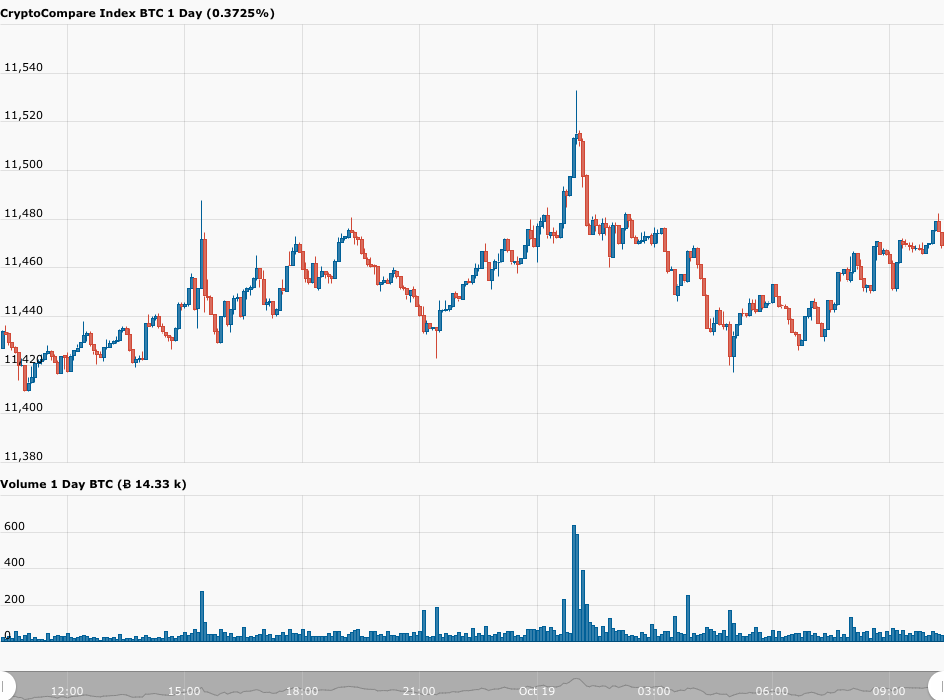

On Monday (19 October 2020), Bitcoin is trading around the $11,500 level, almost 1% up over its weekend price, as traders wait for the outcome of the fiscal stimulus negotiations in Washington.

At 01:00 BST on Monday, the Bitcoin price got as high as $11,532, which is the highest it has been since last Thursday (October 15), when the BTC price reached a high of $11,607.

One reason for the small increase in the price of Bitcoin during the past weekend was renewed hope that we could see a COVID-19 fiscal stimulus deal in the next few days.

What happened is that on Saturday (October 17), Drew Hammill, House Speaker Nancy Pelosi’s spokesperson (and her Deputy Chief of Staff) tweeted that Pelosi and U.S. Treasury Secretary Steven Mnuchin had spoken to each other that day, and that although House Democrats and the Trump administration were making some progress on the issue of COVID-19 testing, there were still “an array of additional differences.”

He also mentioned that Pelosi was giving the White House 48 hours to reach agreement on a comprehensive COVID-19 relief package (because otherwise there might not be sufficient time to get a fiscal stimulus bill passed by both chambers of US. Congress before Election Day, which is November 3):

Then, on Sunday, Peolsi gave an interview to ABC news anchor George Stephanopoulos, the host of the “This Week with George Stephanopoulos” program.

During an interview, Stephanopoulos asked Pelosi if she was getting any closer to a deal with the Trump administration.

Pelosi answered:

“Well, we’re seeking clarity, because, actually, the — with all due respect to some of the people in the president’s administration, they’re not legislators.

“So, when they said we’re accepting the language on testing, for example, they’re just making a light touch. They said they changed shall to may, requirements to recommendations, a plan to a strategy, not a strategic plan. They took out 55 percent of the language that we had there for testing and tracing…”

Later, Stephanopoulos asked Pelosi what would happen if the two sides could not reach an agreement during this 48-hour window.

Pelosi answered:

“Well, here’s the thing, the 48 only relates to if we want to get it done before the election, which we do…

“But we’re saying to them, we have to freeze the design on some of these things. Are we going with it or not and what is the language?”

The other stumbling block for the stimulus talks is the unhappiness of the majority of Senate Republicans with Pelosi’s $2.2 trillion proposal and Mnuchin’s $1.8 trillion proposal. Senate Majority Leader Mitch McConnell said on Saturday that the Senate is voting on Wednesday on a $500 billion GOP COVID-19 stimulus bill (which the House Democrats will mostly certainly reject).

McConnell aid in a statement:

“Nobody thinks this $500B+ proposal would resolve every problem forever… It would deliver huge amounts of additional help to workers and families right now while Washington keeps arguing over the rest.”

A large COVID-19 relief package is important for U.S. stocks because the U.S. economy badly needs it, especially during this second wave of COVID-19 where the daily number of cases keeps rising.

As for gold and Bitcoin, the prices of both have gone up during the past few months due to the crazy amount of quantitative easing that the Federal Reserve (and to a lesser extent, other major central banks) has had to do to avoid the economy going into a depression. This is based on the narrative that such “money printing” devalues fiat currency (in this case, the U.S. dollar) and eventually leads to high inflation.

So, if a COVID-19 fiscal stimulus bill does get approved by Congress and signed into law by President Trump before Election Day, it should move the prices of U.S. stocks, gold, and Bitcoin.

If this does not happen, then we will have to wait until February 2021 to see a COVID-19 relief package in the U.S. However, regardless of who wins the U.S. presidential election, analysts seem to agree that much more government spending will be necessary to help the U.S. economy, which could lead to higher gold and Bitcoin prices next year.

According to a report by Kitco News, RJO Futures senior commodities broker says:

“Gold will continue to grind higher going into the elections and maybe even make new highs off of that. There is an edge for more stimulus if Biden gets in as more money will be pumped out without restraint. With Trump, it is more going to be a directional flow of money.

“But you still have the Federal Reserve continuing to print up paper and buy Treasuries. Everything is extremely accommodating. Ultimately, we make new highs by year-end. $2,300 was my target at the beginning of the year. There is a possibility that we may still get up there.”

Featured Image by “WorldSpectrum” via Pixabay.com

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.