Although the Bitcoin price went as low as $44,845 on Bitstamp yesterday (February 23), some annoucements that were made later in the day seem to have helped Bitcoin get above $50K, thereby calming the crypto market’s nerves.

According to data by TradingView, although Bitcoin started Tuesday (i.e. 00:00 UTC) around $54,173, by 11:45 UTC, the Bitcoin price had fallen to $44,845.

As you can see in the chart above, last Sunday (February 21), Bitcoin was trading on Bitstamp as high as $58,354 (at 19:05 UTC). So, what dented confidence in Bitcoin so much that two days later some people were ready to sell it for as low as $44,845, i.e. selling their BTC at a price that was over 23% lower?

Yesterday, one crypto analyst offered the following plausible explanations for Bitcoin’s price crash:

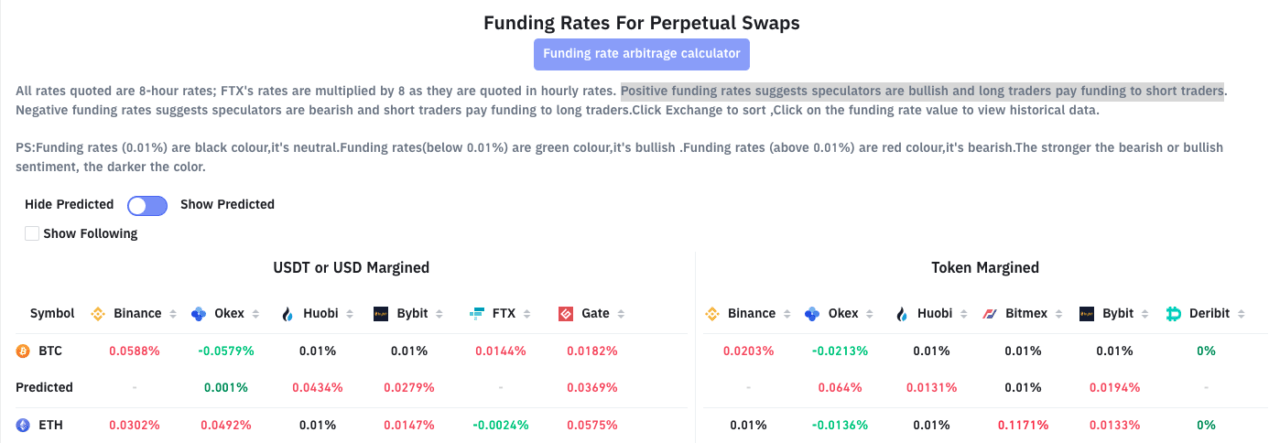

The chart below from Glassnode shows that on Sunday (February 21), the funding rates for perpetual swaps were above 0.12%, which is quite high. As Bybt explains, “positive funding rates suggests speculators are bullish and long traders pay funding to short traders.” Then, as the BTC price header lower toward $50K and below, the funding rate funding rate for perpetual swaps across all crypto derivatives exchanges started going down until it reached around 0.01%, which is considered a neutral position.

Note that currently (as of 09:03 UTC on February 24) on Binance the funding rate for perpetual swaps is positive (+0.0588% for USDT/USD perpetuals), which means that margin traders on Binance Futures are feeling bullish on Bitcoin.

So, what were the announcements made yesterday that apparently stopped Bitcoin from falling to the low 40s?

Well, first, at 12:57 UTC, it was announced that Tether and Bitfinex have settled their 2.5 year dispute with the New York State Attorney General’s office.

Second, just after closing below (i.e. 21:00 UTC), FinTech firm Square (NYSE: SQ) announced fourth quarter and full year 2020 results. In its press release, Square said that it had bought another $170 million worth of Bitcoin:

“Square… has purchased approximately 3,318 bitcoins at an aggregate purchase price of $170 million. Combined with Square’s previous purchase of $50 million in bitcoin, this represents approximately five percent of Square’s total cash, cash equivalents and marketable securities as of December 31, 2020.

“Aligned with the company’s purpose, Square believes that cryptocurrency is an instrument of economic empowerment, providing a way for individuals to participate in a global monetary system and secure their own financial future. The investment is part of Square’s ongoing commitment to bitcoin, and the company plans to assess its aggregate investment in bitcoin relative to its other investments on an ongoing basis.“

Square’s CFO told CNBC that Bitcoin “has the potential to be the native currency of the internet” and that Bitcoin is becoming an increasing par of their business.

Since Square’s announcement, on Bitstamp, the price of Bitcoin has gone from $48,404 to $50,838 (as of 09:20 UTC on February 24), which is an increase of just over 5%. What makes this price increase even more noteworthy is that it has come during Asian trading hours.

One of the partners at advisory firm and crypto hedge fund Spartan Group had this to say about the current state of the market:

Around the same time, Steven McClurg, one of the co-founders of cryptoasset management firm Valkyrie, disclosed that his firm had put more Bitcoin on its corporate balance sheet.

Featured Image by “SnapLaunch” via Pixabay.com

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.