The price of Ethereum’s ether cryptocurrency has hit a new all-time high near the $2,000 mark as institutional demand for the second-largest cryptocurrency by market capitalization keeps on growing.

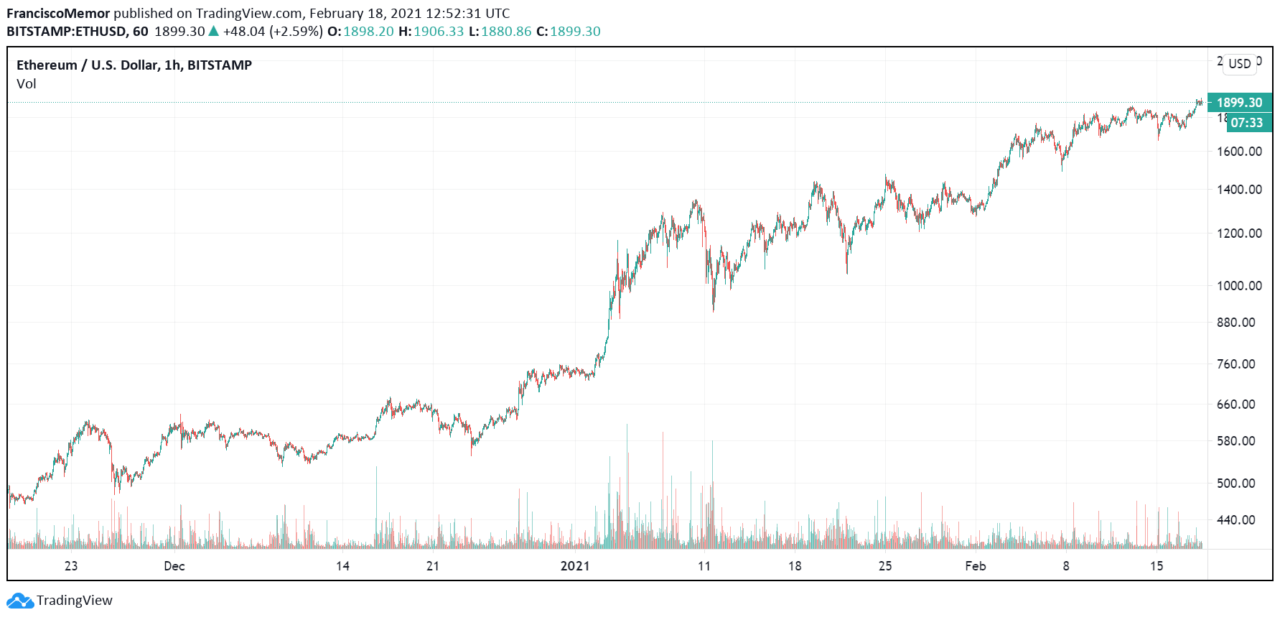

According to data from CryptoCompare and TradingView, on several cryptocurrency exchanges the ETH/USD trading pair surpassed the $1,920 mark before enduring a small correction that took it just below the $1,900 mark at press time.

The cryptocurrency has been trading sideways for much of February after surpassing its previous all-time high above $1,400 and consolidating around the $1,600 to $1,700 range. Year-to-date, ether has been outperforming bitcoin, as it’s up over 160% versus BTC’s 85%, data shows.

Ethereum’s meteoric rise has been attributed to several factors, including the upcoming Ethereum 2.0 upgrade. Late last year phase 0 of the upgrade started with the launch of the Beacon Chain, a Proof-of-Stake (PoS) blockchain that runs alongside the original Ethereum PoW chain, making sure that there is no break in the continuity of the chains.

The Ethereum 2.0 staking contract now has over 3.1 million ETH locked in it, worth over $6 billion. These funds are locked. On top of that, institutional demand for ETH has been growing to at least justify the launch of ETH futures contracts from the CME Group.

As CryptoGlobe reported, the chief strategy officer at investment firm CoinShares, Meltem Demirors, has revealed institutional investor interest in Ethereum has been at unprecedented levels. During an interview, Demirors said that last week 80% of inflows CoinShares tracked, or about $175 million, went into Ethereum investment products, pointing out they had “never seen institutional interest like that before.”

Ki Young Ju, CEO of crypto analytics firm CryptoQuant, pointed out on social media late last year his firm tracked several massive ETH outflows from Coinbase cold wallets, which could suggest large investors were buying up the cryptocurrency in over-the-counter deals.

Ki suggested a bullish case for ETH can be made based on fewer deposits and more withdrawals across cryptocurrency trading platforms, as “selling pressure [is] significantly weaker than in 2018.

Popular cryptocurrency analyst Alex Krüger said on social media that $1,920 is a level to watch for Ethereum, along with $2,000 and $2,240. After breaking these levels, the cryptocurrency’s rise will go on to $2,500 and $2,750, he suggested. His levels were derived from round number, Fibonacci extensions, and option strike prices.

Featured image via Unsplash.