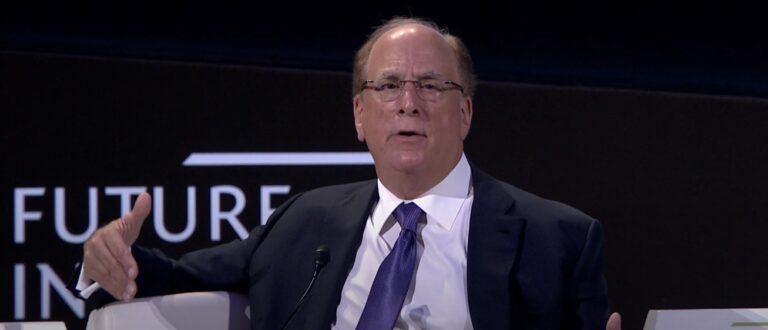

On Tuesday (December 1), Larry Fink, Co-Founder, Chairman and CEO of BlackRock, the world’s largest asset manager, said during an interview that “Bitcoin has caught the attention and the imagination of many people.”

BlackRock, which was founded in 1988, started with just eight people working in one room. It made its Initial Public Offering on the New York Stock Exchange on 1 October 1999 at $14 a share.In 2006, BlackRock acquired Merrill Lynch Investment Management. Then in 2009, it acquired Barclay’s Global Investors (BGI), “becoming the world’s largest asset manager, with employees in 24 countries.” As of 31 March 2020, BlackRock had $6.47 trillion in assets under management (AUM).

On Tuesday, when according to CryptoCompare Bitcoin set a new all-time high ($19,892 at 11:00 UTC), MarketWatch reported that Fink made some interesting comments about Bitcoin during a talk with former Bank of England Governor Mark Carney at the Council on Foreign Relations.

“Bitcoin has caught the attention and the imagination of many people. Still untested, pretty small market relative to other markets.”

The MarketWatch report says that Fink went on to say:

“these big giant moves every day…it’s a thin market. Can it evolve into a global market? Possibly…”

On November 20, during an interview on CNBC’s Squawk Box, Rick Rieder, BlackRock’s Chief Investment Officer of Global Fixed Income, was asked if he agreed with Jamie Dimon, Chairman and CEO of JPMorgan Chase who thinks that the U.S. government will try to regulate Bitcoin if its price gets too high.

Rieder replied:

“I think cryptocurrency is here to stay, and I think it is durable… I think digital currency and the receptivity — particularly, millennials’ receptivity of technology and cryptocurrency — is real.

“Digital payment systems is real. So, I think Bitcoin is here to stay…

“I don’t do a lot of it or actually any of it in my portfolios…

“But do I think it’s a durable mechanism that will take the place of gold to a large extent? Yeah, I do because it’s so much more functional than passing a bar of gold around…”

The recent comments of Fink and Rieder stand in sharp contrast to what the BlockRock CEO was saying about Bitcoin three years ago. On 13 October 2017, at an Institute of International Finance (IIF) meeting, Fink called Bitcoin an “index of money laundering”:

“Bitcoin just shows you how much demand for money laundering there is in the world… That’s all it is.”

Then, on 26 February 2018, BlackRock, as part of its Global Weekly Commentary, made the following conclusion about the “crypto craze”:

“We see cryptocurrencies potentially becoming more widely used in the future as the markets mature. Yet for now we believe they should only be considered by those who can stomach potentially complete losses.”

However, a few months later (on 12 July 2018), the London-based Financial News, reported that, according to people familiar with the matter, BlackRock, “has created a team from different parts of the business to investigate cryptocurrencies and their underlying infrastructure, blockchain”, and that this working group “will examine whether BlackRock should invest in bitcoin futures” as well as look “at what BlackRock’s competitors are doing with cryptocurrencies and how that could impact its business.”