This article provides an update (as of 10:30 UTC on 4 February 2021) on the current state of the Bitcoin markets, as well on the latest thinking on Bitcoin by influential crypto analysts, investors, traders, and other thought leaders.

Bitcoin’s Price Action

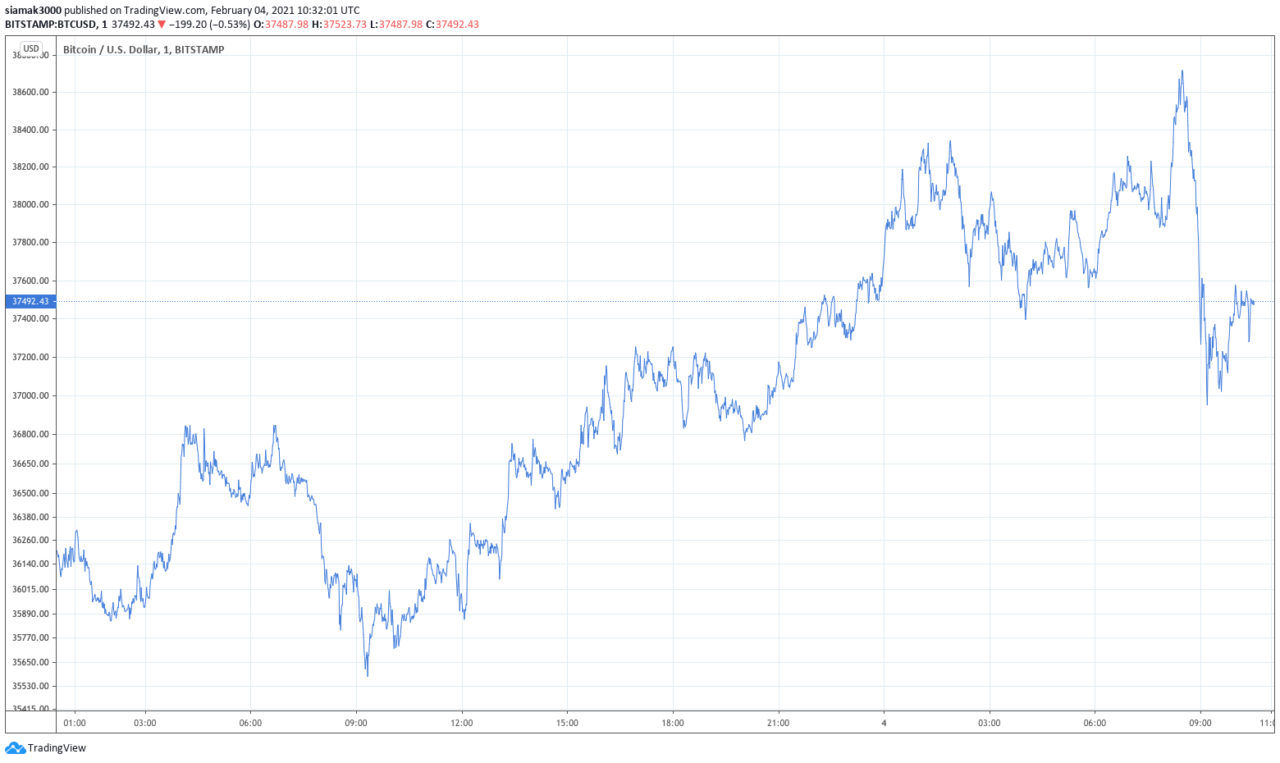

According to data by TradingView, on crypto exchange Bitstamp, Bitcoin traded in the range $35,520 (at 00:00 UTC) – $37,691 (at 23:59 UTC) on Wednesday (February 3).

As for today (February 4), on Bitstamp, Bitcoin had its intraday high of $38,721 at 08:28 UTC.

According to data by CryptoCompare, currently (as of 10:47 UTC), BTC-USD is trading around $37,724, which means that Bitcoin’s market cap stands roughly at $702 billion. The Bitcoin price is up 4.67% in the past 24-hour period and up 30.20% in the year-to-date (YTD) period.

