On Wednesday (August 19), Weiss Ratings, the only financial rating agency that grades cryptoassets, explained why it is super bullish on decentralized finance (DeFi) project Synthetix (SNX).

Weiss Ratings, which was founded in 1971 by Dr. Martin Weiss, started covering cryptoassets (tokens and coins) on 24 January 2018, when it launched a new website called Weiss Cryptocurrency Ratings.

The idea was to provide a weekly paid report that gave an overall rating for each cryptocurrency (initially only 74 were covered), as well as two component grades: an “Invest Risk/Reward” grade and a “Technology/Adoption” grade. Grades range from A+ (best) to F (worst).

Here is how Synthetix is described by its Litepaper:

“Synthetix is a decentralised synthetic asset issuance protocol built on Ethereum. These synthetic assets are collateralized by the Synthetix Network Token (SNX) which when locked in the contract enables the issuance of synthetic assets (Synths).

“This pooled collateral model enables users to perform conversions between Synths directly with the smart contract, avoiding the need for counterparties.

“This mechanism solves the liquidity and slippage issues experienced by DEX’s. Synthetix currently supports synthetic fiat currencies, cryptocurrencies (long and short) and commodities.

“SNX holders are incentivised to stake their tokens as they are paid a pro-rata portion of the fees generated through activity on Synthetix.Exchange, based on their contribution to the network.

“It is the right to participate in the network and capture fees generated from Synth exchanges, from which the value of the SNX token is derived. Trading on Synthetix.Exchange does not require the trader to hold SNX.”

In an article published yesterday, Weiss Ratings started by explaining why the DeFi sector is “booming” right now.

It then explained that SNX holders can stake their SNX tokens to create synthetic instruments (Synths) representing any kind of asset–such as gold, fiat currencies, and real estate–which can then be traded short/long on the Synthetix Exchange.

Next, Weiss Ratings gave three reasons for its bullishness on Synthetix:

- Synthetix is well-positioned in the red-hot DeFi sector to “capture a big chunk of it.”

- Synthetix offers potentially substantial rewards for staking SNX. According to a blog post published by Synthetix on 15 February 2019, “synths generate transaction fees, which are distributed to locked SNX holders as reward for providing collateral.” To further incentivise SNX holders to mint Synths, during years two to six of operation (we are now in year three), additional SNX will be distributed to SNX stakers.

- Upcoming support for “futures and leveraged trading”.

Finally, Weiss Ratings says that their $15 price target for SNX (by end of 2020) is “conservative” and in reality “your gains could be a lot larger.”

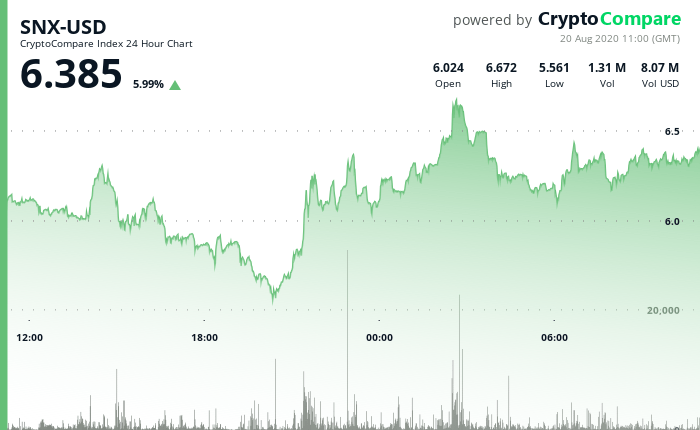

According to data by CryptoCompare, currently (as of 11:00 UTC on August 20), SNX is trading around $6.385, up 5.99% in the past 24-hour period:

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.