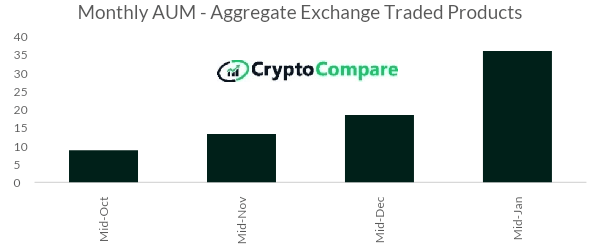

The assets under management (AUM) and trading volumes of cryptocurrency exchange-traded products (ETPs) have started surging over the last few weeks, to the point there are now nearly $36 billion in AUM across all ETPs.

According to CryptoCompare’s Digital Asset Management Review, the AUM across all ETPs increased 95% to $35.96 billion as aggregated ETP trading volumes almost tripled this month to $837 million per day.

Average daily trading volumes, the report reads, now stand at $1.51 billion compared to $516.8 million in December 2020. ETP activity is relevant as it may be the “best bellwether of institutional investor demand,” since these products may be the only way highly regulated investors gain exposure to cryptoassets, the report adds.

The data, per CryptoCompare, paints a clear picture of “surging institutional investor demand and this supports the widely believed narrative that this bull market is largely institutional investor led.” The rally is, as such, different from the retail-driven bull market in 2017, which led to the year-long bear market in 2018.

As for ETP price performance, the best performing Bitcoin product by market price was 3iQ’s Listed Trust Product (QBTC), with 91.3%. its performance exceeds that of CryptoCompare’s CCCAGG BTC/USD index performance, which went up 89.2%.

For Ethereum, the top-performing product among the most liquid ETPs included XBT Provider’s Ether Tracker Euro, showing 30-day returns of 98%, in line with CryptoCompare’s CCCAGG ETH/USD index performance. Grayscale’s Bitcoin and Ethereum trusts, it’s worth noting, were among the worst-performing products relative to others.

CryptoCompare’s report adds that out of the top 15 ETPs by volume, six underperformed the MVDA index, a market cap-weighted index that tracks the performance of a basket of the 100 largest cryptoassets by market capitalization.

The index, it adds, “serves as benchmark and universe for the other MVIS CryptoCompare Digital Assets Indices.” Premiums for Grayscale’s and 3iQ’s bitcoin products have decreased since the price of BTC hit a new all-time high near $42,000 earlier this month, which could suggest demand slowed down.

Taking into account a drop in demand Ki Young Ju, CEO of blockchain analytics startup CryptoQuant, has revealed he has “no doubt” the price of bitcoin will hit $100,000 this year, but added that in the short-term he has a bearish stance over the lack of significant buying pressure.

Featured image via Pixabay.