A team of strategist led by Nikolaos Panigirtzoglou at JPMorgan Chase have made a case that younger investors often prefer bitcoin when choosing an alternative investment, while older investors go with gold.

According to Bloomberg, in a note sent on August 4 the JPMorgan Strategists pointed out that millennials prefer tech stocks, while older investors are selling their shares and buying bonds. The strategists were quoted as saying:

The older cohorts continued to deploy their excess liquidity into bond funds, the buying of which remained strong during both June and July.

So far this year, retail investor demand has jumped, according to Bloomberg, as evidence by the stock market’s jump from its March lows, which came shortly after the World Health Organization (WHO) declared the COVID-19 outbreak a pandemic. At the time the price of bitocin and other cryptocurrencies also plummeted, and since then cryptos have outperformed equities.

As both young and older investors see the case for an “alternative” currency, the strategists wrote the inflows to gold and bitcoin-related products have been increasing over the past five months. The prices of both assets have also been moving up steadily.

CNBC reports gold broke past the $2,000 mark this week for the first time in history, as the ultra-low interest rate environment and hopes for more government stimulus to safeguard the economy have seen investors bet on the precious metal. Bitcoin, on the other hand, broke through the $10,000 mark last month and has been hovering over $11,000 since.

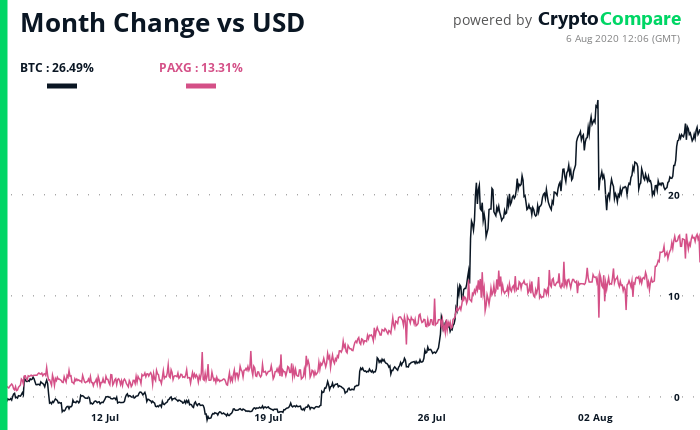

CryptoCompare data shows BTC has been outperforming gold, represented in the chart via the Paxos Gold (PAXG) cryptocurrency, an ERC-20 token backed by physical gold. Per Paxos, one PAXG token is backed by one fine troy ounce of a 400 oz London Good Delivery gold bar.

Both bitcoin and gold are likely moving up as they are seen as safe havens. Over the last few months the Federal Reserve’s balance sheet has swollen past the $7 trillion mark, while the U.S. dollar has tested lows not seen for about two years. This, coupled with ultra-low interest rates, has seen investors move towards alternative assets.

Featured image by Dmitry Demidko on Unsplash.