Cryptocurrencies have taken the world by storm and Canada wasn’t left out. Data shows the cryptocurrency ecosystem in the country has been steadily growing over the last few years, although retail interest has remained relatively low throughout the recent bull run.

A study from the Bank of Canada in 2018, referring to data from 2017, revealed that awareness of bitcoin, measured by the response to the question “have you heard of bitcoin?” rose 21% year-over-year to 85% in the country, with some regions going as far as 93%.

That same study found that in 2016 2.9% of Canadians owned BTC, while in 2017 the figure moved up to 5%. Most BTC users in the country, however, bought relatively small amounts below 0.1 BTC. In Canada, according to a study from the Information and Communication Technology Council (ICTC) there are 280 companies employing 1,600 workers in the blockchain ecosystem.

Vancouver and Toronto are the leading centres of the new blockchain-based economy in the country, employing 65% of the total workforce with 60% of the companies based there. A large percentage of the companies in Canada are crypto mining businesses, which move there thanks to the low climate and low energy costs.

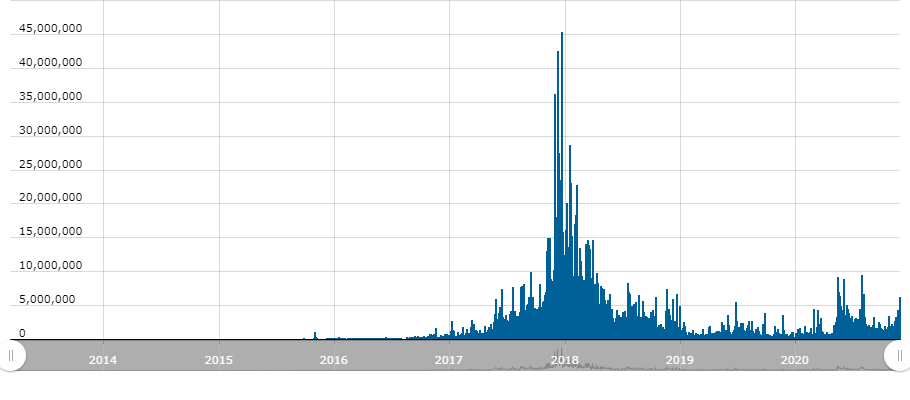

CryptoCompare data shows that trading volumes in the country’s currency, the Canadian Dollar (CAD) exploded in late 2017 when the price of BTC hit a new all-time high near $20,000, and haven’t recovered since, despite the cryptocurrency’s price recovery to over $19,000 this month.

Crypto Regulations in Canada

Canada’s stance towards cryptocurrencies is permissive, and users are allowed to buy and sell cryptoassets as they want to, and are allowed to use them as a payment method for goods and services. The government’s page on cryptocurrencies reads:

You can use digital currencies to buy goods and services on the Internet and in stores that accept digital currencies. You may also buy and sell digital currency on open exchanges, called digital currency or cryptocurrency exchanges.

The page warns, however, that digital currencies such as bitcoin are not legal tender in Canada, unlike the Canadian dollar. The Currency Act, it adds, defines legal tender as “bank notes issued by the Bank of Canada under the Bank of Canada Act” and “coins issued under the Royal Canadian Mint Act.”

Bitcoin and other cryptocurrencies are not issued by any government or financial institution. In Canada, when you file taxes you must report gains or losses from buying and selling cryptoassets.

Digital currencies, the government’s website ads, are considered a commodity and are “subject to the barter rules of the Income Tax Act.” Not reporting income from crypto transactions is illegal, it adds.

Buying Bitcoin

It’s important to consider several factors when looking at cryptocurrency exchanges to buy your crypto assets, as an unsecure platforms may mean a lot of trouble. As no authority controls a cryptocurrency’s network, your funds are at risk with unregulated entities.

The following points should always be considered:

- Security

- Custody

- Regulatory and banking relationships

- Closed-loop or open-loop

- Trading and transaction fees.

It’s common practice for most cryptocurrency exchanges to keep the majority of deposited funds offline in so-called cold storage, a cryptocurrency exchange must also secure banking relationships so they can process deposits and withdrawals with ease and maintain their operations.

Seemingly, regulatory relationships are crucial. Popular derivatives trading platform BitMEX was earlier this year charged with failing to prevent money laundering, and the result was an exodus from the platform.

Understanding whether an exchange is closed-loop or open-loop is simple. Closed-loop exchanges are those that do not allow users to transfer funds out of their platform: PayPal, Robinhood, and others are closed-loop platforms. While users can gain exposure to cryptoassets, they cannot transfer them to a wallet to which they own the private keys of.

On the other hand, open-loop exchanges let users withdraw their funds to wallets under their control.

Finally, trading and transaction fees can easily eat away users’ profits, defeating the purpose of investing in the cryptocurrency space. Exchanges should be transparent about their fee schedule.

Options to Buy Crypto in Canada

For Canadian users there are several options out there to gain exposure to cryptocurrencies. Some are closed-loop trading platforms, so It’s important to be aware. Here are some of the most prominent options:

3iQ

3iQ is a digital asset management firm that is behind The Bitcoin Fund (QBTC), whose net asset value (NAV) is now above the $300 million mark, and trades on the Toronto Stock Exchange (TSX).

With the fund it’s easy to buy BTC using either USD or CAD on the exchange, but being on such a platform means it’s a closed-loop exchange. Moreover, each unit of the fund has 0.001114 BTC in it, meaning you’d need to buy 897.34 units to own one whole BTC. The fund has a management fee of 1.95%.

WealthSimple

WealthSimple is a popular firm in Canada for its equity investment and stock trading products. It has released cryptocurrency trading solutions as well, via the WealthSimple Crypto (WSC) platform.

The platform is registered as a Restricted Dealer with the Canadian Securities Administrator’s Regulatory Sandbox and assets purchased through it are not protected by insurance. Users are limited to buying BTC or ETH on WSC and the platform runs a closed-loop system.

The firm has zero withdrawal, deposit or trading fees. WealthSimple does charge a spread in market prices to make a profit on its cryptocurrency operations.

Cryptocurrency Exchanges – NDAX

The last option is to trade cryptocurrencies directly on exchanges, these allow users to buy various cryptocurrencies – not just BTC or ETH – in an open-looped system, which means the funds can be withdrawn and moved to a wallet under your control.

The National Digital Asset Exchange (NDAX) is a popular solution among Canadian users. It’s registered with the Financial Transactions and Reports and Analysis Centre of Canada (FINTRAC) and Autorité des marchés financiers (AMF) as a Money Service Business (MSB).

The firm has a banking relationship with a Canadian Crown-owned financial institution with insurance protection for user funds, and holds the majority of cryptocurrency funds deposited offline in cold storage, away from hackers.

NDAX, as other top crypto exchanges, runs an open-looped system and lets users buy several cryptocurrencies, including BTC, ETH, LTC, USDT, XRP, EOS, and LINK. It charges a 0.2% trading fee, and has standard withdrawal fees meant to cover the costs of moving funds on the blockchain.

You can read a full review of NDAX here.

Featured image via Unsplash.