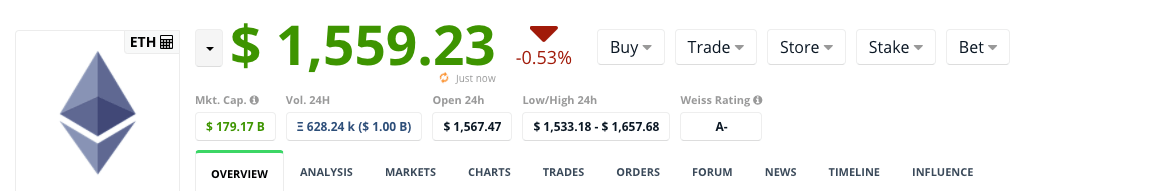

On Thursday (March 4), Ether is trading (as of 07:47 UTC) around $1559, which feels somehow appropriate since on Friday (March 5) EIP-1559 will be considered — at an All Core Devs meeting — for inclusion in the next network upgrade (“London”).

According to data by CryptoCompare, ETH is down 0.53% (vs USD) in the past 24-hour period, but up 111.53% (vs USD) in the year-to-date period.

EIP-1559 is a fee market change for the current ETH 1.0 blockchain. More specifically, it introduces a transaction pricing mechanism that “includes fixed-per-block network fee that is burned and dynamically expands/contracts block sizes to deal with transient congestion.” This enhancement was proposed on 13 April 2019 by Vitalik Buterin (@vbuterin), Eric Conner (@econoar), Rick Dudley (@AFDudley), Matthew Slipper (@mslipper), Ian Norden (@i-norden), and Abdelhamid Bakhta (@abdelhamidbakhta).

The following is a summary of how it is designed to work:

“There is a base fee per gas in protocol, which can move up or down each block according to a formula which is a function of gas used in parent block and gas target (formerly known as gas limit) of parent block. The algorithm results in the base fee per gas increasing when blocks are above the gas target, and decreasing when blocks are below the gas target. The base fee per gas is burned.

“Transactions specify the maximum fee per gas they are willing to give to miners to incentivize them to include their transaction (aka: inclusion fee). Transactions also specify the maximum fee per gas they are willing to pay total (aka: max fee), which covers both the inclusion fee and the block’s network fee per gas (aka: base fee).

“The transaction will always pay the base fee per gas of the block it was included in, and they will pay the inclusion fee per gas set in the transaction, as long as the combined amount of the two fees doesn’t exceed the transaction’s maximum fee per gas.“

Although many people in the Ethereum community expect EIP-1559 to go live on the current Proof-of-Work (PoW) blockchain in July as part of the “London” network upgrade, this has not been confirmed. In fact, there is an All Core Devs meeting (ACD 107) tomorrow (March 5), the second part of which will consider what EIP(s) should be part of the London hard fork.

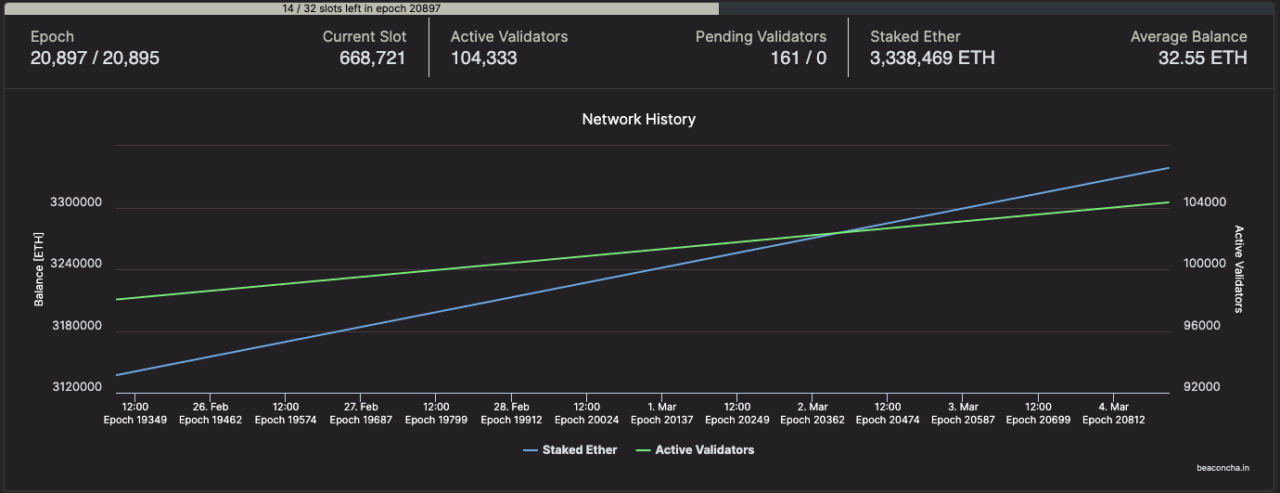

As for ETH 2.0, Bitfly’s ETH 2.0 Beacon Chain explorer tool tell us that as of 09:05 UTC on March 4, there are nearly 104,333 active validators, with around 3.33 million ETH (worth roughly $5.19 billion at current ETH prices) staked.

Featured Image by “elifxlite” via Pixabay.com

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.