Correction Notice: An earlier version of this article incorrectly had “January 2018” instead of “June 2019” in the title and a couple of other places in the article. We apologize for any confusion this may have caused.

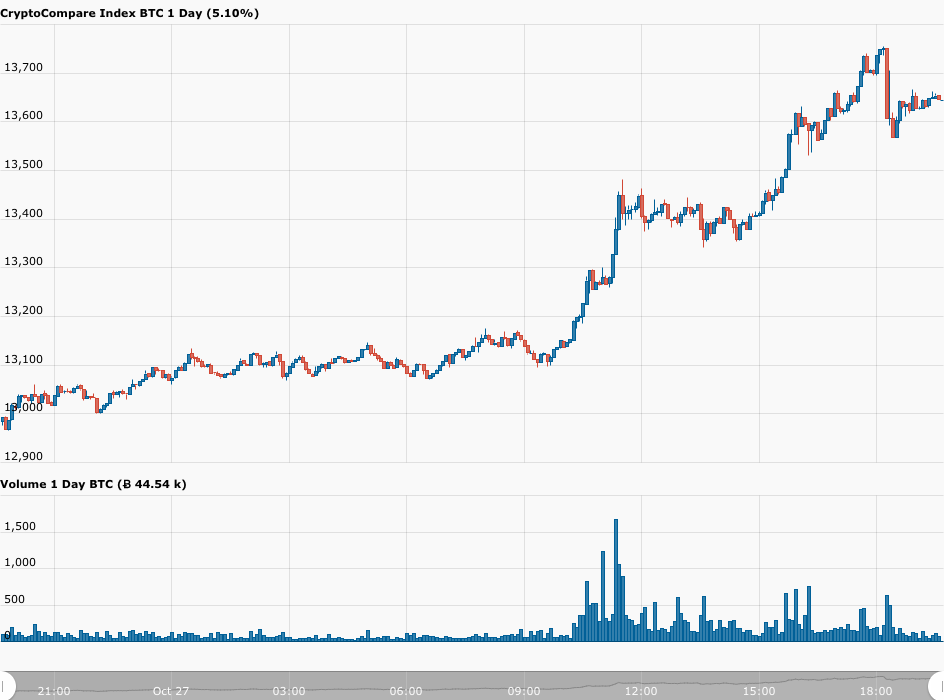

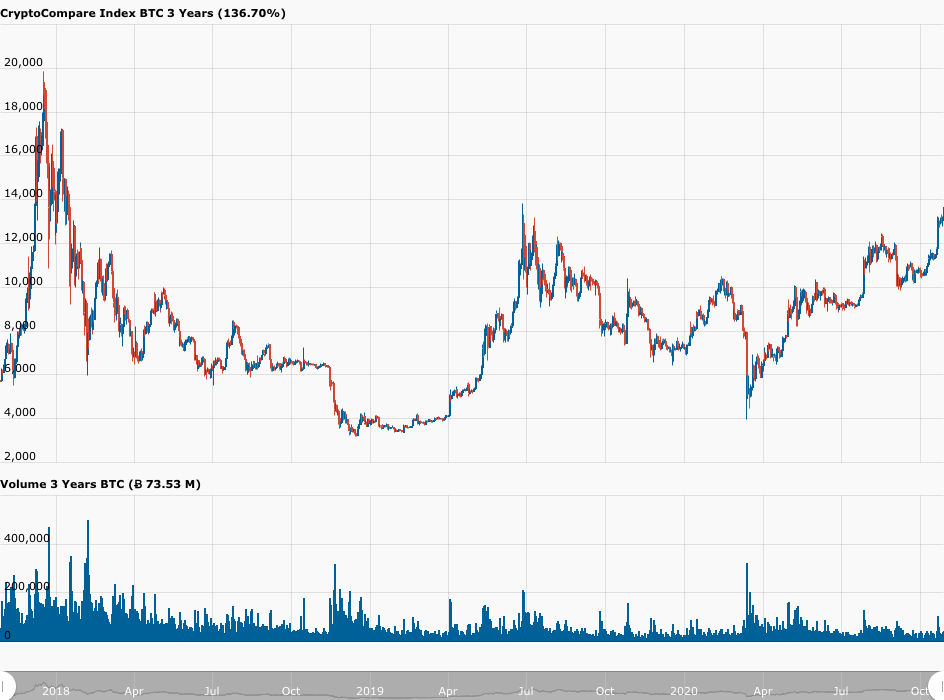

On Tuesday (October 27), FOMO due to all the recent bullish Bitcoin news seems to have caused a short squeeze that’s resulted in the Bitcoin price surging past the $13,750 level for the first time since June 2019.

According to data from CryptoCompare, at 18:10 UTC, the Bitcoin price reached $13,754, and currently (as of 19:40 UTC), Bitcoin is trading at $13,650, up 4.7% in the past 24-hour period.

This is the first time that the Bitcoin price has been over the $13,750 level since 26 June 2019 (when BTC-USD reached a high of $13,826).

In the past one-month period, the BTC price has gone up 27.18% vs USD, mostly it seems due to all the bullish news that we have seen. Here are a few examples:

- October 8: Jack Dorsey’s FinTech firm Square announced that it had “purchased approximately 4,709 bitcoins at an aggregate purchase price of $50 million.”

- October 21: FinTech startup Mode Global Holdings PLC (“Mode”) announced that it had become the first publicly listed company (PLC) in the UK to adopt Bitcoin as a treasury reserve asset. More specifically, it said that it had “allocated up to ten percent (10%) of its cash reserves to purchase Bitcoin.”

- October 21: PayPal announced that it was getting ready to launch a new service in the U.S. (“in the coming weeks”) that would allow its customers to “buy, hold and sell cryptocurrency directly from their PayPal account.” Furthermore, PayPal said that it planned to “significantly increase cryptocurrency’s utility by making it available as a funding source for purchases at its 26 million merchants worldwide.”

- October 27: Singapore-based DBS Bank, which is South East Asia’s largest bank (by total assets), accidentally revealed (via an update to its website) that it is planning to launch a crypto exchange (named “DBS Digital Exchange”) aimed at institutional clients.

Of course, we must not forget MicroStrategy Inc., the Nasdaq-listed business intelligence company whose CEO, Michael Saylor, disclosed on September 15 that his firm had “purchased a total of 38,250 bitcoins at an aggregate purchase price of $425 million.”

Mainstream media so far mostly has ignored the current Bitcoin rally that seems to be driven by institutions and wealthy investors. However, all of this good news, in addition’s to Bitcoin’s resilience in the face of the dropping U.S. stock prices (partly due to the failure of U.S. fiscal stimulus talks and alarming COVID-19 data), has made Bitcoin investors very bullish.

Former macro hedge fund manager Raoul Pal said earlier today that he would not be surprised to see Bitcoin’s price reach a new all-time high (ATH) by early next year.

And angel investor Qiao Wang, a former Director of Products at Messari, seemingly agreed with Pal’s technical analysis, and explained why he is so bullish on Bitcoin at the moment.

Tyler Winklevoss, Co-Founder and CEO of crypto exchange Gemini, believes that the Bitcoin price will reach a new ATH before the end of the year.

Featured Image by “SnapLaunch” via Pixabay.com

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.