With Bitcoin hovering around the $23,500, one popular and highly-respected crypto analyst says “old price action is irrelevant now” and explains why.

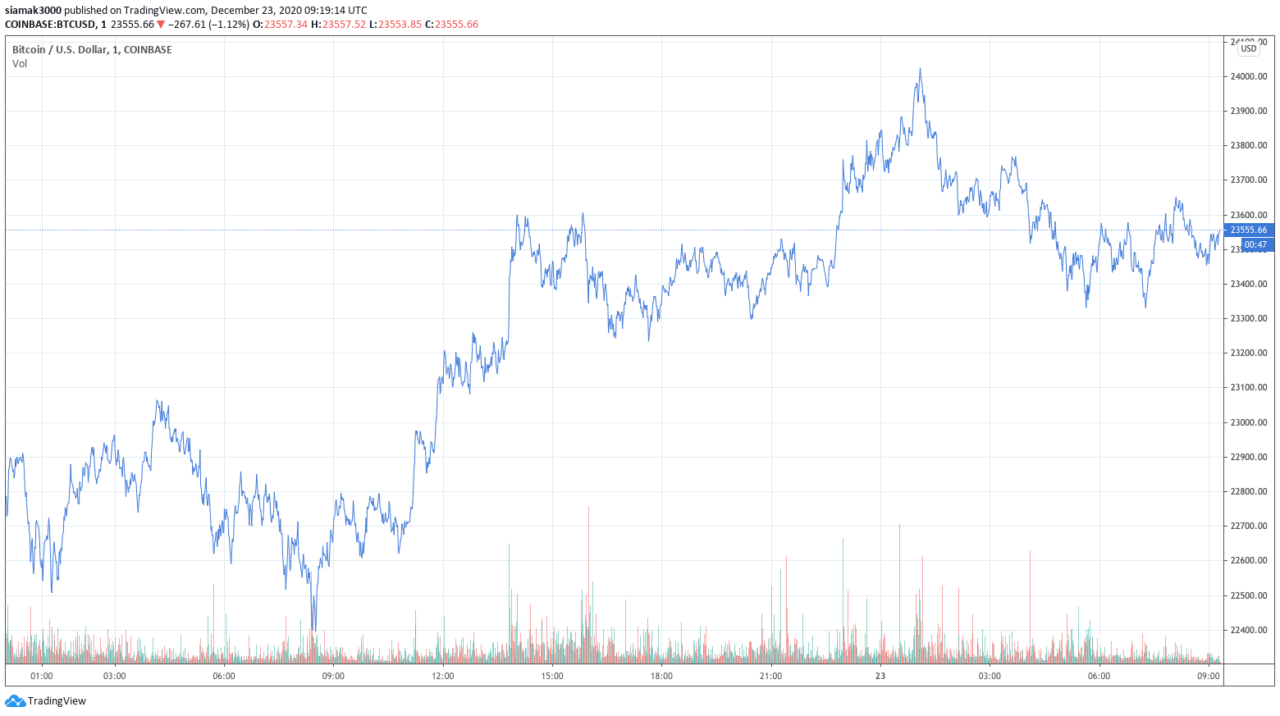

According to data by TradingView, currently (as of 09:19 UTC on December 23), Bitcoin is trading around $23,555 on Coinbase.

On Tuesday (December 22), Alex Saunders, Founder and CEO of Nugget’s News, explained why he is so bullish on Bitcoin:

Yestersay, prominent macroeconomist and crypto analyst Alex Krüger also commented on Btcoin’s price action:

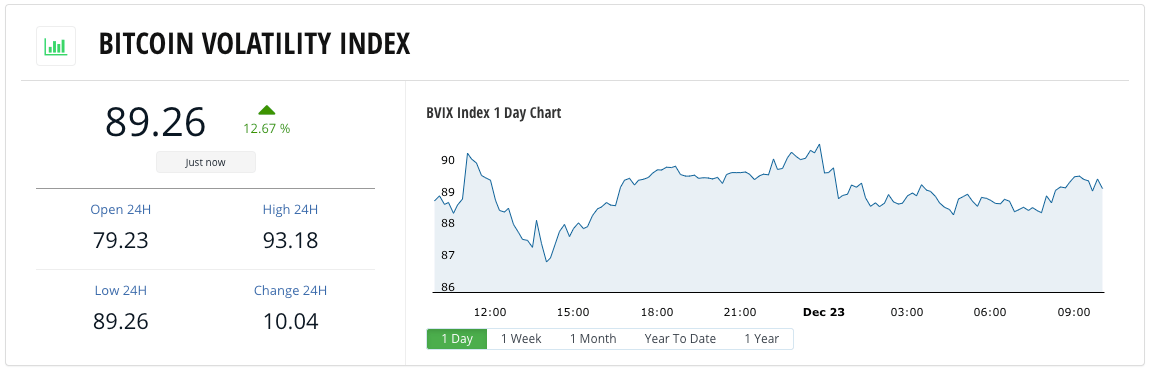

Krüger says that Bitcoin’s implied volatility suggests that the market is bearish in the short-term but very bullish in the long term.

Implied volatility is “a metric that captures the market’s view of the likelihood of changes in a given security’s price,” and it can be used by investors to “project future moves and supply and demand.” It usually goes up in bearish markets and goes down in bullish markets.

On December 3, CryptoCompare, a leading cryptoasset market data provider, launched the Bitcoin Volatility Index (BVIN), which was developed in partnership with the University of Sussex Business School. This innovative tool for Bitcoin traders provides a highly accurate way to understand Bitcoin’s 30-day implied volatility, i.e. how volatile Bitcoin prices are likely to be over the next 30 days based on traders’ expectations.

Of course, all of these institutional investors are buying Bitcoin as an inflation hedge asset (similar to gold but better). On December 15, Coin Metrics research analyst Nate Maddrey explained what makes Bitcoin a good inflation hedge:

On Monday (December 21), Michael Saylor, Co-Founder, Chairman, and Chief Executive Officer of Nasdaq-listed business intelligence software company MicroStrategy Inc. (NASDAQ: MSTR), said that his firm had invested another $650 million in Bitcoin (for use as its primary treasury reserve asset).

Well, yesterday, Saylor explained why “money is flowing out of conventional assets into.”

Featured Image by “SnapLaunch” via Pixabay.com

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.