A supposed new liquidity mining pool on the decentralized finance ecosystem, YFDEX.Finance (YFDEX) has allegedly pulled an exit scam, leaving with $20 million worth of investors’ funds merely two days after launch.

The supposed DeFi project ran a two-day campaign heavily promoting itself on social media, even incentivizing cryptocurrency giveaways on Twitter to get more people on board. Its promotions saw investors put in $20 million worth of cryptocurrency on its wallets.

Crypto community commentator CryptoWhale tweeted about the incident, showing the project was promoting itself on Instagram as well.

At press time, YFDEX’s social media accounts have all been taken down, and the protocol’s website, along with its page on Medium, are now returning error messages. YFDEX managed to make $20 million through a pre-sale of its UFDEX token.

The project touted itself as a “powerful player” in the crypto industry “that breaks down all barriers.” Its pre-sale, reminiscent of the initial coin offering (ICO) bubble of 2017, saw it received ether in exchange for YFDEX tokens. Each ETH token would give investors 12 YFDEX tokens.

Soon after it raised the $20 million, it pulled the plug. Investors likely piled into the token sale because of the recent hype surrounding DeFi projects and their governance tokens. While some projects’ tokens have been rather volatile because of the controversies surrounding them, others have been going almost straight up.

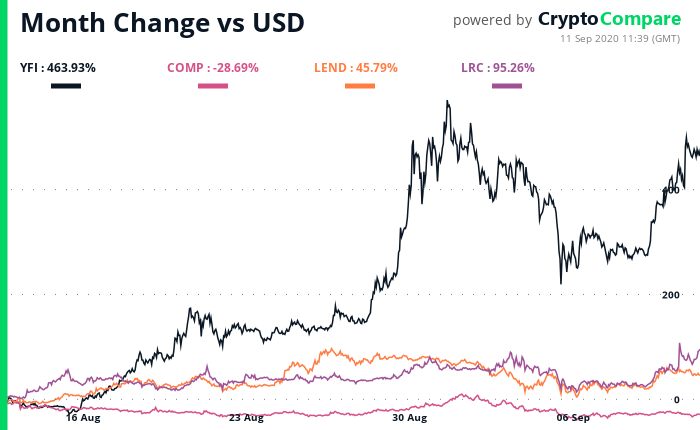

Data from CryptoCompare shows that investing in DeFi could be extremely profitable. In the above chart, we can see that top tokens in the space have performed very well in the last 30 days, with Yearn.Finance’s YFI moving up 463% in said period. Aave’s LEND token moved up 45%, while Loopring’s LRC moved up 95%. Compound’s COMP token, which started the yield farming trend, dropped 28.7% in said period.

Featured image via Unsplash.