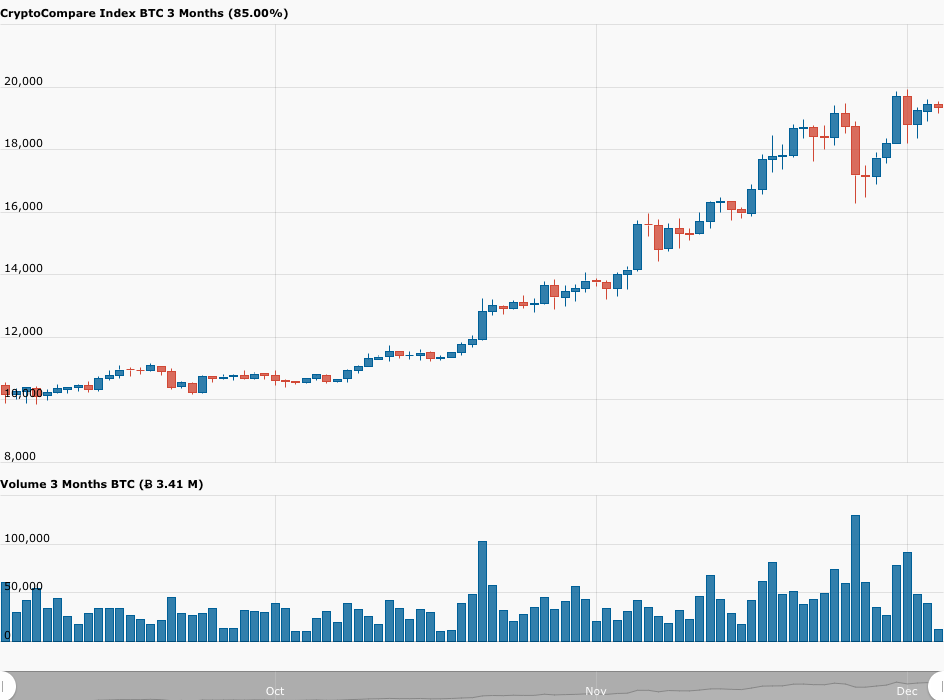

On Thursday (December 3), Reuters reported that as Bitcoin’s current bull ran has taken the price to new all-time highs this week, it appears that most of the buying is coming not from East Asia (unlike in 2017) but from North America.

According to the Reuters report, which used data from blockchain analysis firm Chainalysis, “weekly net inflows of bitcoin – a proxy for new buyers – to platforms serving mostly North American users have jumped over 7,000 times this year to over 216,000 bitcoin worth $3.4 billion in mid-November.”

It goes on to say that East Asian exchanges are losing out, with net outflows of 240,000 BTC (worth around $3.8 billion in November) versus net inflows of 1,460 BTC in January.

Ciara Sun, Head of Global Business and Markets at crypto exchange Huobi, told Reuters:

“The sudden influx of institutional interest from the North American region is driving a shift in bitcoin trading, which is rebalancing asset allocations across different exchanges and platforms.”

Apparently, based on Chainalysis data, “volumes at four major North American platforms have doubled this year to reach 1.6 million bitcoin per week at the end of November, while trading at 14 major East Asian exchanges have risen 16% to 1.4 million.”

Experts that Reuters interviewed said that U.S.-based investors are “being attracted by the tightening oversight of the American crypto industry.” Meanwhile, over in East Asia, according to Leo Weese, co-founder of the Hong Kong Bitcoin Association, there is concern among some investors that there might be a crackdown on major crypto exchanges that have many/mostly China-based customers but are headquartered elsewhere.

Christopher Matta, Managing Director of Sales and Trading at Canada’s leading bitcoin and cryptoasset fund manager 3iQ Corp, told Reuters:

“A lot of U.S. funds are trading with large U.S. counterparties. It tells you right there how important the regulatory nature of the space is, and having venues to trade on that are regulated – it’s definitely something that institutional investors are thinking about.”

Featured Image by “EivindPedersen” via Pixabay.com

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.