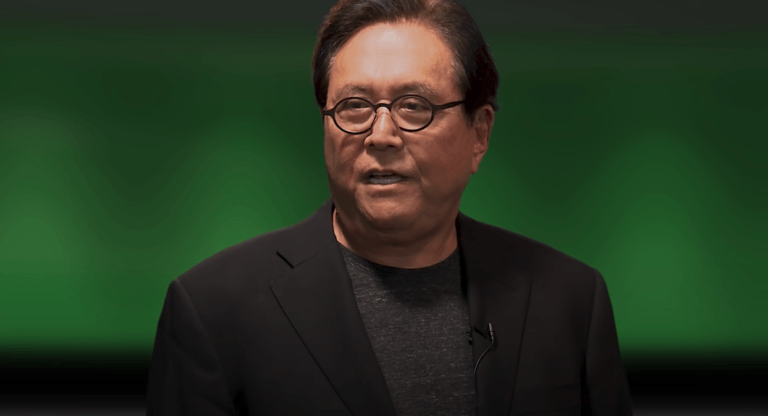

On Thursday (November 26), Robert Kiyosaki, the highly successful author of the “Rich Dad Poor Dad” series of personal finance books, gave his latest thoughts on three inflation hedge assets he is fond of—silver, gold, and Bitcoin.

“Rich Dad Poor Dad“, which is one of the top 10 personal finance books of all time, “advocates the importance of financial literacy (financial education), financial independence and building wealth through investing in assets, real estate investing, starting and owning businesses, as well as increasing one’s financial intelligence (financial IQ) to improve one’s business and financial aptitude.”

At various times during the current COVID-19 pandemic, Kiyosaki has been criticizing the Federal Reserve’s response to the resulting economic fallout and strongly urging his large following on social media platforms to protect themselves from what he feels is inevitable high inflation (and possibly hyperinflation) in the future by using their fiat holdings to buy silver, gold, and Bitcoin.

Episode #263 of Anthony Pompliano’s “Pomp Podcast”, which was released on April 7, featured an interview with Kiyosaki.

During this interview, Pompliano (aka “Pomp”) asked for Kiyosaki’s thoughts on “traditional inflation hedge” assets.

Kiyosaki said:

“Gold and silver are God’s money. Bitcoin is open source people’s money.”

Well, around 01:57 UTC on November 26, Kiyosaki assured his 1.4 million Twitter followers that Bitcoin is “going to the moon”, and told them to also consider buying more silver if its price (currently, $23.29 per ounce) falls to $19 and more gold if its price (currently, $1,814.60 per ounce) hits $1,750:

Although Kiyosaki likes all three of these assets, he still acknowledges that Bitcoin is vastly outperforming both silver and gold:

Back on August 8, when Bitcoin was trading around $11,770 and gold was trading around $2,032 (i.e. near its all-time high), he kind of predicted that Bitcoin would turn out to be the “fastest horse”:

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.