Popular crypto analyst and trader Michaël van de Poppe had this to say about Bitcoin’s latest price action:

Crypto analyst Scott Melker says that– depending on how things go today — the Bitcoin price could be heading toward $63,400:

As for the Reddit crowd, which has been helping to pump XRP and Dogecoin (DOGE) recently, there are some signs that they might be getting interested in investing in Btcoin:

Although there are some who say that that the current high prices of stocks and cryptoassets suggests we are witnessing a bubble that could burst at any time, macroeconomist and crypto analyst Alex Krüger argues that the current prices are appropriate given the amount of quantitative easing (or “money printing”) by the world’s major central banks in the past one year period.

With regard to price targets for Bitcoin, Mike McGlone, Senior Commodity Strategist at Bloomberg Intelligence (BI), Bloomberg’s research arm on the Bloomberg Terminal, said in the February 2021 edition of Bloomberg’s Crypto Outlook report:

“Bitcoin’s price-discovery stage points to the next threshold vs. gold, around 100x an ounce, as its upward trajectory has legs. The benchmark crypto was initially capped at 1x until 2017, then 10x until December as the dichotomy between the Bitcoin haves and have-nots quickly narrows.

“Absent a major technology glitch, old-guard gold allocators are primarily at risk if the crypto becomes a reserve asset and Bitcoin as 1-5% of one’s investable assets becomes increasingly prudent. About $30,000 is Bitcoin’s support level vs. $50,000 initial target resistance. The broader crypto market is more speculative and increasingly subject to Bitcoin.“

Bitcoin’s Taproot Upgrade

According to a report by Coindesk published yesterday, “many of Bitcoin’s most active stakeholders have just about nailed down the activation method for Taproot, the Bitcoin software’s biggest upgrade in years.”

Taproot is “a proposed Bitcoin protocol upgrade that can be deployed as a forward-compatible soft fork” that expands Bitcoin’s “smart contract flexibility” by “combining the Schnorr signature scheme with MAST (Merklized Alternative Script Tree) and a new scripting language called Tapscript.”

The Coindesk report went on to say:

“In a public meeting on Internet Relay Chat (IRC) Tuesday, Bitcoin developers, miners, business professionals and enthusiasts hashed out the specifics of how to package the Taproot upgrade into an update – and how to activate it once the code has been shipped.“

Upcoming Bitcoin Trusts

On Wednesday (February 2), Bitwise Asset Management, which is a leading cryptoasset manager with over $700 million in assets under management (“AUM”), announced that it has “begun the regulatory process to allow shares of the Bitwise Bitcoin Fund to trade on OTCQX.”

Its approval would mean that “shares of the fund would be available for trading in traditional brokerage accounts and for custody with many traditional custodians.”

Bitwise President Teddy Fusaro had this to say:

“We are tremendously excited to take the Bitwise Bitcoin Fund down the path recently taken by the Bitwise 10 Crypto Index Fund (OTCQX: BITW),” said Bitwise President Teddy Fusaro. “We have been managing this fund since 2018, offering investors a cost-effective, convenient, and secure means of gaining investment exposure to bitcoin, and are excited to potentially see shares of the fund quoted on OTCQX.“

Bitwise says that this fund — which was opened for private placements by U.S. accredited investors in December 2018 — “charges a 1.5% expense ratio, which includes costs related to custody, tax, accounting, and management fees, lower than competing products.”

Matt Hougan, chief investment officer at Bitwise, stated:

“There is significant growth in interest from professional investors in accessing bitcoin as a tool to hedge their portfolios against rising inflationary risks… Financial advisors in particular are taking note of the large allocations that hedge funds, institutions, insurance companies, and traditional asset managers are making to bitcoin, and based on our recent survey of nearly 1,000 financial advisors, many are deciding that now is the time to consider an allocation of their own.“

Featured Image by “SnapLaunch” via Pixabay.com

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.