Arcane Research, the research division of European crypto-focused investment firm Arcane Crypto explains in its latest report why Bitcoin is the perfect collateral asset, comparing it against gold, real estate, and government bonds.

Arcane Crypto is “managed by Norway’s leading cryptocurrency expert Torbjørn Bull Jenssen” and “currently operates out of Stockholm, London and Oslo.” Arcane Research’s report (titled “Banking on Bitcoin: The State of Bitcoin as Collateral”) was sponsored by crypto exchange Bitstamp.

The 71-page report starts out by talking about the size of the collateral market and the main problem with it:

“The value of the global market for collateral is estimated to be close to $20 trillion in assets. Government bonds and cash-based securities alike are currently the most important parts of a wellfunctioning collateral market. However, in that, there is a growing weakness as rehypothecation creates a systemic risk in the financial system as a whole. The increasing reuse of collateral makes these assets far from risk-free and shows the potential instability of the financial markets and that it is more fragile than many would like to admit.“

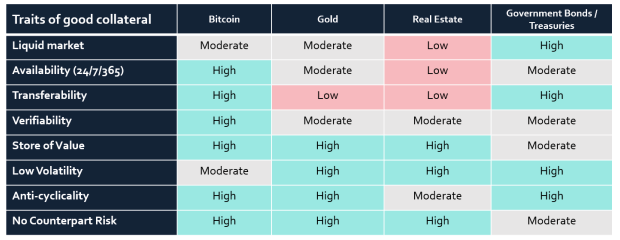

Arcane Research then explains how Bitcoin’s “unique properties” make it the ideal collateral asset:

“Bitcoin’s combination of properties is unlike those of any other asset classes: It is an asset without both counterparty risk and credit risk. It is available for trading 24/7, 365 days a year, all over the world. In addition, it is the most portable asset the world has ever seen. Bitcoin can be transferred around the world, instantly, at almost no cost, any time of the day, and any day of the year, and with full finality. No other assets can match these properties today, making bitcoin the perfect collateral asset for the future.“

Featured Image by “petre_barlea” via Pixabay

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.