On Saturday (November 21), Chris Burniske, a partner at crypto-focused venture capital firm Placeholder, talked about Ether (ETH) and where he expects to go in the short term and in the long run.

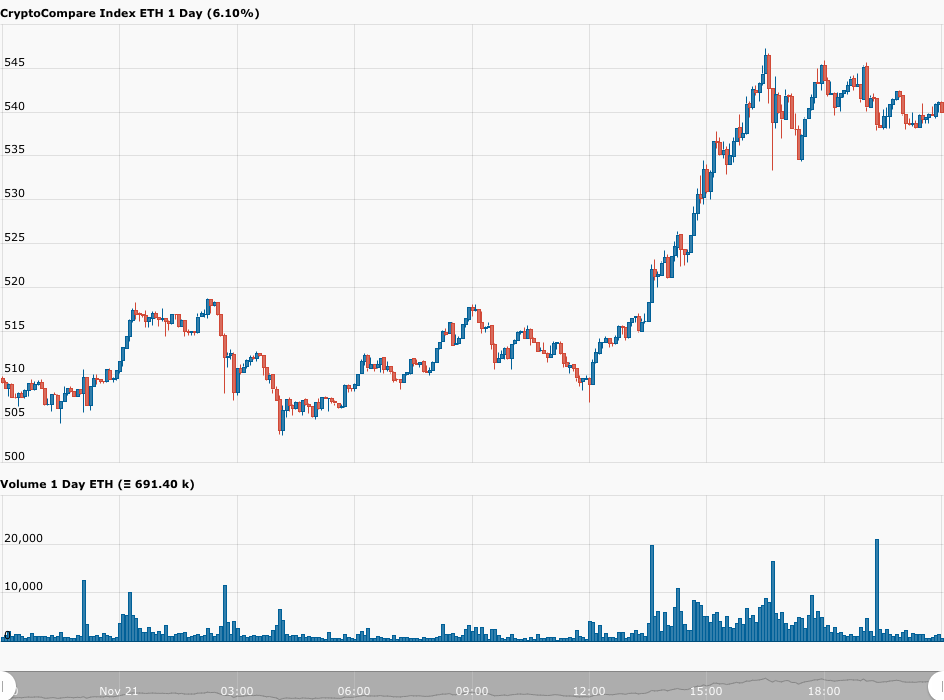

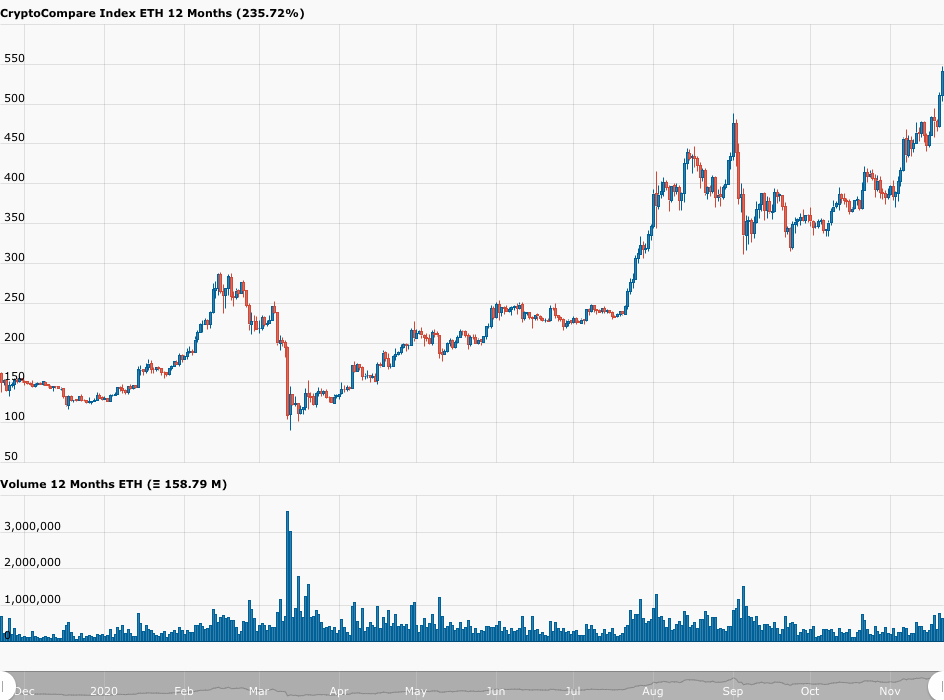

According to data by CryptoCompare, around 08:55 UTC on Friday (November 20), the Ether (ETH) price broke through the $500 level for the first time since June 2018. This meant that since the start of the year, Ether had gone up over 292% vs USD.

Simon Dedic, co-founder of crypto-focused research firm Blockfyre, believes that if the price of Ether stays above $488 by the end of this week, then the ETH price has a good chance to go to $800 and then to $1400:

By the end of the day (midnight UTC), ETH was trading around $511.60.

Well, it looks like Ether’s bull run is far from over since currently (as of 21:00 UTC on November 21), ETH is trading at $540.29, up 6.12% in the past 24-hour period.

This means that in the year-to-date period, the Ether price has gone 322% vs USD.

Although Ether’s price action is managing to delight ETH HODLers around the world, crypto venture capitalist Chris Burniske says we ain’t seen nothing yet.

More specifically, Burniske says that ETH can go from $500 to $800 just as quickly as BTC went from $14,000 to $18,000:

Furthermore, Burniske, who has long been bullish on both Bitcoin and Ether, says that the ETH price can go a lot higher than that:

And if you are wondering where the demand for ETH will come from, Burniske has what seems like a plausible answer:

By the way, it is worth noting that earlier today (around 11:15 UTC), according to blockchain data and intelligence provider Glassnode, Ethereum’s mining difficulty went above 3635 terrahashes, which is a new two-year high:

Finally, earlier today, Ethereum influencer “DeFi Dad”, Chief DeFi Officer at Zapper and Host of Yield TV, summarized in one tweet why he feels 2020 has been a remarkable year for Ethereum and its highly impressive ecosystem:

Featured Image by “elifxlite” via Pixabay.com

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.