcoin price, real rates are not the only price determinant for Bitcoin:

“Prices tell you real rates have become a secondary factor for $BTC. Were that not the case, $BTC would be getting trashed, like gold is. Rising reals still represent a headwind by reducing institutional demand and negatively impacting risk sentiment.

“Fortunately, real rates are not the only variable. Many want to buy bitcoin regardless of what rates are doing. Rates and governments’ response to covid opened the adoption floodgates. You can slow the flow, but can’t close the dam.“

Currently (as of 22:54 UTC on March 3), according to data by CryptoCompare, Bitcoin is trading around $50,641, up 5.84% in the past 24-hour period and up 74.79% since the start of the year.

Featured Image by “SnapLaunch” via Pixabay.com

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.