On Sunday (September 6), Bitcoin, as well as the vast majority of altcoins, are giving signs that they may have bottomed for now.

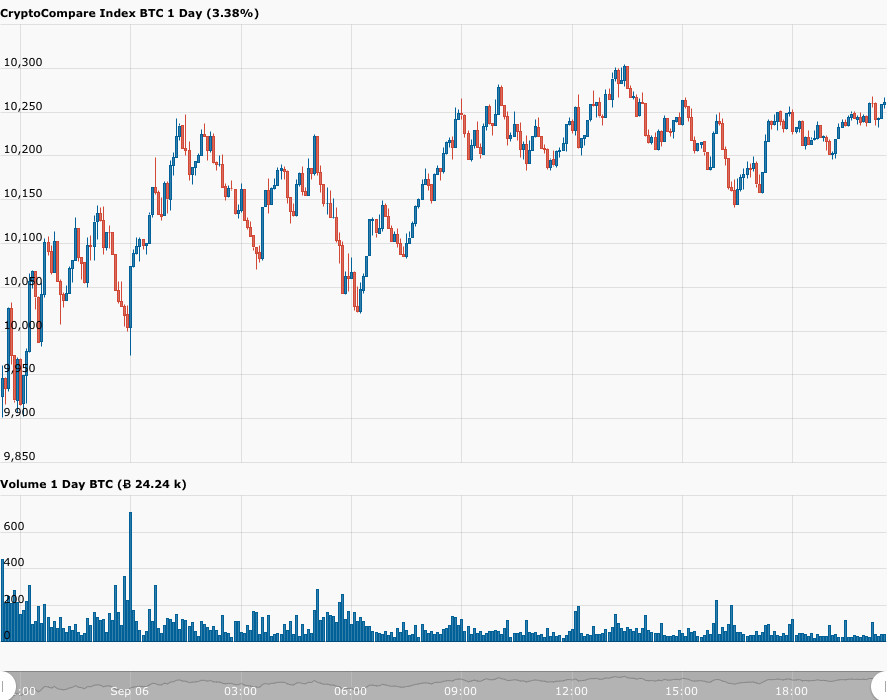

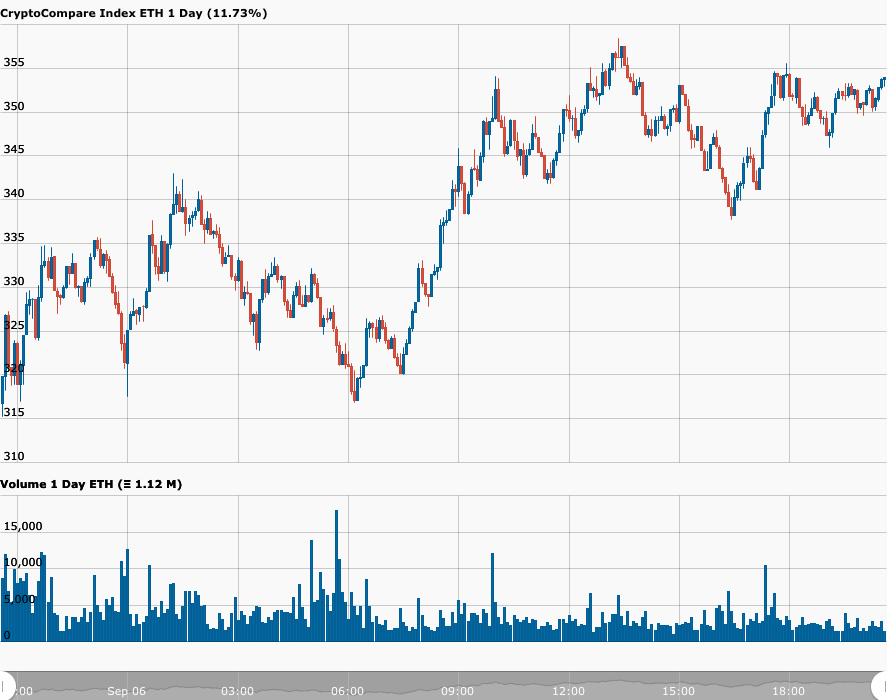

All market data used in this article was taken from CryptoCompare around 19:30 UTC on 6 September 2020.

To give you a rough idea of how well the crypto market is doing today, 93 of the top 100 cryptoassets (by market cap) are currently in the green (i.e. up against USD).

Bitcoin (BTC) is currently trading around $10,260, up 2.96% vs USD in the past 24-hour period.

Ether (ETH), has done even better, surging 9.51% in the past 24-hour period to bring its price to $354.19.

However, what is even more interesting is how strongly some of those cryptocurrencies that suffered the biggest losses on Thursday, Friday, and Saturday have bounced back.

Here are a few notable examples:

- Chainlink (LINK): $12.74 (+15.39%)

- Polkadot (DOT): $4.74 (+13.54%)

- Binance Coin (BNB): $23.14 (+23/08%)

- UMA (UMA): $15.87 (+39.97%)

- Synthetix (SNX): $5.02 (+17.26%)

- SushiSwap (SUSHI): $3.22 (+78.80%)

There are four reasons for today’s sea of green:

- Bitcoin staying mostly above $10,200 for the past 12 hours (i.e. since 07:30 UTC on September 6) has made many investors/traders feel that the $10,000 support level is pretty strong.

- No bad macro news to spook market players.

- Equities markets being closed over the weekend meant that there was no opportunity for a bad day in the U.S. stock market to create further havoc in the crypto market.

- The only bad crypto news over the weekend was the anonymous founder of SushiSwap, i.e. @NomiChef on Twitter, allegedly taking 20,039 ETH and 2,558,644 SUSHI from the project’s development fund. However, thankfully, he decided to transfer control of SushiSwap to Sam Bankman-Fried, the CEO of crypto exchange FTX, who is planning to set up a “real multisig”. This rescue action seems to have calmed the jittery nerves of holders of Ehereum-powered DeFi tokens such as LEND and SNX, and it helped the price of the SUSHI token to surge over 78% in the past 24-hour period.

According to data from TradingView, during the past 24-hour period, the estimated total crypto market cap has increased by 2.16%, and as of 20:18 UTC on September 6, it stands at $312.84 billion.

Macro-economist and crypto analyst/trader Alex Krüger feels confident that altcoins have bottomed.

What crypto investors and traders will now be hoping for is a calm week for U.S. equities so that the crypto market has a chance to continue this recovery and more specifically to give Bitcoin a chance to return to above the $12,000 level.

Featured Image by “WorldSpectrum” via Pixabay.com

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.