On Friday (October 9), optimism for a COVID-19 stimulus deal remains despite the confusing state of the talks between President Trump’s representative, U.S. Treasury Secretary Steven Mnuchin, and House Speaker Nancy Pelosi. Meanwhile, Bitcoin is continuing to enjoy its endorsement by Square.

On Thursday (October 8), Drew Hammill, who is Deputy Chief of Staff to Pelosi, tweeted about a 40-minute conversation between Mnuchin and Pelosi earlier that day and mentioned that Mnuchin had said that President Trump is interested in reaching agreement with the Democrats on a “comprehensive” COVID-19 fiscal stimulus package.

Interestingly, on Thursday morning, President Trump said during an interview with “Mornings with Maria” host Maria Bartiromo on Fox Business that although he had shut down on Tuesday the previous set of stimulus talks with House Democrats — because they weren’t “going anywhere” — now the talks are going better:

“We are starting to have very productive talks,” he said. “[House Speaker Nancy Pelosi] wants it to happen too. She doesn’t want it not to happen. I believe she wants it to happen because it’s so good for our country.”

Keith Buchanan, portfolio manager at asset management firm GLOBALT, told CNBC:

“Stimulus talks are really dictating the market action on a day-to-day basis.”

Also, yesterday, billionaire investor Carl Icahn, founder and and chairman of American conglomerate Icahn Enterprises, said at the “13D Monitor Active-Passive Investor Summit” that that monetary and fiscal stimulus measures have been “very effective” for the U.S. economy and the U.S. stock market:

“If you look at stock prices, I think some of them are ridiculously high but going short on them proves to be a very, very expensive operation… A lot of those stocks you believe are tremendously overpriced just keep going up. So basically, I think the stimulus is doing the trick… At this juncture, I’m net long because I believe that this stimulus is coming and it’s going to continue, especially after the election.”

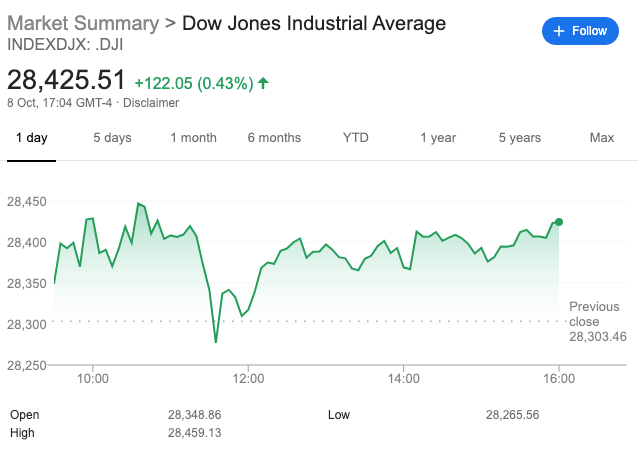

This optimism helped the Dow, the S&P 500, and the Nasdaq Composite to advance 0.43%, 0.8%, and 0.5% respectively yesterday.

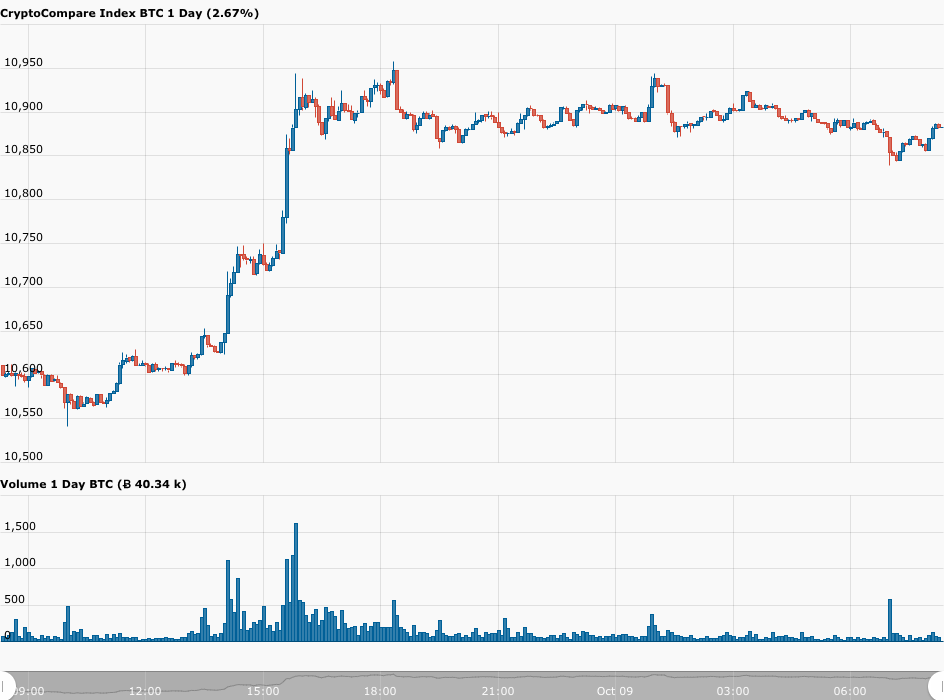

As for the crypto market, yesterday (October 8), Bitcoin, which had spent most of this week trading between $10,650 and $10,800 and which was trading as low as $10,541 around 09:00 UTC yesterday, managed to surge to as high as $10,957 by 17:20 UTC thanks to the announcement by Jack Dorsey’s Square that it had “purchased approximately 4,709 bitcoins at an aggregate purchase price of $50 million.”

Currently (as of 07:20 UTC on October 9), Bitcoin is trading around $10,880, up 2.72% in the past 24-hour period.

As for the rest of the crypto market, the cryptoassets that have recorded the highest percentage gains vs. USD since Square’s announcement are DeFi tokens such as Yearn Finance (YFI) and Uniswap (UNI), which have gone up 27.06% and 19.45% respectively in the past 24-hour period.

Here is what macro-economist and crypto analyst Alex Krüger had to say about the decision by listed companies such as MicroStrategy and Square to use Bitcoin as a treasury reserve asset:

Featured Image by “WorldSpectrum” via Pixabay.com

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.