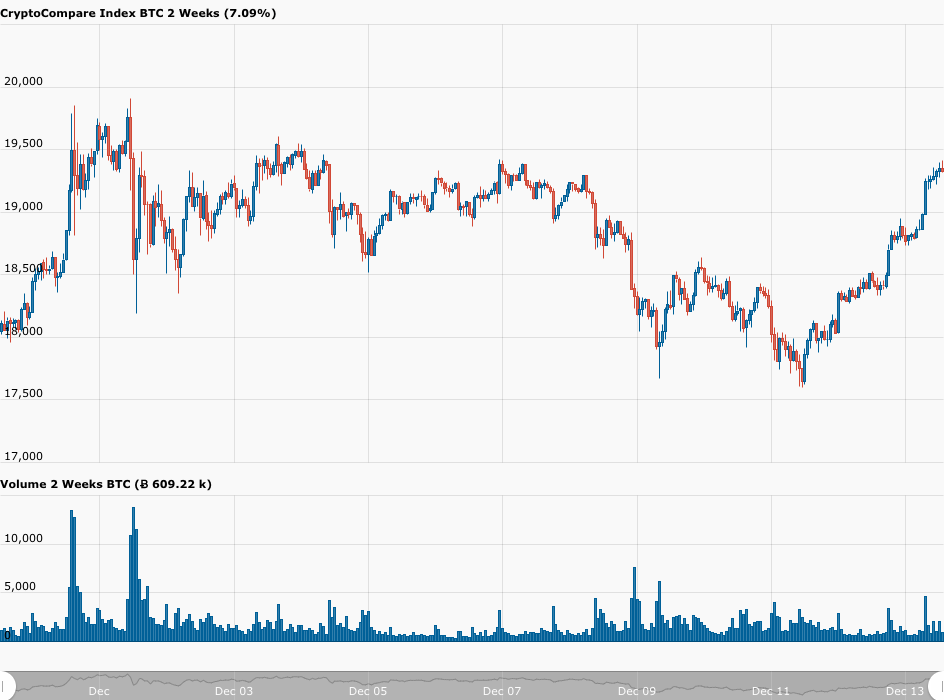

Bitcoin has had a pretty great weekend so far, up almost 10% since Friday’s intraday low.

According to data by CryptoCompare, on Friday, around 17:00 UTC, Bitcoin reached the intraday low of $17,598. Currently (as of 13:38 UTC on December 13), BTS-USD is trading at $19,331, which means that the Bitcoin price has gone by $1,733 or 9.85% since then.

Earlier today, Robert Kiyosaki, the highly successful author of the “Rich Dad Poor Dad” series of personal finance books, gave his latest thoughts on three inflation hedge assets he is fond of—silver, gold, and Bitcoin.

“Rich Dad Poor Dad“, which is one of the top 10 personal finance books of all time, “advocates the importance of financial literacy (financial education), financial independence and building wealth through investing in assets, real estate investing, starting and owning businesses, as well as increasing one’s financial intelligence (financial IQ) to improve one’s business and financial aptitude.”

At various times during the current COVID-19 pandemic, Kiyosaki has been criticizing the Federal Reserve’s response to the resulting economic fallout and strongly urging his large following on social media platforms to protect themselves from what he feels is inevitable high inflation (and possibly hyperinflation) in the future by using their fiat holdings to buy silver, gold, and Bitcoin.

Episode #263 of Anthony Pompliano’s “Pomp Podcast”, which was released on April 7, featured an interview with Kiyosaki.

During this interview, Pompliano (aka “Pomp”) asked for Kiyosaki’s thoughts on “traditional inflation hedge” assets.

Kiyosaki said:

“Gold and silver are God’s money. Bitcoin is open source people’s money.”

Anyway, currently, Kiyosaki is recommending to his nearly 1.5 million Twitter followers to buy Bitcoin below the $20,000 level.

Holger Zschaepitz, Senior Editor at the Economic and Financial desk of the German daily Die Welt and its Sunday edition Welt am Sonntag, believes that what is driving the latest Bitcoin price rally is growing “institutional interest”, as most recently exemplified by American life insurance giant Mass Mutual’s decision to invest $100 million in Bitcoin “for its general investment account in a transaction facilitated by NYDIG.”

Popular crypto analyst/trader Josh Rager, who is also a Co-Founder of online crypto learning platform Blockroots, as well as an advisor to several blockchain startups, offered this bit of technical analysis:

Featured Image by “SnapLaunch” via Pixabay.com

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.