On Monday (December 14), the Bitcoin price is above the $19,000 level, seemingly poised for further gains following announcements/comments last week by the European Central Bank (ECB), life insurance giant MassMutual, and J.P. Morgan strategists.

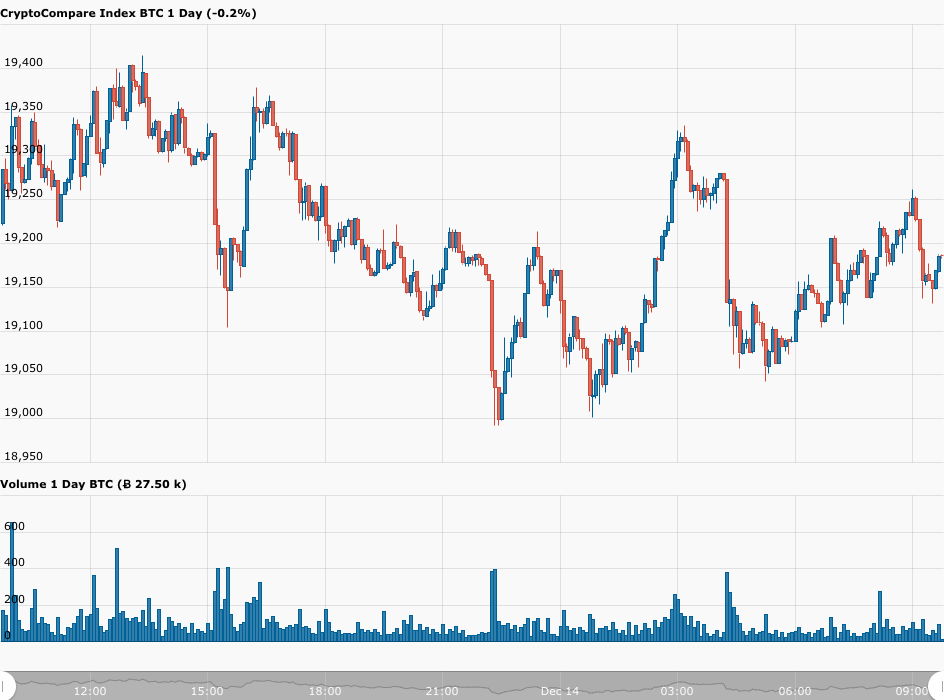

According to data by CryptoCompare, currently (as of 09:47 UTC on December 14), Bitcoin is trading around $19,186, down 0.37% in the past 24-hour period.

This means that Bitcoin’s market is roughly $356 billion, and its market cap dominance is 62.46%.

Bitcoin’s return-on-investment (vs USD) in the year-to-date(YTD) period is +167.10%.

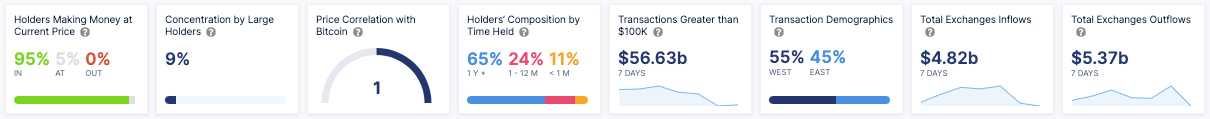

Here are a few interesting Bitcoin metrics by crypto analytics firm IntoTheBlock:

“Total Exchange Inflows” and “Total Exchange Outflows” refer to the total amount in USD entering exchange deposit wallets and the total amount in USD leaving exchange withdrawal wallets respectively. Since, currently, the latter has a larger value than the former, this means that there is less selling pressure on Bitcoin since coins are usually moved to exchanges when people are getting ready to sell them.

European Central Bank Introduces Additional Monetary Stimulus

Last Thursday (December 10), the ECB announced that its Governing Council had “decided to increase the envelope of the pandemic emergency purchase programme (PEPP) by €500 billion to a total of €1,850 billion.” It went on to say that it had also “extended the horizon for net purchases under the PEPP to at least the end of March 2022.” Furthermore, the Governing Council will “conduct net purchases until it judges that the coronavirus crisis phase is over.”

As for interest rates, the ECB said:

“… the interest rate on the main refinancing operations and the interest rates on the marginal lending facility and the deposit facility will remain unchanged at 0.00 percent, 0.25 percent and -0.50 percent respectively.”

On the same day, Bloomberg published a report titled “One of the World’s Top Bond Markets Is Slowly Capitulating to QE.”

According to Bloomberg, all this bond buying by the ECB is killing the European bond market for traders:

“Concern is growing that Europe’s bond markets are being “Japanified” — effectively shut down by a single, dominant buyer. Even yields for nations that were nearly bankrupt less than a decade ago are rapidly descending toward 0%, the level at which investors can no longer expect to generate a return by simply holding a bond to maturity. Portugal’s 10-year yield fell below 0% for the first time this week, while Italy’s is less than 0.6%.”

Of course, with several countries in the European Union suffering from a second (or third wave) of COVID-19, the additional quantitative easing (QE) by the ECB is not surprising, and many people in the crypto community expect further QE measures by the world’s major central banks next year.

This could help Bitcoin in two ways:

- Additional QE means expansion of money supply (or “money printing”), which could result in higher inflation rates than what the central banks are aiming for. That’s why many individuals and institutions are buying inflation hedge assets such as gold and Bitcoin.

- Negative or close to zero bond yields could encourage more institutions to follow MicroStrategy’s lead and buy Bitcoin for use as a treasury reserve asset.

Insurance Giant MassMutual Invests $100 Million in Bitcoin

Another highly bullish event that took place last Thursday was 169-year-oldAmerican life insurance giant Massachusetts Mutual Life Insurance Company (“MassMutual”) announcing that that it had made a $100 million investment in Bitcoin and bought a minority stake in New York Digital Investment Group LLC (NYDIG).

According to MassMutual’s press release, it bought $100 million in Bitcoin “for its general investment account in a transaction facilitated by NYDIG.” These bitcoins are “held on NYDIG’s secure, audited, and insured custody platform.”

Billionaire investor Mike Novogratz, the Founder and CEO of Galaxy Digital, called this announcement the most important Bitcoin news of this year:

J.P. Morgan Strategists’ Latest Comments About Bitcoin

According to a report by Bloomberg published earlier today, J.P. Morgan strategists including Nikolaos Panigirtzoglou (a Managing Director at J.P. Morgan who works on Global Market Strategy) said in a note sent out to clients last Friday that institutional adoption of Bitcoin could expand to pension funds and other insurance companies”

“MassMutual’s Bitcoin purchases represent another milestone in the Bitcoin adoption by institutional investors… One can see the potential demand that could arise over the coming years as other insurance companies and pension funds follow MassMutual’s example.”

Apparently, the J.P. Morgan strategists also mentioned that although such institutions are likely to invest a small portion of their funds in Bitcoin, this could still significantly help Bitcoin:

“If pension funds and insurance companies in the U.S., euro area, U.K. and Japan allocate 1% of assets to Bitcoin, that would result in additional Bitcoin demand of $600 billion.”

On October 3, Panigirtzoglou published a report that talked about the long-term potential of Bitcoin.

Featured Image by “SnapLaunch” via Pixabay.com

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.