Written by: Dmytro Spilka. Dmytro is the CEO and Founder of Pridicto, a web analytics startup. His work has been featured in various publications, including The Next Web, Entrepreneur.com, Huff Post, TechRadar, Hackernoon and Bitcoin.com.

Slowing cryptocurrency trading in a decentralized finance landscape that appeared to be so promising in the summer has inadvertently helped to ease high volumes of congestion on the Ethereum blockchain. This easing of pressure on the popular ledger has helped to calm the concerns from onlookers that the network was becoming overloaded with new DeFi projects.

The fall in trading arrives as the prices of a wide range of popular decentralized finance tokens began to fall significantly. The likes of SUSHI token – once revered as one of the hottest new arrivals on the market – has experienced a 77% drop in value in the space of a month, while the DeFi lender Compound’s COMP token has shed 37% of its value.

Likewise, Uniswap, which offered so much to so many traders, has experienced a 46% correction in recent weeks, leaving the token resembling something that looks more like a pump and dump rather than one of the biggest arrivals on decentralized exchanges.

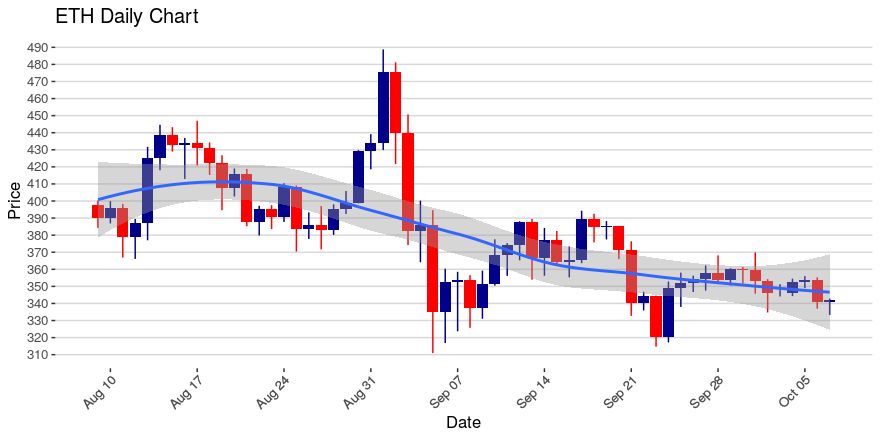

Although the value of Ethereum has dwindled in the wake of DeFi losses, the currency has stood fairly strong in what appears to be a bearish market moving into the final months of 2020. This should ensure that the currency remains the most favourable altcoin on exchanges.

But what effect could the loss of decentralized finance protocols have on Ethereum? With reports sugg esting that the cost of sending a transaction on the Ethereum blockchain has fallen 82% from $11.61 to $2.09, it’s clear that the DeFi crowd may have been a little bit too much for the protocol to cope with during the booming summer months.

The Unwinding of DeFi

Decentralized finance, or DeFi, is the name for advanced blockchain-powered financial technology, like smart contracts, decentralized applications and various protocols that are built on the Ethereum blockchain.

One of the most effective parts of decentralized finance is that the smart contracts are publicly accessible and highly interoperable. Different facets of DeFi can be pieced together to create an entirely new protocol. Decentralized finance is an exciting prospect for people due to the quality of the technology available. With smart contracts, multiple parties can come to a binding agreement that’s automatically actioned without the need of any mediators.

However, after a positive summer that saw the arrival of wildly successful DeFi tokens, including yearn.finance, which achieved a value of around $40,000 at its peak, the emerging cryptocurrencies spent much of September 2020 plummeting – with many coins facing corrections of between 15% and 20%.

The collapse of DeFi may have been sparked by a Bitcoin rally in mid-September. In a strong upsurge that appeared to only influence the value of BTC whilst leaving other altcoins and DeFi coins in the lurch, it appears that many investors en-masse chose to convert their DeFi profits into BTC in a bid to consolidate their bullish activities.

Subsequently, decentralized finance tokens have failed to recapture the support that they’ve seen flood into the network in the summer months.

Why Ethereum Came to Rule The Roost in Blockchain

Ethereum has long been favoured when it comes to the delivery of decentralized financial products. Particularly in the past year or so, an increasing number of external assets and financial tools have utilized Ethereum for tokenization.

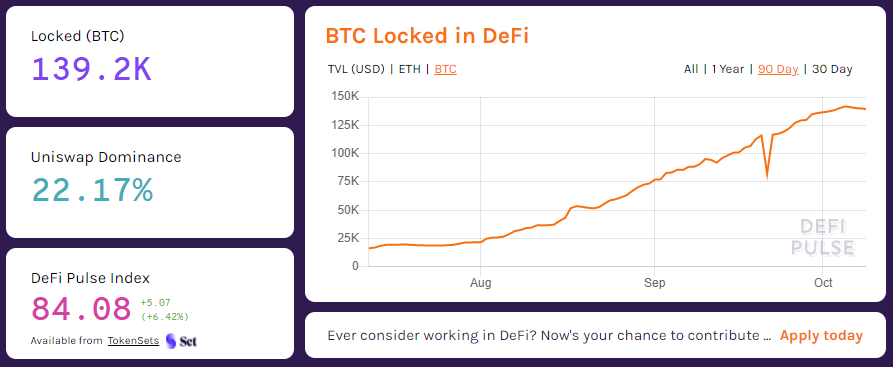

Bitcoin, which is incapable of offering the complex smart capabilities that are sought after by DeFi projects, is itself a highly liquid crypto asset. As a result, the currency is often injected into emerging decentralized projects which typically lock BTC as collateral while producing Ethereum-based tokens. Ethereum, being the world’s most popular blockchain network that’s adaptive enough to incorporate more complex services within its framework, has been tasked with handling the massive influx of new projects.

As the chart above shows, there are over 139,000 Bitcoins locked into DeFi at the time of writing. This allows DeFi projects to track the value of Bitcoin while operating wholly within the more advanced blockchain framework offered by Ethereum.

Breathing Life Into a Congestion-Free Ether

Writing for NewsBTC, Cole Petersen has suggested that a life away from DeFi could be a largely prosperous one for Ethereum. Petersen’s article acknowledges that the fading hype for decentralized finance could fuel a small pump for ETH.

The article also quotes a prominent analyst on social media who believes that Ethereum may enter a significant bull run in the wake of DeFi’s unravelling: “Ethereum is about to break out of its freshman bear market, like Bitcoin did 9 years ago. Positive market sentiment is fertile soil for the future promise narratives that story assets like ETH thrive in. The recent DeFi bull market will implode shortly and feed into ETH,” the analyst explained.

If this forecast becomes a reality, Ethereum could yet gain more than just a little bit of breathing room on its clogged blockchain. It’s worth keeping a lookout to see if an inverse correlation occurs as more DeFi tokens lose their value and Ethereum builds a greater level of support.

The crypto market is a wonderfully cyclical place at times, where wealth is commonly re-invested rather than cashed out. If the hype surrounding DeFi really does unwind, we could yet see more investors revert back to Bitcoin and leading altcoins like Ethereum. In a market place that thrives on speculation, time will certainly tell.

Featured image via Pixabay.