On Thursday (December 10), VanEck’s MV Index Solutions (MVIS) and leading cryptoasset market data provider CryptoCompare, announced the licensing of the “MVIS CryptoCompare Institutional Ethereum Index” (ticker: MVIETH) to 3iQ Corp., Canada’s leading digital asset manager, for their Ether Fund.

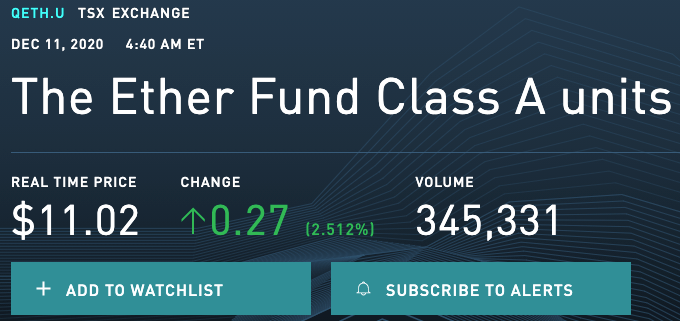

On the same day, 3iQ Corp. announced that The Ether Fund had completed its initial public offering (IPO) of “7,240,000 Class A Units and Class F Units for aggregate gross proceeds of approximately US$76.5 million.” The Class F Units were “reclassified into Class A Units immediately upon the closing of the offering,” and the Class A Units started trading on Thursday on the Toronto Stock Exchange (TSX) under the symbol QETH.U.

3iQ says that funds’s investment objectives are to provide holders of units of the fund with (a) “exposure to the digital currency Ether and the daily price movements of the U.S. dollar price of Ether”, and (b) “the opportunity for long-term capital appreciation.” 3iQ Corp. is the investment manager and portfolio manager of the fund.

According to MVIS and CryptoCompare’s joint press release, Steven Schoenfeld, CEO of MVIS, had this to say:

“We are proud to expand our Digital Asset Index family with the launch of the MVIS CryptoCompare Institutional Ethereum Index and its licensing to 3iQ.

“This launch advances our industry-leading position in cryptocurrency benchmarks, and further confirms our role as a trusted partner to innovative product issuers in this dynamic space.”

The MVIS CryptoCompare Institutional Ethereum Index (ticker: MVIETH) is “an index designed to measure the performance of a digital assets portfolio which invests in Ethereum, priced on selected exchanges.”

Quynh Tran-Thanh, Head of Indices and Investable Instruments of CryptoCompare, stated:

“We are excited to provide 3iQ Corp. with a premium measure of market performance for their product. The launch of this fully regulated fund marks yet another milestone in the advancement of global exposure to innovative digital asset products.”

And Tom Lombardi, Managing Director of 3iQ, added:

“Our charter at 3iQ is to bring digital assets to the listed markets with the help of best-in-class service providers like MVIS. The new product is the next step in our company’s journey.”

The MVIS CryptoCompare Institutional Ethereum Index, which was launched on 6 August 2020, is a robust and transparent benchmark for Ethereum. It’s a rules-based index, intended to give investors a means of tracking the performance of Ethereum on selected exchanges, which are ranked on the basis of CryptoCompare’s Exchange Benchmark. These exchanges include Binance, Bitstamp, Coinbase, Gemini, itBit and Kraken.

This is how Tyler Winklevoss, Co-Founder and CEO of Gemini, congratulated Ether HODLers:

Featured Image by “jplenio” via Pixabay.com

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.