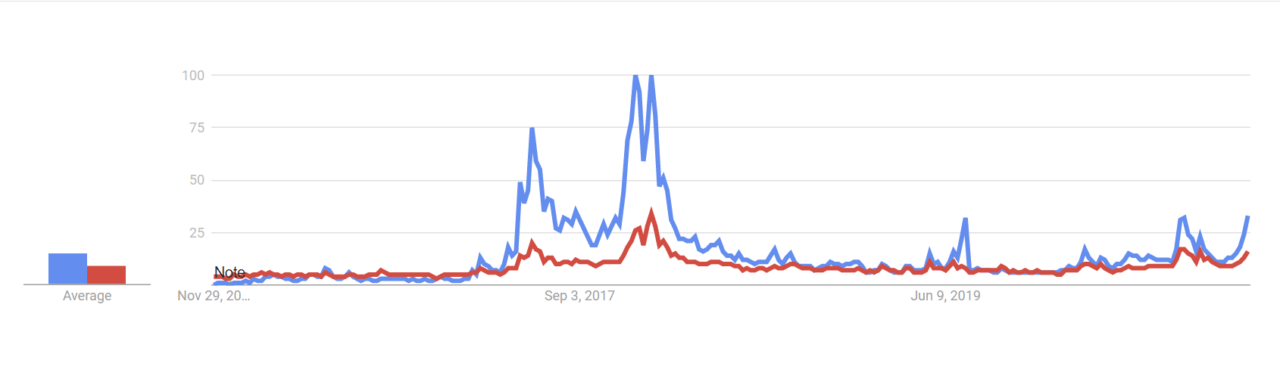

As the price of Ethereum remains above the $600 mark, search interest for the second-largest cryptocurrency by market capitalization has surged to levels that hadn’t been seen since early 2018, shortly after it hit an all-time high of $1,400.

According to data from Google Trends, search interest for the term Ethereum is now at 33 on a scale ranging from 0 to 100, surpassing a high of 32 seen in both early August of this year and in July of last year. Similarly, search interest for the term “ETH,” the ticker used for Ethereum, has started surging.

Search interest for the cryptocurrency started moving up worldwide as its price broke through the $400 resistance it had been facing and moved past $500 for the first time since June 2018 earlier this month. Since then, the cryptocurrency kept moving up and is now trading above $600, CryptoCompare data shows.

As reported, the price rise has seen the percentage of Ethereum addresses in profit reach a 2-year high above 86%, even though the cryptocurrency is still far from its previous all-time high. Search interest for the cryptocurrency may be rising not only because of the price, but also because of its upcoming Ethereum 2.0 upgrade.

This week the smart contract set to trigger the first phase of Ethereum 2.0 reached enough funds to activate Ethereum’s ambitious upgrade that will shift the cryptocurrency’s economic model, resource usage, and governance. At press time, the deposit contract has 724,224 ETH worth over $434 million, far above the 524,288 ETH necessary to ensure Ethereum 2.0 will launch on Dec. 1.

The launch isn’t of the Ethereum 2.0 network itself just yet, but is for a parallel proof-of-stake blockchain dubbed “the beacon chain.” It will run alongside the existing ETH network and its initial development will not impact Ethereum and its existing applications.

Investors may also be searching for Ethereum because of PayPal, as the fintech giant recently launched a service letting users buy, sell, and hold a few cryptocurrencies directly on their accounts. These cryptos are bitcoin, bitcoin cash, ether, and litecoin.

Featured image via Pixabay.