This article provides an update (as of 08:30 UTC on 28 January 2021) on the latest thinking on Bitcoin by influential crypto analysts, investors, and traders, and other thought leaders.

Bitcoin’s Price Action

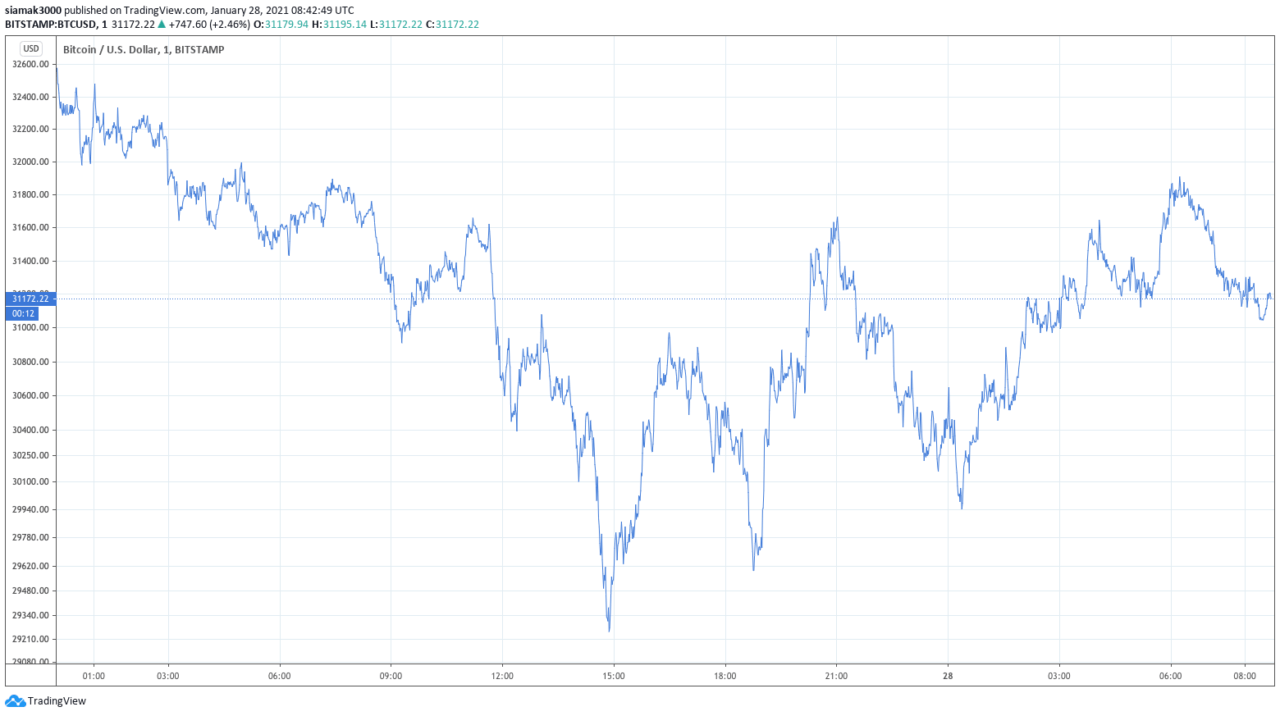

According to data by TradingView, on crypto exchange Bitstamp, Bitcoin traded in the range $29,250 (at 14:52 UTC) – $32,580 (at 00:00 UTC) on Wednesday (January 27).

Currently (as of 08:45 UTC on January 28), per data by CryptoCompare, Bitcoin is trading around $31,292, up 0.24% in the past 24-hour period and up 8% in the year-to-date period.

Prominent crypto analyst Michaël van de Poppe had this to say yesterday about Bitcoin’s latest price action:

Another popular crypto analyst, Josh Rager, also advises patience at this time:

Holger Zschaepitz, Senior Editor at the Economic and Financial desk of the German daily Die Welt and its Sunday edition Welt am Sonntag, said earlier today that the current “risk-off” mood is helping both Bitcoin and gold at the moment:

General Manager of Bank for International Settlements (BIS) Criticizes Bitcoin

BIS was established in 1930 and is based in Basel, Switzerland. Its aims are “to serve central banks in their pursuit of monetary and financial stability, to foster international cooperation in those areas and to act as a bank for central banks.”

Yesterday, Agustín Carstens, General Manager of the BIS, delivered a speech to public policy think tank Hoover Institution, and he took this opportunity to criticize Bitcoin.

“Satoshi Nakamoto’s protocol envisions a decentralised consensus, with no need for a central intermediary. Yet in practice, it is clear that Bitcoin is more of a speculative asset than money. One contact recently told me that like Bitcoin is ‘Tesla without the cars’ – observers are fascinated by it, but the actual value backing is lacking. Perhaps the Bitcoin network should be seen more like a community of online gamers, who exchange real money for items that only exist in cyber space.

“Bitcoin poses as its own unit of account, but fluctuations in value mean it is unrealistic to set prices in bitcoin. This also undermines its usefulness as a means of exchange, and makes it a poor store of value.

“The structure of the Bitcoin market is decidedly concentrated and opaque, and there is research evidence on price manipulation.

“Above all, investors must be cognisant that Bitcoin may well break down altogether. Scarcity and cryptography alone do not suffice to guarantee exchange.

“Bitcoin needs a hugely energy-intensive protocol, called ‘proof of work’, to safely process transactions. Currently, so-called miners sustain the system’s security, and are rewarded with newly minted coins. A sad side effect is that the system uses more electricity than all of Switzerland.

“In the future, as Bitcoin approaches its maximum supply of 21 million coins, the ‘seigniorage’ to miners will decline. As a result, wait times will increase and the system will be increasingly vulnerable to the ‘majority attacks’ that are already plaguing smaller cryptocurrencies.“

Re Carstens’s comment about potential 51% attacks on Bitcoin in the future, Jameson Lopp, CTO at Casa, told CoinDesk:

“Bitcoin becoming attackable like other networks is not likely, because it would still require a large upfront capital expense for someone to acquire the appropriate hardware. This would only make sense in a world where another SHA256 secured network came along and became far more valuable to mine than Bitcoin.“

Miami and Bitcoin’s White Paper

In a recent interview, Miami mayor Francis Suarez said that his city is looking into “having and holding” a percentage of its treasury reserves in Bitcoin. Suarez’s comments about Bitcoin during an interview last Thursday (January 14) with Stuart Varney, the host of FOX Business’ “Varney and Co.”

Varney stated the interview by asking Suarez if he was ready to explain why Miami was considering investing in such a volatile asset.

Mayor Suarez replied:

“Sure! if I would have done it last year, I would have made 200+ percent. So, I would have looked like a genius, but we want to be one of the most crypto forward and technological cities in the country. So, we’re looking at number one, creating a regulatory framework that makes us the easiest place in the United States to do business if you’re doing it in cryptocurrencies…

“We’re looking at laws from Wyoming, Wisconsin, and New York… and we have a tremendous amount of interest in tech right now. So, we’re looking at a variety of things from being able to make payments in crypto, in Bitcoin in particular, being able to your taxes, being able to pay fees to the city, and then yes we are looking at the possibility of diversifying our investment portfolio, and having and holding a percentage of our investments in Bitcoin.“

Well, yesterday, Mayor Suarez reported on Twitter that the City of Miami government had decided to host Bitcoin’s white paper.

Featured Image by “SnapLaunch” via Pixabay.com

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.