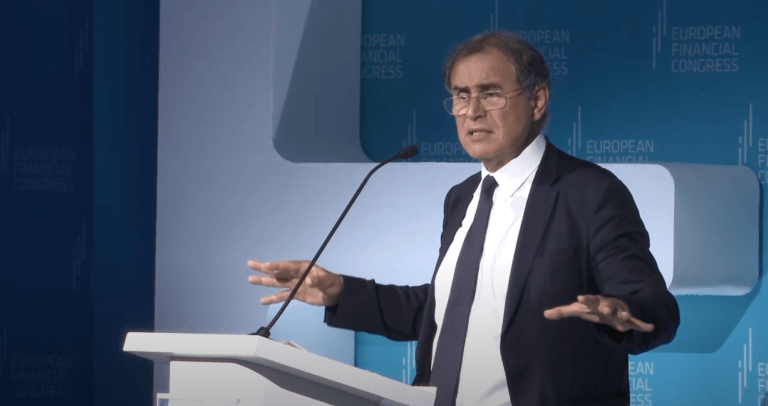

During a recent interview, prominent economist and crypto skeptic Dr. Nouriel Roubini (aka “Dr. Doom”) talked about the future of central bank digital currencies (CBDCs). He also appeared to have softened his stance on Bitcoin.

Professor Roubini teaches at New York University’s Stern School of Business, and is chairman of Roubini Macro Associates LLC, an economic consultancy firm.

During 2018, Roubini called blockchain “a glorified Excel spreadsheet” and “one of the most overhyped technologies ever”. As for Bitcoin, as far back as 2014, he was attacking it, calling it “a Ponzi scheme”, a “lousy” store of value, and “a conduit for criminal/illegal activities”.

In March 2019, during an interview with the CFA Institute, Roubini was asked about his “strong views” on Bitcoin and other cryptocurrencies.

Here were a couple of his comments:

“…to me, the whole crypto space is one of assets that are not really money. They’re not really a currency. They’re not a scalable means of payment. They’re not as stable in terms of store of value.“

“And what happened, especially in 2017 when the price of bitcoin went from $2,000 all the way to $20,000 by the end of the year, to me had all the features of a bubble… And guess what? That bubble started to burst because there was no real fundamental value on these assets… This was to me the mother and the father of all bubbles.“

Well, now, with Bitcoin stubbornly refusing to go away and with institutional interest/support continuing to grow (e.g. the recent announcement by PayPal that it will its 346 million users to buy, sell, and hold cryptocurrencies), it appears that Dr. Roubini has softened his stance on Bitcoin and that he no longer thinks it is worthless.

Last Friday (November 6), during an interview with Yahoo Finance, Dr. Roubini was asked what he thinks about the fact that “a lot of folks” are “pretty bullish” on Bitcoin these days with the Bitcoin price around $15,387.

Dr. Roubini replied:

“Well, first of all, I have pointed out that cryptocurrency is a misnomer, because for something to be a currency, you have to be a unit of account. Nothing is priced in Bitcoin or any other cryptocurrency. You have to be a single numerator, and with so many tokens, you don’t have a single numerator. You have to be a scalable means of payment, and with Bitcoin, you can make only five transaction per seconds. With a Visa Network, you can make 25,000. And you have to be a stable store of value that is not very volatile.

“Now, based on the first few criteria, Bitcoin is not a currency. It’s maybe a partial store of value, because, unlike thousands of other what I call shitcoins, it cannot be so easily debased because there is at least an algorithm that decides how much the supply of Bitcoin raises over time, because for most of those other ones, literally, is done ad hoc, and they’re being debased faster than what the Fed is doing.

“So what’s the future of this asset class? In my view, is not scalable, is not secure, is not decentralized, is not a currency, and remember, many central banks, starting now with the Chinese one, the Swedish, but even the eurozone, are starting to think about creating a central bank digital currency. Once you have a central bank digital currency, every individual can use an account with the central bank to do payments.

“So not only you don’t need crypto, you don’t even need Venmo. You don’t even need a bank account. You don’t even need the check. And the big revolution we’re gonna see in the next three years is gonna be central bank digital currencies. They’re gonna be crowding out digital payment systems, or in private sector, starting with cryptocurrencies that are not really currencies.”