It seems that there are enough buyers out there who still love Bitcoin enough, despite the recent price correction, to keep it from falling below the psychologically important $10,000 level.

According to data from CryptoCompare, at 15:00 UTC on Tuesday (September 1), the Bitcoin price went above the $12,000 (to touch as high as $12,052) for the first time since August 19.

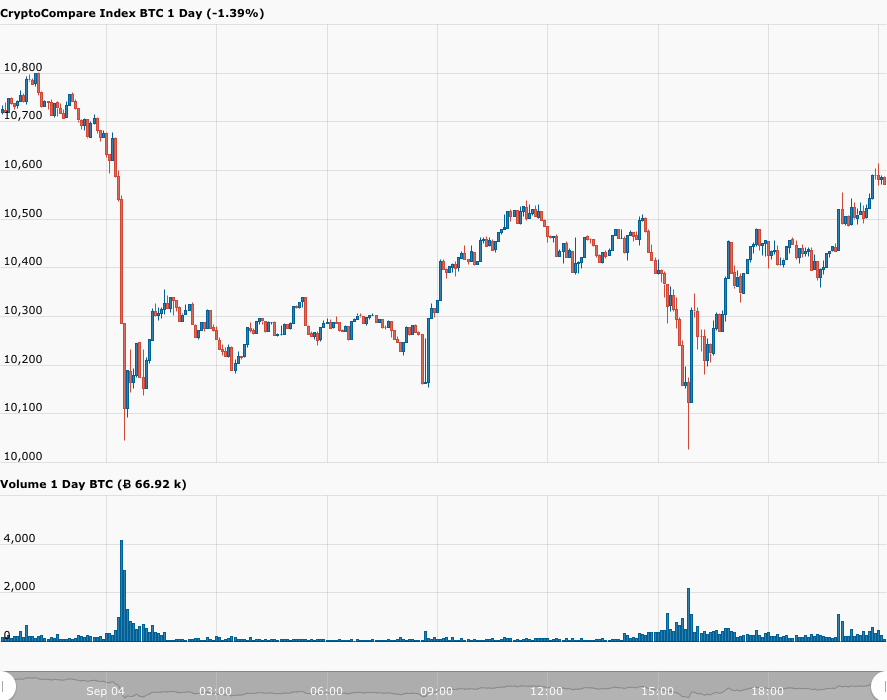

Bitcoin started (i.e. 00:00 UTC) Wednesday (September 2) at $11,926. The dips we have seen during the past three days took the Bitcoin price to as low as $10,025 by 14:50 UTC (on September 4), i.e. a fall of 15.94% vs USD during this interval.

That was the bad news. The good news is that since Bitcoin reached today’s intraday low of $10,025, the BTC price has surged 5.5% (BTC-USD is currently trading around $10,576).

This means that since Bitcoin broke through the $12K resistance level on Tuesday, it has had a roughly 12.2% price correction.

So, what could have caused this fall in the price of Bitcoin (and most other cryptoassets)?

- The rise in the value of the U.S. dollar. The U.S. Dollar Index (DXY) has gone from a low of 91.78 on Tuesday (at 03:20 UTC) to 92.82 (as of 20:40 on September 4). A stronger dollar makes holding cash in the form of dollars more attractive to investors who might be worried about a bursting of “the everything bubble” that we seem to be witnessing.

- Profit taking by both miners and retail investors.

- The fall of the U.S. stock indexes on Thursday and Friday. This was initially led by tech stocks (which have experienced the biggest gains during the past few months). Although on Wednesday (September 2), the S&P 500 managed to close at 3579.95 (a new all-time high),on Thursday, it closed at 3455.12, and today, it went even lower, closing at 3426.38. Although there is not always a strong positive correlation between Bitcoin and the S&P 500, as the old saying goes, in times of stress, all correlations go to 1.

For those investors and traders who are concerned about this latest correction in the price of Bitcoin, Messari researcher Ryan Watkins put things in perspective by correctly points out that the price of no asset ever goes up in a straight line:

Yesterday, Mike McGlone, a Senior Commodity Strategist at Bloomberg Intelligence, said that Bitcoin is likely to continue its upward trajectory:

And finally, a few hours ago, Scott Melker, a crypto analyst/trader at Texas West Capital, expressed succinctly what he thinks about Bitcoin at these levels and how he is currently trading it:

Featured Image by “WorldSpectrum” via Pixabay.com

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.